Public Bank Call Warrants

NickelLee

Publish date: Mon, 08 Jul 2024, 07:38 PM

Maximizing Performance with Public Bank Call Warrants

For investors seeking enhanced performance from their Public Bank Bhd shares, call warrants offer a compelling alternative. In a bullish market, conservative counters like Public Bank may exhibit muted performance. By leveraging call warrants, investors can amplify their potential returns.

Why Choose Public Bank?

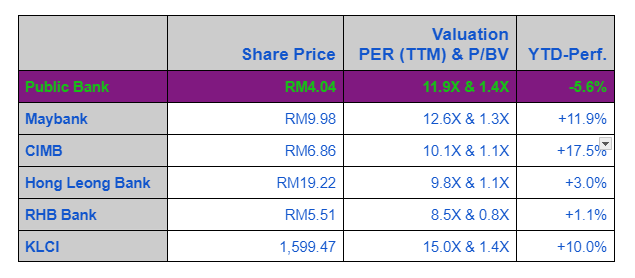

Public Bank is a well-managed institution with a market capitalization of RM78.4 billion, making it the third-largest on Bursa Malaysia. It is a staple for benchmark tracking and large institutional funds. Valuation-wise, it trades at 12x PER (TTM) and 1.4x P/BV with a dividend yield of 4.7%. Despite these strengths, Public Bank's share price has underperformed its peers and the broader market. For those bullish on the Malaysian stock market but wanting to minimize risk, Public Bank represents a safe, value-oriented investment.

The Power of Leveraged Warrants

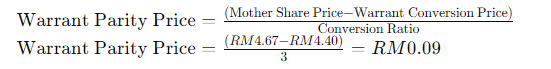

Having selected Public Bank, we now consider the benefits of its call warrants. Call warrants allow for a leveraged exposure to the underlying stock. The warrant parity price calculation illustrates this leverage:

Assuming Public Bank's share price aligns with KLCI movements and reaches RM4.67, the Warrant Parity Price would be:

A 15.6% increase in the mother share price can translate to a 900% rise in the warrant price, showcasing the potential for significant gains. However, this leverage also introduces greater risk, akin to driving a fast car—it can lead to rapid gains or substantial losses due to warrant expiry or declining share prices.

Recommended Warrants

Based on our proprietary warrant picking matrix, we recommend:

- PBBANK-C1B (12951B), Expiry: 30-08-2024

- PBBANK-C1D (12951D), Expiry: 24-01-2025

In conclusion, for those looking to enhance their investment returns in Public Bank, call warrants provide a high-risk, high-reward opportunity, ideal for investors with a robust risk appetite and a bullish outlook on the Malaysian stock market.