My Trading Diary

Francisco García Paramés

Publish date: Tue, 27 Sep 2016, 09:01 PM

Brite-Tech Group is an integrated water purification and wastewater treatment solutions provider and the Group's business activities comprises the following business segments :

Environmental Product & Services:

To provide a complete range of services and products in the field of water treatment as well as engineered and formulated chemical products for water and wastewater treatment; and to provide analytical laboratory and environmental monitoring services.

System Equipment & Ancillary Products:

To provide consultation, engineering design, construction, installation and commissioning of water purification, water recycling and wastewater treatment systems; and to provide rental of portable ion-exchange resin columns as well as supply of chemicals and consumer products.

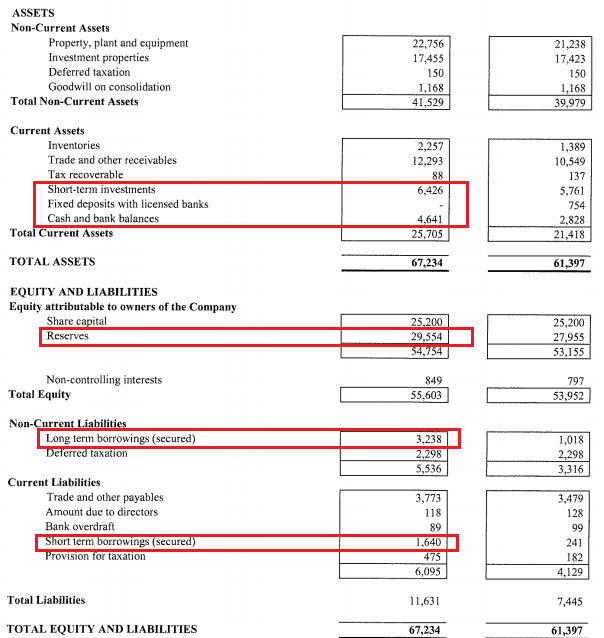

Company Balance Sheet

Company Cash Flow

Summary for BTECH

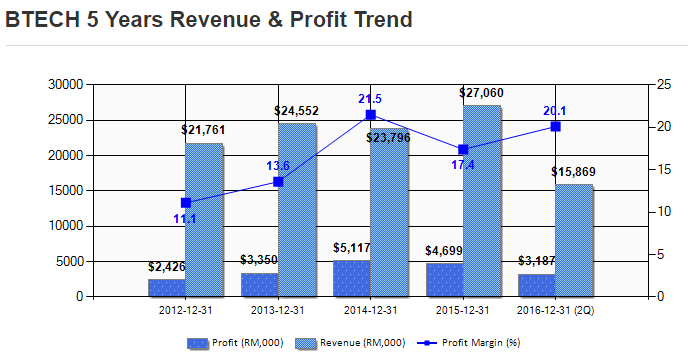

- BTECH is a growing company, which business model is very defensive and recession prove

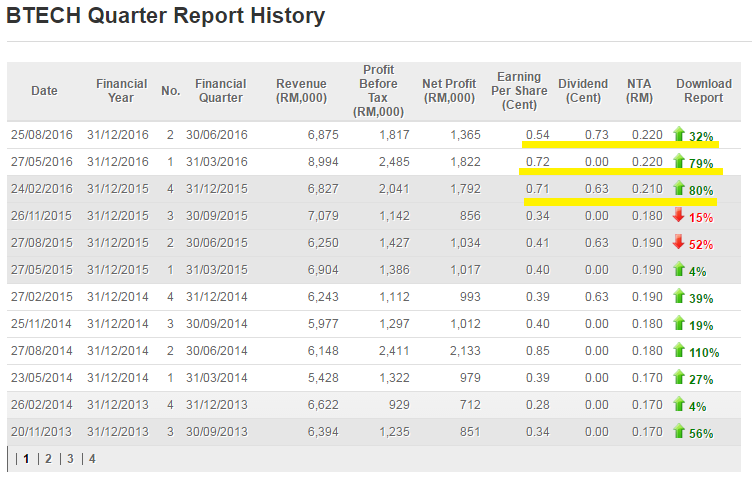

- While Environmental and Product Services division grow at a slower phase, System Equipment and Ancillary Product constantly hit double digit growth (Refer to previous 2 quarter revenue breakdown).

- BTECH Net profit margin is about 20% plus minus, and it’s very tempting profitable business. How many listed company in Bursa that have such profit margin? Probably Less than 10%

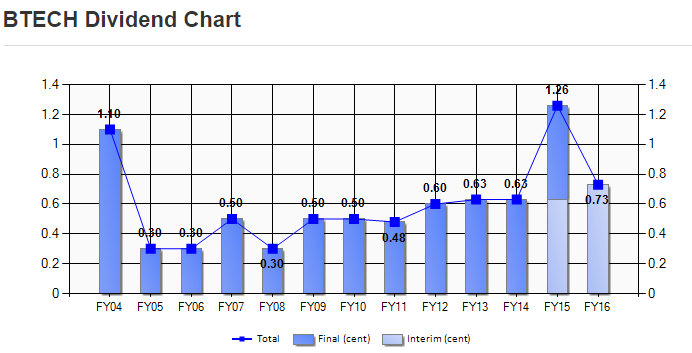

- BTECH is a net cash company, a zero gearing company, with the ability to pay more and more dividend

- BTECH is a generous in paying out dividends. As we can see on FY15, company is paying 1.26 cents which is equivalent to 3.7% Dividend Yield. Moving forward for FY16, company already paid 0.73 cents for interim dividend, and company is expected to pay another 0.73 cents for the final dividend, making it total 4.3% Dividend Yield. To be honest, you will never find any penny stocks that pays so generously.

- Valuation: Annualized PE method, FY16 Full year EPS forecast will be 2.52 cents, implying 13.5x PE, Which is considerable cheap for Small caps.

Target price

15x FY16 PE: 0.38

16x FY16 PE: 0.40

17x FY16 PE: 0.43

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on My Trading Dairy

Created by Francisco García Paramés | Feb 01, 2021