Backtesting KLSE Buying Point - Low Volume Monthly

Wah Lau

Publish date: Sun, 25 Oct 2015, 10:38 AM

I try to use backtesting to study buying point for KLSE (FTSE Bursa Malaysia KLCI). 1st backtesting is volume. The reason is my 1st ebook about investment is KLSE8k ebook http://cn.cari.com.my/forum.php?mod=viewthread&tid=2052344 . 1 of his buy point is low volume (RM).

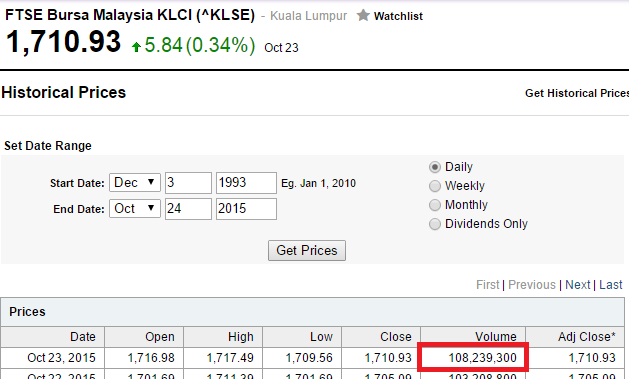

Data I take from YAHOO Finance. https://finance.yahoo.com/q/hp?s=%5EKLSE&a=11&b=3&c=1993&d=9&e=24&f=2015&g=d&z=66&y=0

Data selection Method 1 (Low Volume - Monthly)

I collect take data from low volume to higher volume, Monthly I will select early and only 1 data for same month data.

For example I select 2/9/1998, but dont select lower volume like 22/9/1998. Detail as below:

| Date | Open | High | Low | Close | Volume | Adj Close | Use/Not use |

| 22/9/1998 | 380.12 | 389.02 | 380.12 | 385.45 | 4734500 | 385.45 | Not use |

| 17/8/1999 | 766.09 | 768.78 | 749.35 | 751.47 | 6115300 | 751.47 | Not use |

| 18/9/1998 | 384.9 | 394.65 | 381.72 | 393.3 | 6117800 | 393.3 | Not use |

| 21/9/1998 | 392.65 | 394.79 | 375.49 | 378.32 | 7186700 | 378.32 | Not use |

| 17/9/1998 | 395.08 | 399.05 | 385.16 | 386.55 | 7273200 | 386.55 | Not use |

| 15/9/1998 | 402.32 | 404.4 | 387.23 | 389.08 | 8839200 | 389.08 | Not use |

| 11/9/1998 | 376.94 | 379.27 | 360.69 | 368.53 | 8839200 | 368.53 | Not use |

| 16/9/1998 | 389.12 | 398.59 | 382.81 | 394.04 | 9082900 | 394.04 | Not use |

| 16/10/1998 | 396.69 | 404.22 | 394.83 | 396.26 | 9107600 | 396.26 | Use |

| 24/9/1998 | 380.82 | 388.48 | 380.82 | 387.46 | 9435500 | 387.46 | Not use |

| 25/9/1998 | 385.97 | 388.66 | 382.5 | 387.27 | 9435500 | 387.27 | Not use |

| 23/9/1998 | 385.82 | 386.2 | 372.56 | 376.26 | 9435500 | 376.26 | Not use |

| 8/12/1998 | 514.55 | 521.68 | 508.73 | 510.85 | 9456900 | 510.85 | Use |

| 10/9/1998 | 396.34 | 397.38 | 373 | 380.2 | 9786300 | 380.2 | Not use |

| 25/8/1999 | 775.94 | 777.71 | 765.23 | 768.43 | 9850800 | 768.43 | Not use |

| 5/11/1998 | 433.71 | 442.87 | 433.71 | 438.66 | 10145400 | 438.66 | Use |

| 16/8/1999 | 776.69 | 780.83 | 756.61 | 766.41 | 10254800 | 766.41 | Not use |

| 11/12/1998 | 525.71 | 536.94 | 520.69 | 533.88 | 10313000 | 533.88 | Not use |

| 6/8/1999 | 706.44 | 713.89 | 692.7 | 703.09 | 10473500 | 703.09 | Not use |

| 14/9/1998 | 370.85 | 393.24 | 352.5 | 393.24 | 10533200 | 393.24 | Not use |

| 14/12/1998 | 537.02 | 546.28 | 537.02 | 541.01 | 10723100 | 541.01 | Not use |

| 9/12/1998 | 510.91 | 522.18 | 502.38 | 522.18 | 10842800 | 522.18 | Not use |

| 29/7/1999 | 780.75 | 781.07 | 762.08 | 774.52 | 10921300 | 774.52 | Not use |

| 6/11/1998 | 440.18 | 453.29 | 435.91 | 453.29 | 10984700 | 453.29 | Not use |

| 10/12/1998 | 525.22 | 533.08 | 521.89 | 525.58 | 11109400 | 525.58 | Not use |

| 22/4/1999 | 618.01 | 637.19 | 618.01 | 636.43 | 11414100 | 636.43 | Not use |

| 7/1/1999 | 589.86 | 599.71 | 585.89 | 585.89 | 11628700 | 585.89 | Use |

| 20/4/1999 | 614.73 | 626.83 | 609.88 | 621.53 | 11663000 | 621.53 | Use |

| 21/10/1998 | 425.55 | 428.45 | 415.23 | 424.37 | 12287200 | 424.37 | Not use |

| 2/9/1998 | 269.42 | 295.2 | 269.42 | 294.59 | 12372800 | 294.59 | Use |

| 11/10/1999 | 747.14 | 753.72 | 743.31 | 747.39 | 12612700 | 747.39 | Not use |

| 8/10/1999 | 736.19 | 748.36 | 736.19 | 743.84 | 12949500 | 743.84 | Use |

| 22/1/1999 | 615.7 | 621.57 | 612.38 | 618.54 | 12974300 | 618.54 | Not use |

| 22/7/1999 | 839.02 | 840.36 | 827.29 | 829.77 | 13082600 | 829.77 | Use |

| 30/7/1999 | 774 | 779.89 | 765.38 | 768.69 | 13090000 | 768.69 | Not use |

| 23/4/1999 | 640.26 | 648.71 | 640.26 | 646.92 | 13110500 | 646.92 | Not use |

| 2/8/1999 | 768.92 | 769.06 | 732.06 | 734.94 | 13682000 | 734.94 | Use |

| 24/11/1998 | 480.44 | 491.23 | 480.44 | 489.66 | 13898700 | 489.66 | Not use |

| 3/8/1999 | 734.98 | 748.34 | 723.17 | 748.34 | 14220400 | 748.34 | Not use |

| 2/1/2003 | 646.99 | 647.22 | 632.34 | 632.43 | 14224200 | 632.43 |

Use |

After I take those data method 1, sort descending, select data and result as below:

| Buying Point | Compare Point | Results | ||||||

| Date | Close | Next Day Open | Volume | Date | Close | Compare Year | Compare KLSE | KLSE/year |

| 16/10/1998 | 396.26 | 397.95 | 9107600 | 1/10/2015 | 1633.93 | 17.00 | 1235.98 | 72.70 |

| 8/12/1998 | 510.85 | 510.91 | 9456900 | 1/10/2015 | 1633.93 | 16.83 | 1123.02 | 66.71 |

| 5/11/1998 | 438.66 | 440.18 | 10145400 | 1/10/2015 | 1633.93 | 16.92 | 1193.75 | 70.57 |

| 7/1/1999 | 585.89 | 587.88 | 11628700 | 1/10/2015 | 1633.93 | 16.75 | 1046.05 | 62.45 |

| 20/4/1999 | 621.53 | 621.78 | 11663000 | 1/10/2015 | 1633.93 | 16.50 | 1012.15 | 61.34 |

| 2/9/1998 | 294.59 | 284.60 | 12372800 | 1/10/2015 | 1633.93 | 17.08 | 1349.33 | 78.99 |

| 8/10/1999 | 743.84 | 747.14 | 12949500 | 1/10/2015 | 1633.93 | 16.00 | 886.79 | 55.42 |

| 22/7/1999 | 829.77 | 826.30 | 13082600 | 1/10/2015 | 1633.93 | 16.50 | 807.63 | 48.95 |

| 2/8/1999 | 734.94 | 734.98 | 13682000 | 1/10/2015 | 1633.93 | 16.17 | 898.95 | 55.61 |

| 2/1/2003 | 632.43 | 633.99 | 14224200 | 1/10/2015 | 1633.93 | 12.75 | 999.94 | 78.43 |

| Totals | 162.50 | 10553.59 | 64.95 | |||||

The resuld for volume mathod 1 volume is average +64.95 KLSE point/ year.

For your infro:-

Problem Facing (data)

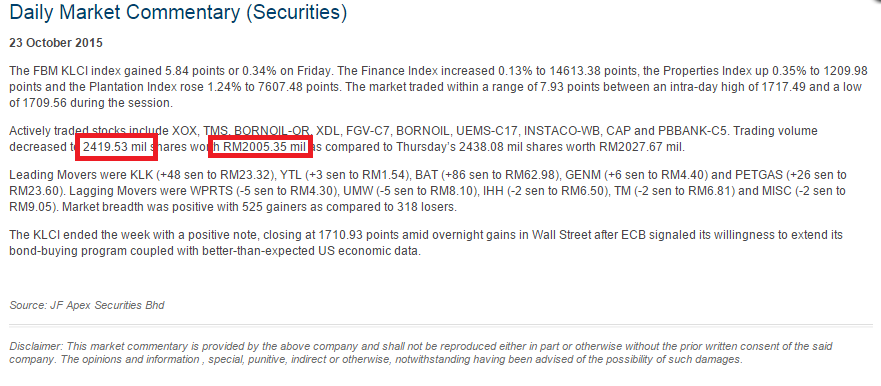

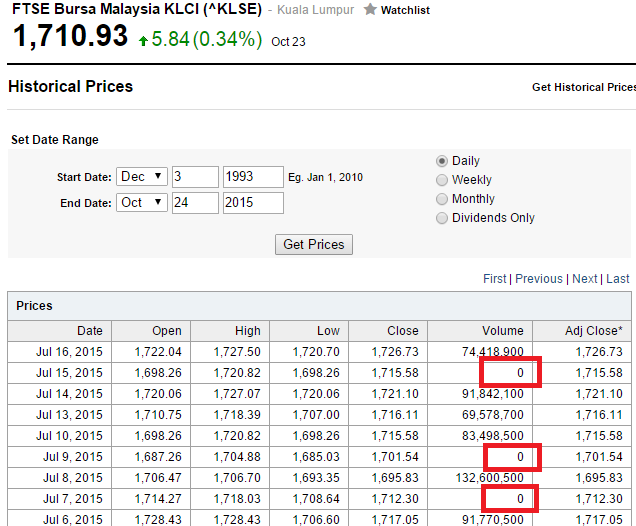

Problem facing YAHOO finance volume(RM) do not same with Bursa report (Any senior know the reason, please let me know) and data do not complete . Print screen as below:

Beside YAHOO finance, any senior here got any ideas to find more than 10 years KLSE Volume(RM)’s data.

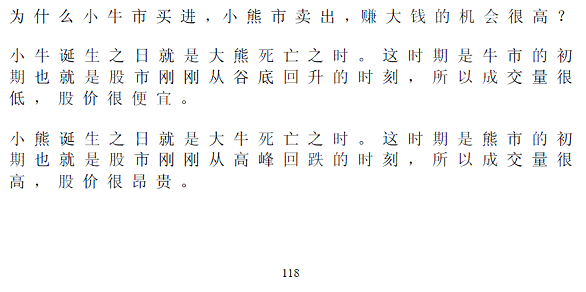

Copy from KLSE ebook (page 118)

What is backtesting?

Backtesting is the process of applying a trading strategy or analytical method to historical data to see how accurately the strategy or method would have predicted actual results.

For more can refer link as below:

http://www.investinganswers.com/financial-dictionary/stock-market/backtesting-865

More articles on WahLau Backtesting

Created by Wah Lau | Nov 12, 2015