A STOCK TRADING 40% BELOW NTA & OVERLOOKED EARNINGS !!!

BURSAMASTER

Publish date: Sat, 07 Aug 2021, 02:31 PM

A STOCK TRADING 40% BELOW NTA & OVERLOOKED EARNINGS !!!

Hello to all readers out there. Recently, market has been picking up on a lot of undervalued & overlooked stocks which have good fundamentals.

Having said the above, the stock which I'd like to talk about today is PANTECH GROUP HOLDINGS BERHAD (PANTECH - Stock Code 5125, Main Market, Industrial Products & Services)

BASIC INFORMATION ABOUT PANTECH

PANTECH was founderd in 1987 with core businesses in a few fields:

i) Metal Piping

ii) Industrial Hardware & Machinery

Market Capitalization : RM 417.01 million

Shares Float : 765.16 million

Website : https://pantech-group.com

1. DOING GOOD REVENUE & EARNINGS DESPITE RECENT GLOBAL

SLOWDOWNS DUE TO COVID19

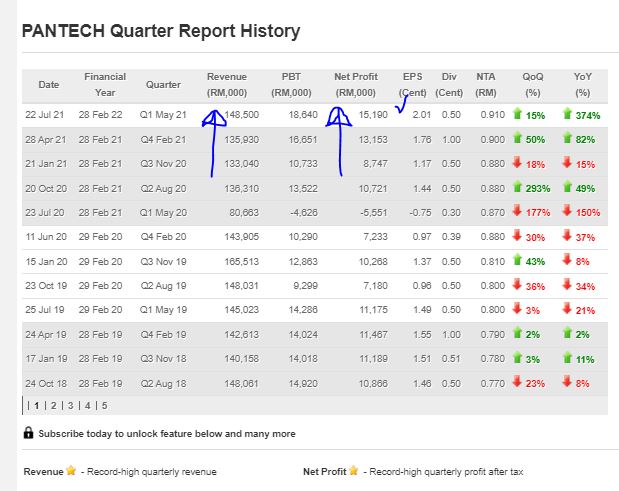

Refer below latest QR history for PANTECH. Despite recent lockdowns being imposed by the government, they have recorded stellar revenue and earnings which have been improving for the past 3 quarters.

This is mainly due to better product mix and robust export demand for manufactured products.

In latest QR, they recorded revenue of RM 148.5 mil and net profit of RM 15.19 mil (EPS 2.01c). They also issued a dividend of 0.5c to shareholders.

Taking a full year earnings of 8c per share, this translates to a fair value of around 80-96c taking a PE Ratio of 10-12 times.

https://www.malaysiastock.biz/Corporate-Infomation.aspx?securityCode=5125

2. TRADING AT 40% DISCOUNT TO ITS NTA OF 91C

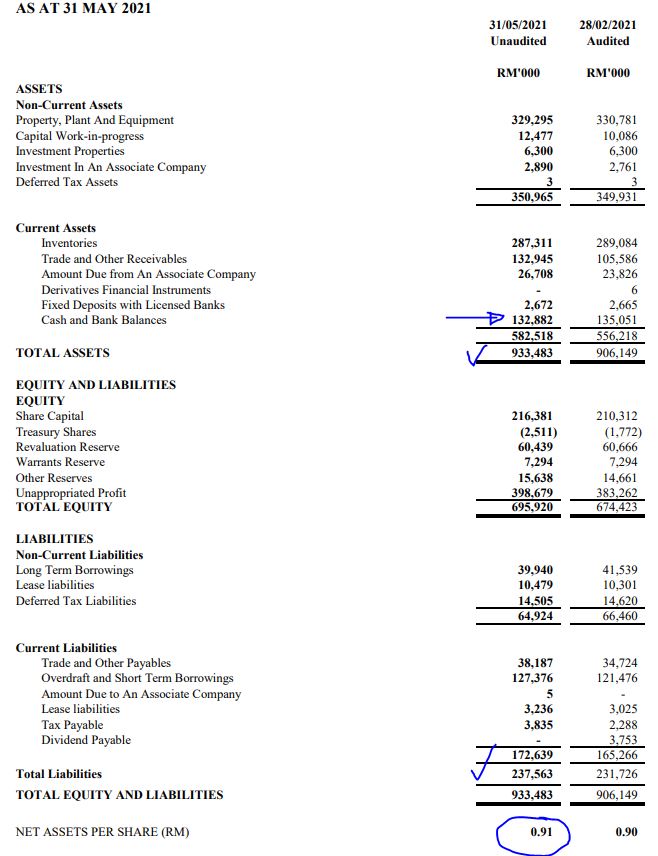

Refer below Assets Vs Liability Sheet for PANTECH. We can note the following:

i) Cash & Bank Balance stood strong at RM 132.88 mil (32c cash per share)

ii) Total Assets stood at RM 933.48 mil (91c per share)

iii) Total Liabilities stood at RM 237.56 mil

iv) Net Assets Vs Liabilities of RM 695.92 mil

At latest closing price of 54.5c, it is trading at 40% to its NTA of 91c, which in my opinion is undervalued and presents opportunity to investors wanting to get in at a good value.

3. TECHNICAL ANALYSIS - BULLISH INVERTED HEAD & SHOULDERS, PENDING

BREAKOUT AT 58 CTS AND 62 CTS

Refer below the basic price and volume chart with key EMAs for PANTECH daily chart :

A few observations on the monthly chart:

i. A bullish inverted head & shoulders pattern formed

ii. The shoulder support is at 50 cts

iii. The breakout point is at 58c and 62c for a shoulder breakout

iv. With recent price and volume momentum building up, I opine that price would test the resistance to break out at some point soon

4. CHEAPER ENTRY INTO PANTECH VIA PANTECH WARRANT-B (PANTECH WB)

Following is the profile of PANTECh WB, for traders looking at lower cost entry into this stock. A few comments:

i. Maturity is 21 December 2021, which means about 4 months to go till expiry, but still a reasonable time for entry

ii. Premium of 9% is considered quite low, with the amount of life left for this warrant

iii. Strike price of 50c, which means the latest mother share price closing of 54.5c is above the strike price

iv. Very low gearing, indicating high sensitivity of this warrant relative to the mother shares movement

CONCLUSION

Considering all the above, I opine that current price for PANTECH is attractive due to below:

i) Able to generate good earnings even in touch Covid19 economic situations

ii) Trading at 40% below its NTA and having big cash balance in bank

iii) Daily chart formed an inverted head and shoulders bullish pattern, pending a breakout above resistance levels

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

BURSAMASTER

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Bursa Master

Created by BURSAMASTER | Sep 22, 2023

Created by BURSAMASTER | Aug 20, 2023

DISCLAIMER: This post serves as an educational analysis and is never meant/ intended to be a buy/sell call or recomendation, whatsoever.

Investors / punters must always do their own due deligence bef

Created by BURSAMASTER | Dec 25, 2022

Created by BURSAMASTER | Oct 23, 2021

The_JQuestion

mah sing also 40% discount earning give dividend whack it u wont regret one

2021-08-08 23:36