HUGE POTENTIAL EARNINGS AHEAD FOR THIS CO !!! A POTENTIAL TAKEOVER TARGET ???

BURSAMASTER

Publish date: Sat, 23 Oct 2021, 12:57 PM

HUGE POTENTIAL EARNINGS AHEAD FOR THIS CO !!! A POTENTIAL TAKEOVER TARGET ???

Hello to all readers out there. Recently, market has been improving a lot due to decrease in COVID19 cases & reopening of sectors.

Having said the above, the stock which I'd like to talk about today is IREKA CORPORATION BERHAD (IREKA - Stock Code 8834, Main Market, Construction)

BASIC INFORMATION ABOUT IREKA

IREKA was founderd in 1967 with core businesses in a few fields:

i) Construction

ii) Real Estate

iii) Technology

iv) Urban Transportation

Market Capitalization : RM 148.75 million

Shares Float : 225.38 million

Website : https://ireka.com.my/

1. RM 196 MIL CONTRACT SECURED IN OCTOBER 2021 - A BOOST FOR FUTURE QUARTER EARNINGS

Refer below news extract from 7th October 2021. Ireka had secured a RM 196 million contract for Langkawi connectivity project.

This contract would definitely boost earnings in the upcoming quarter.

The contract itself is larger than the whole market cap of IREKA which is currently at RM 148.75 million.

Based on a potential conservative margin of 10-20% from this project, we are looking at RM 9.8 to 19.6 million earnings in upcoming quarter, which would translate to around 5-9 cents earning per share.

https://www.thestar.com.my/business/business-news/2021/10/07/ireka-unit-receives-rm196mil-contract-for-langkawi-connectivity-project

2. JV AGREEMENT WITH WANLAND METRO TO BE MAIN CONTRACTOR FOR THE LATTER'S CONSTRUCTION JOBS

Refer below news clipping highlighting that Ireka's Subsidiary, has signed a JV Agreement with Wanland Metro Sdn Bhd (WMSB) to be the main contractor for the latter's construction jobs.

This JV allows Ireka to increase its construction order books and project pipeline.

On July 15, Ireka secured a RM 124.39 million award from WMSB to construct two 16-storey apartment blocks, single-storey terrace houses, double-storey terrace houses, double-storey shophouses and a food court.

The Board is optimistic on the medium to long term prospects of the construction & property development with this JVA.

https://www.nst.com.my/business/2021/08/722805/irekas-unit-inks-deal-be-wanland-metros-main-contractor

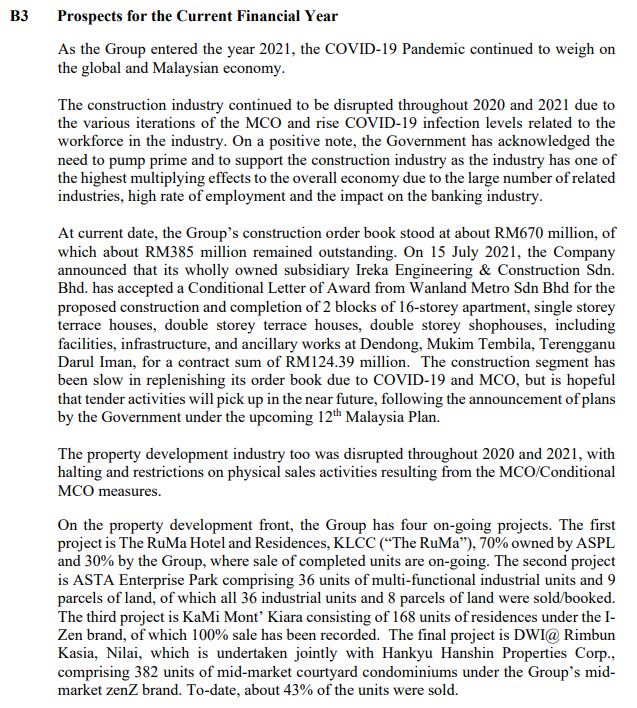

3. BRIGHT PROSPECT AS MENTIONED IN LATEST QUARTER RESULTS

Refer below extract from the "Prospects" Section taken from the latest Quarter Results as at End September 2021, a few key notes to be mentioned :

i) IREKA order book stood at RM 670 million, which RM 385 million is outstanding

ii) On 15th July 2021, IREKA unit accepted a LoA from Wanland Metro Sdn Bhd for a sum of RM 124.39 million, for a mixed development in Terengganu

iii) In Property development, the group has 4 projects, first is The RuMa Hotel & Residences KLCC, where sales are ongoing

iv) ASTA Enterprise Park, which is near to fully sold

v) KaMi Mont' Kiara, 168 units residences, have been fully sold

vi) Last project is DWI@ Rimbun Kasia, Nilai, to date about 43% sold

From all the above, I opine that the company shall be expected to make earnings in upcoming future, as construction & property sector will start to accelerate as all sectors are allowed to operate at full capacity.

4. TECHNICAL ANALYSIS - STRONG VOLUME IN 2021, PENDING BREAKOUT ABOVE TRENDLINE TOWARDS R1

Refer below the basic price and volume chart with key EMAs for IREKA daily chart :

A few observations on the daily chart:

i. Refer to Circle 1, we can observe that volumes interest in this counter has spiked up from April 2021 onwards, indicating a stronger interest in this counter

ii. Refer Circle 2, the short term EMAs have crossed up the long term EMAs. This generally indicates a change from long term downtrend to UPTREND

iii. We see that buyers are supporting at the Support (S) area between 58-60 cents.

iv. With recent price and volume momentum building up, I opine that the price shall test R1 at 75-77c, then at R2 81-83c, before testing the 5 year R3 at 89-90c.

CONCLUSION

Considering all the above, I opine that current price for IREKA is attractive due to below:

i) RM 196 mil contract secured in October 2021 for Langkawi connectivity project, will boost its earnings in upcoming quarters

ii) JV Agreement with Wanwan Metro SB, to boost its order books & project pipeline

iii) A bright prospect for upcoming quarters as mentioned by the board

iv) Strong volume interest in 2021, pending a breakout towards the trendline

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

BURSAMASTER

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Bursa Master

Created by BURSAMASTER | Sep 22, 2023

Created by BURSAMASTER | Aug 20, 2023

DISCLAIMER: This post serves as an educational analysis and is never meant/ intended to be a buy/sell call or recomendation, whatsoever.

Investors / punters must always do their own due deligence bef

Created by BURSAMASTER | Dec 25, 2022