Uchitech; the second liner beneficiaries of booming Semi-Conductor Industry

Francisco García Paramés

Publish date: Mon, 01 Feb 2021, 08:59 PM

UCHI Technologies Berhad is a Malaysia-based company, primarily an Original Design Manufacturer (ODM) that specialises in the design, research, development and manufacture of electronic control systems which includes software development, hardware design and system construction. Its Manufacturing segment includes manufacturing of touch screen advance display, light measurement (optoelectronic) equipment, mixed signal control system for centrifuge/ laboratory equipment, mixed signal micro-processor based application, system integration products and electronic modules. While the Trading segment includes the trading of electric module and saturated paper for printed circuit board (PCB) lamination.

UCHITEC is an investment holding company with three 100%-owned operating subsidiaries, i.e. Uchi Optoelectronic (M) Sdn. Bhd. (UOM), Uchi Electronic (M) Sdn. Bhd. (UEM) and Uchi Technologies (Dongguan) Co., Ltd. (Uchi Dongguan).

UCHITEC has two operating sites:

a) UOM situated in Malaysia is the main operating plant; and

b) Uchi Dongguan situated in Dongguan City, Guang Dong Province of China, is the assembly arm of UOM.

Understanding ODM (Original Design Manufacturer)

An original design manufacturer (ODM) is a company that designs and produces products that are marketed and sold under the name of the original equipment manufacturer (OEM). In other words, an ODM provides "ready-to-go" products for the OEM. The latter purchases products from the former who determines what design and products to be built. The right to the intellectual property that goes into the products is mostly owned by the ODM.

Much simpler in a layman word, you would like to develop a product but you do not have any budget to spend for research and development, you come to ODM manufacturer, and they will have everything prepared for you from the design, the development of the product, the technologies to manufacture your desired product, everything from A to Z. And you brand it as your own brand. In most of the cases, even it is theoretically your brand, but the intellectual property belongs to the ODM manufacturer. In usual case, the ODM manufacturer had a pre-existing expertise and the manual to develop a particular product of this industry which makes them the 2nd liner beneficiaries when an industry is booming.

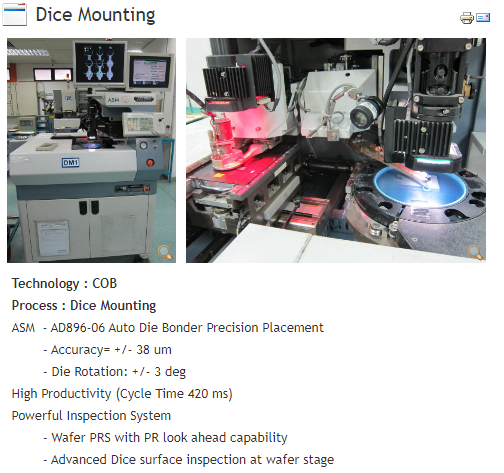

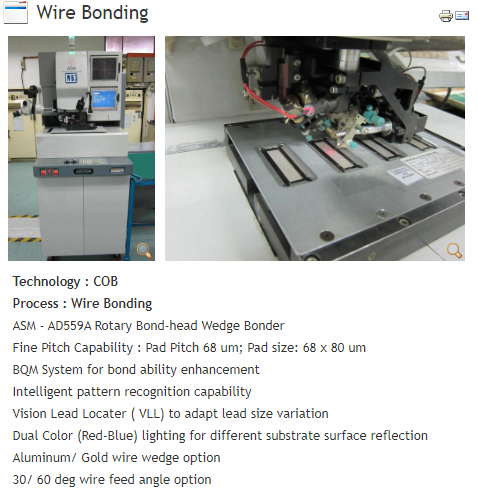

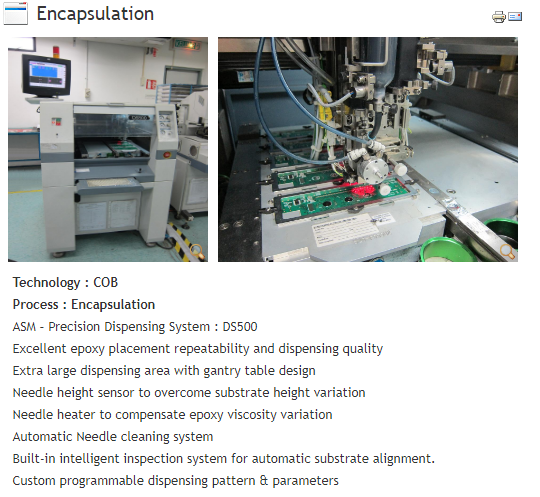

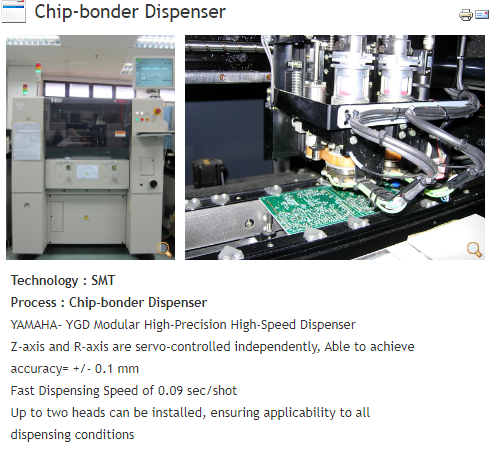

The Mystery of Uchitech Manufacturing Capability

Uchitech is well positioned as a premium fully / semi-automated “Coffee Modules“ supplier in many investors mind, probably because bulk of it’s revenue came from it but, there are something that is more interesting about Uchitech and its manufacturing capability.

Check the link below:

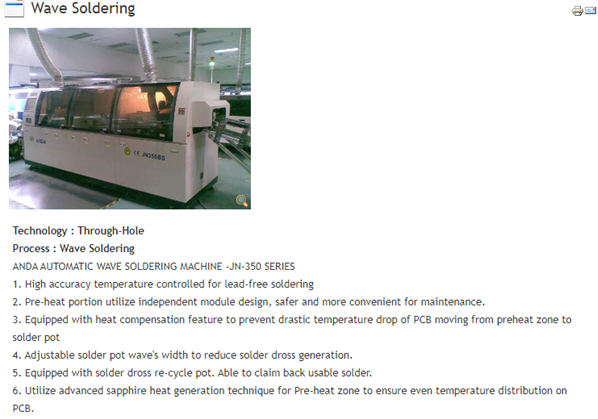

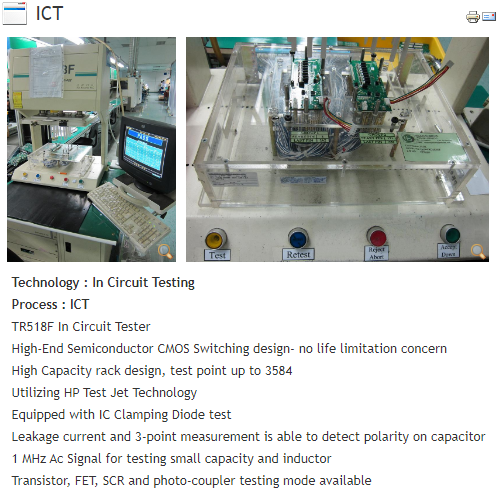

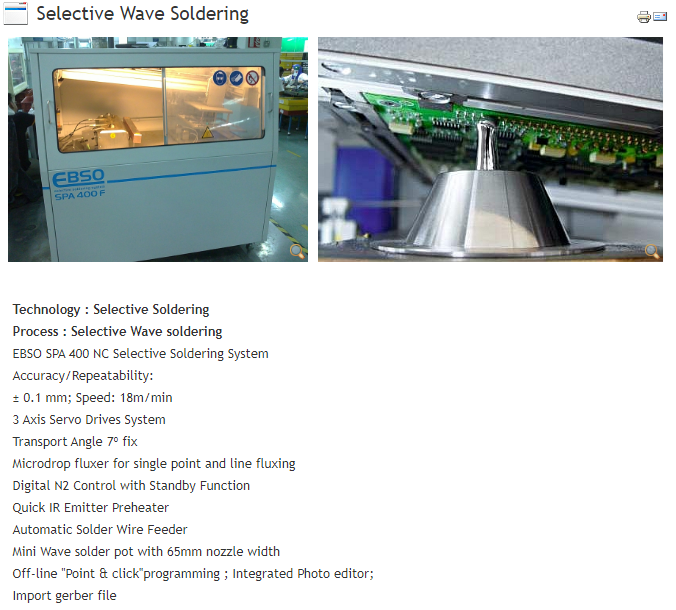

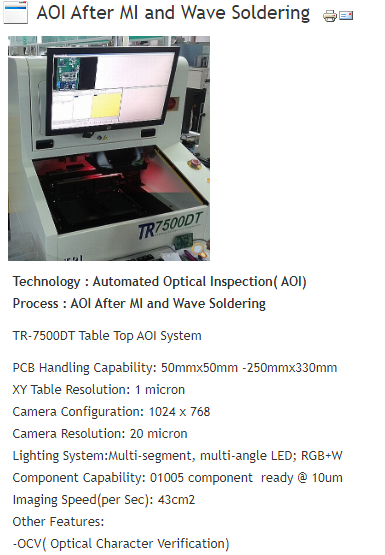

https://www.uchi.net/manufacturing-capability-and-process

Uchitech; the second liner beneficiaries of booming Semi-Conductor Industry

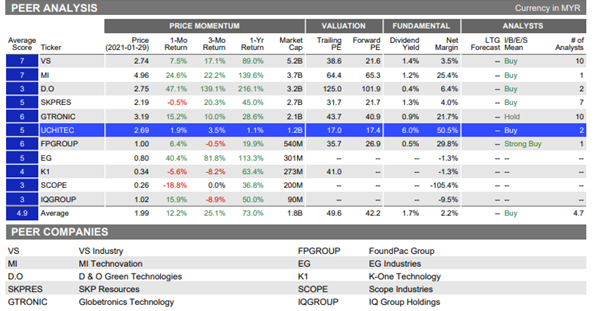

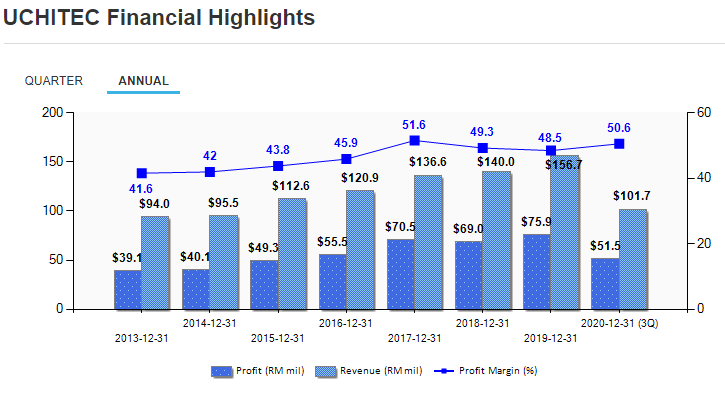

Since Uchitech is capable of manufacturing most of the ATE (Automated Test Equipment), its most likely that companies will be potential beneficiaries of the booming semi-conductor sector. Company like Vitrox, Penta, Mi, is trading at 60-85x PE and peers like D&O who does Optronic, which is nearly as similar with Uchitech who is Specialised in LED Dot Matrix Displays and TFT Display Modules Solutions is trading at 96x PE. While Uchitech is trading at merely 17x PE. Not to mention that Uchitech is a Net cash, debt free, good cashflow with Constantly paying good dividend company. The author personally think that Uchitech will be a great visit after the panic selling (due to the worker tested positive for Covid 19) ends. And even with 30x PE conservative valuation, Uchitech target price will be around RM4.71, not to mention near 60-90x PE.

Disclaimers: Information and comments presented does not represent the opinions whether to buy, sell or hold shares of a particular stock. Information shared above shall be treated solely for educational purpose only. The author may have positions in some of these instruments. The author shall not be responsible for any losses or lost profits resulting from investment decisions based on the use of the information contained herein.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|