HUAAN (2739) BREAKOUT ON 31 OCTOBER 2017!

ChloeTai

Publish date: Wed, 01 Nov 2017, 12:05 AM

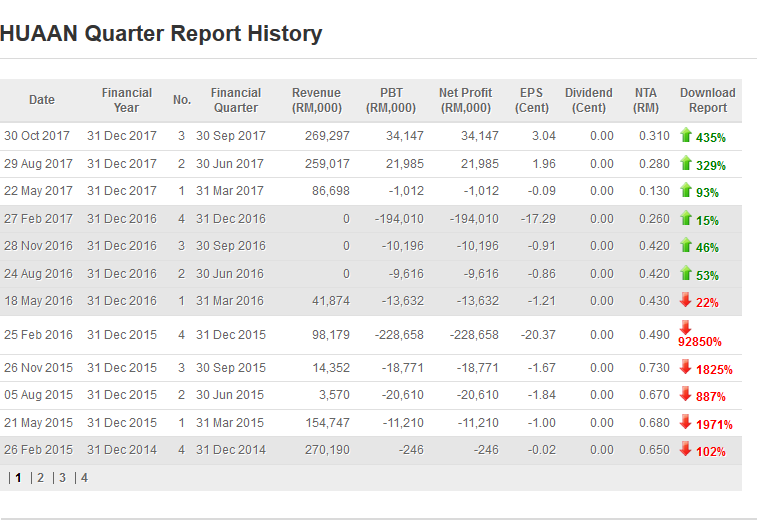

On 30 October 2017, HUAAN reported an exceptional excellent result for the 3rd quarter [Q on Q - up 55.32% and Y on Y - up 434.91%] after reporting a satisfactory good result for the 2nd quarter, as shown in the following Quarter Report History.

As a result, on 31 October 2017, its share price gap up 7 sen (to open at RM0.30) and shot up to high of RM0.35 before closing at RM0.31 (for a rise of 8 sen or 34.8%).

Introduction

Sino Hua-An International Berhad is engaged in production and sale of metallurgical coke. The company operates in two business segments: manufacturing and trading, which is engaged in the manufacturing and sales of metallurgical coke and other related by-products. The company's products include metallurgical coke and by-products, such as coal gas, tar, crude benzene, ammonia sulphate, coal slime and middlings. Its subsidiaries include PIPO Overseas Limited, which is an invesment holding company and Linyi Yehua Coking Co Ltd, which is engaged in the production and sale of metallurgical coke and other related by-products.

Attached Explanatory Notes of the 3rd Quarter Result

Chinese economy has continued to beat expectations with the growth rate coming in slightly ahead of analysts' forecasts. From 6.9% growth in the first six months of the year, China's Central Bank governor, Mr Zhu Xiaochuan, forecasts that the economy could grow at a rate of 7.0% for the second half of the year. Such economic growth are envisaged to be achieved through continued robust public and private sector infrastructure projects as well as real estate development pursuits particularly in the third tiered cities, all of which will provide an impetus to the steel and coke industries. According to a steel industry consensus, the domestic steel demand is expected to continue to be robust and sustainable through the rolling out of several socio-economic initiatives, more notably the expected RMB2 trillion steel consumption required to realize China's high speed rail project from 2017 to 2030 as well as the spin-off effects of the One-Belt-One-Road (OBOR) initiative which will be spearheaded by China. All these may me seen as a catalyst to provide a compelling case on the prospect of the steel and coke industries, moving forward.

Scientific Notes

Metallurgical coal is a special type of coal used to make metallurgical coke. There are two types of metallurgical coal used to make coke: hard coking coal and semi-soft coking coal. These types of coal are ideal for coke because they melt, swell and re-solidify when placed into a superheated furnace. These types of coal also have low levels of impurities. A third type of metallurgical coal, PCI, is used in steel making.

Link

There are two links where we can study the soaring price of metallurgical coke:

(1) https://www.investing.com/commodities/coking-coal-futures-streaming-chart

(2) https://www.investing.com/commodities/metallurgical-coke-futures-historical-data

Conclusion

I would like to quote from a participant in the i3investor forum:

"Pang72: Huaan announced the 3rd quarter result early could be meant to quickly meet the regularization plan. The plan is scheduled to be announced on 1 November 2017."

Hopefully! We shall see how is the latest monthly announcement according to the Paragraph/Rule 8.03A Companies (early of each month).

I would also like to quote from Share4u Channel telegram group:

"HUAAN - Good 2nd quarter result and excellent 3rd quarter result, can continue to invest, mid-term might climb to 50 sen."

Lastly, I would also like to quote from Logic Trading Analysis Channel telegram group:

"HUAAN: Let's cook the coke up! Looking good! Goreng sajalah!"

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Chloe Tai Blog

Created by ChloeTai | Jul 31, 2024

Created by ChloeTai | Jul 29, 2024

The NDWT at Kuantan Port is making huge amount of profit at present (for IJM) while the Smart AI Container port at Port Dickson (a plan by TANCO) can only be materialised in the year 2030.

Created by ChloeTai | Jul 18, 2024

NATGATE is a multi-bagger AI technology gem.

Created by ChloeTai | Jul 16, 2024

IJM new Target Price is RM4.40 forecasted by CGSI.

Created by ChloeTai | Jul 14, 2024

GAMUDA is the king of construction throughout the world (not only in Malaysia).

Created by ChloeTai | Jul 12, 2024

SUNCON TP of RM5.46.

Created by ChloeTai | Jul 12, 2024

Gamuda TP of RM9.50.

Discussions

Sorry to all. Typo error! Edited to 30 October 2017 already. Anyway, wait for rebound in Huaan after flushing out contra traders.

2017-11-05 18:45

GGecko

there aint any 31 november in the calendar year

2017-11-01 07:45