My fundamental and technical analysis of JAKS

FAakaTA

Publish date: Sun, 05 Jul 2020, 06:37 PM

Fundamental analysis (FA) of a stock can help to understand the financial and business prospect of a company. I’m focused on profit growth prospect to determine a company’s intrinsic value.

Jaks (4723) is the potential next ‘rising star’ after JHDP signed a contract with Vietnam’s Ministry of Planning and Investment to undertake the design, engineering, construction and operation of a power plant in Hai Duong Province for a 25-year period on June 2011.

As refer to Annual Report 2019 Chairman’s Statement, ‘The commercial operation of the first unit of the power plant is expected to commence in fourth quarter of 2020, followed by the second unit in first quarter 2021. Upon completion of the construction and commencement of commercial operations of the power plant, the Group will be able to generate recurring concession-type earnings from the generation and sale of power for a period of 25 years.’

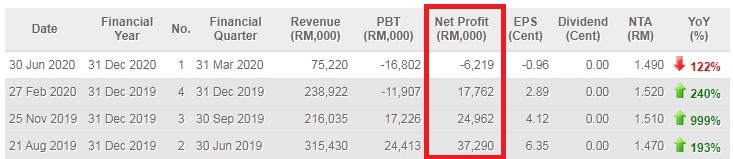

Stock prices tend to move about six months ahead of the earnings. However the table below shows the company has reported reduced net profit in the last 4 quarters. Due to the risk of prolonged and wider spread of Covid-19, it is safer to buy Jaks until it can report increased net profit.

(Source: malaysiastock.biz)

Technical analysis (TA) of a stock can help to predict future share price movements in order to identify entry and exit points for potential trades. I’m focused on uptrend stock because the share price will go higher.

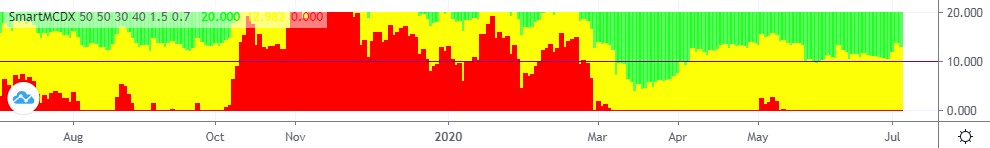

(Source: KLSE Screener)

(Source: TradingView)

Below is my technical analysis views of Jaks price chart:

a. It is currently at downtrend (closing share price below SMA 200, RM 1.08);

b. SmartMCDX (TradingView) is an indicator based on specific formula to detect Institutional/Banker investor activities. Seller’s momentum (Green) is stronger than Buyer’s momentum (Red).

No matter how good the company is, don’t buy the stock on a downtrend. Always wait for a reversal of trend. It is safer to buy Jaks when its closing price above SMA 200 and Buyer’s momentum (Red) is stronger than Seller’s momentum (Green).

DISCLAIMER: The information posted in the group NOT a buy/sell call. The guidance and advises delivered are my personal opinions and suggestions. TRADE AT YOUR OWN RISK!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

1901

stories mirrored along mfcb. Pls share 10 yrs mcdx of mfcb when it approaching rm1? appreciate that.

2020-07-13 13:22