Why Liihen(7089) decrease its dividend payout?- Summary of Liihen (7089) 2018 Q4 quarter report

InvestMY

Publish date: Fri, 22 Feb 2019, 02:32 AM

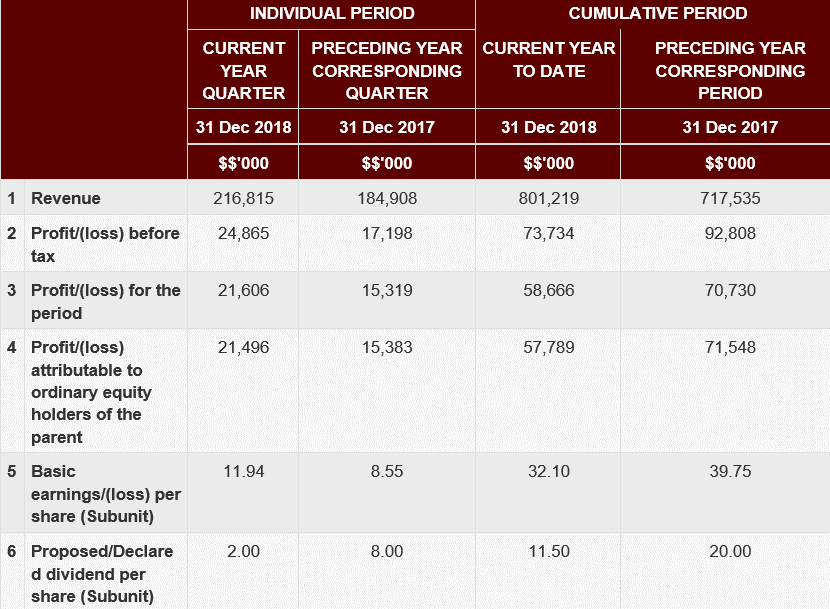

As one of the listed furniture company in Malaysia, Liihen (7089) is famous because of its dividend payout ratio and net cash. However, Liihen only announced 2sen dividend in its 2018 Q4 quarter report which is 75% lower when compared with the 2017 Q4 quarter report's 8sen dividend.

During the quarter, Liihen's net profit rose 39.7% to 21.4 million from 15.3 million last year as revenue climbed 14.71%. The stonger 4QFY18 result was because of the increase in sales and the more effective cost management which it registered lower operating expenses of 17 million versus 23 million in 4QFY17.

Despite the stronger 4QFY18 results, its dividend fell 6sen to 2sen from 8sen a year ago which make a lot of Lihen's shareholder disappointed. However, personally I believe the decrease of dividend is acceptable and the reason can be found in the Liihen's Cash Flow. First, in the financial year 2018, Liihen spend around 20 million in "purchase of property, plant and equipment" which is 66% higher than financial year 2017. In the financial year 2017, it is notable Liihen only spend 12 million in the "purchase of property, plant and equipment". This is one of the reasons why Liihen decrease its dividend payout ratio as it used the money in investing activities.

However, the biggest reason why Liihen decreased its dividend payout is because of Liihen's net cash was decreasing from 2016's 125 million to 2017's 84 million and slightly increase to 90 million in the financial year end 2018. If Liihen maintains its dividend payout ratio in 2018, it is notable that the net cash will directly decrease to 80 million which will affect company's future cash flow.

Prospects

In 2019, Liihen continues to face challenges in the management of production costs and availability of workforce that may impact on the Group’s financial performance. In view of that, the management will continue to focus on the Group’s core products by diversifying its product range to strengthen the market position and expand the customer base and simultaneously continue to adopt an effective cost management. Although Liihen had a poor dividend payout in 2018FY, but with the recover of the net profit and cash flow, I believe the dividend payout will also recover soon.

Good

- Revenue's YOY growth

- More effective cost management

- Recover of the net profit

Bad

- Higher minimum wage nationwide

- The strengthening of RM against USD

- Lower dividend yield will decrease investors' interested

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on 投资理财记事本

.png)