VS INDUSTRY : A WIN- WIN STORY

Bursamaster Kelab

Publish date: Tue, 20 Oct 2015, 12:09 AM

VS INDUSTRY proposed bonus issue of warrant to reward its shareholders came as a pleasant surprise to the investing public when it announced at market end on 19-Oct 2015. VS was known to have rewarded its shareholders several times in a short span of time through issuance of bonus shares; rights issues; share split. Thus this announcement came as totally unexpected to the investing fraternity.

VS INDUSTRY proposed bonus issue of warrant to reward its shareholders came as a pleasant surprise to the investing public when it announced at market end on 19-Oct 2015. VS was known to have rewarded its shareholders several times in a short span of time through issuance of bonus shares; rights issues; share split. Thus this announcement came as totally unexpected to the investing fraternity.

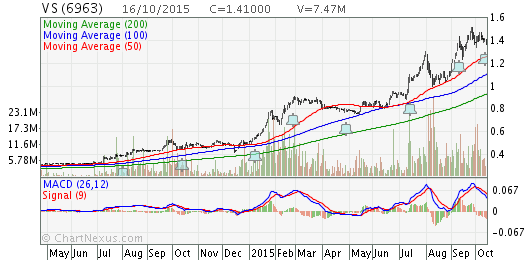

The share price was lackluster throughout the whole morning yesterday, trading in a tight range of 1.40 to 1.43 before closing 12.30pm at 1.42. The afternoon session saw the share price & volume sprung a surprise to closed the day at 1.52, almost at the day’s high. The volume ballooned to 25.79 million.

Rumours of the propose bonus issue of warrant was spreading like wild-fire to the market and many investors; fund manager and punters alike chasing after the counter.

V.S. Industry Bhd is proposing a bonus issue of up to 290.77 million free warrants, on the basis of one bonus warrant for every four existing shares held. The company said the proposed corporate exercise is to reward its shareholders and also to increase shareholders' equity participation by exercising their bonus warrants at a pre-determined exercise price which was fixed at RM1.65, during the tenure of the bonus warrants.

Assuming all the warrant holders converted the warrants to shares, which they can exercise at any time over the tenure of the warrant period; VS tends to gain a handsome sum of approximately RM479.76 million, and these proceeds shall be utilized for working capital purposes.

This is what we call a Win-Win situation where the shareholders are rewarded with free warrants and at the same time the company will benefits through the conversion exercise of the warrant holders by subscribing to the shares.

Now, the question is, whether the warrant holders convert to shares if the share price of VS is less than 1.65, DEFINITELY NOT. So, in order to entice the warrant holders , VS should ensure the share price be comfortably above the 1.65 threshold.

I envisage that most if not all warrant holders will convert to shares; thus by VS tend to gain RM479.76 million, if the share price is within a range of 1.80 to 2.00. the benefits to warrant holders with be several in the sense, warrants are not entitle to receive dividends; bonus issues; rights and loan stock issues.

Thus a WIN-WIN story in the making.

Happy trading

BURSAMASTER

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on BURSAMASTER

Discussions

Long term investors should not only lookout for winners, but also long term win-win stocks

2015-10-20 15:55

paperplane2

Another lie spinning

2015-10-20 07:43