Protasco Bhd No.1 dividend stock? Do not let high yield confuse you - The Edge

FinanceProbe

Publish date: Mon, 19 Nov 2018, 08:31 PM

Do not let high yield confuse you

November 19, 2018 09:15 am +08

This article first appeared in The Edge Financial Daily, on November 19, 2018.

KUALA LUMPUR: As the stock market continues on a rollercoaster path, some investors are seeking out dividend-paying stocks for stability.

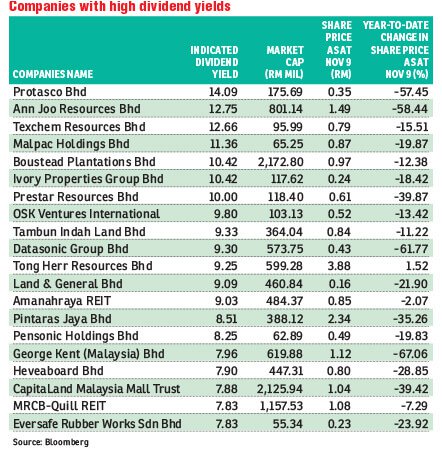

But the traditional big-capitalisation income stocks are not necessarily those with the highest dividend yield — the expected annual payout divided by the price. Bloomberg data showed that Protasco Bhd took the top spot in the list of companies with yields in excess of 10% — at 14.08% based on its Nov 9 closing price.

Apart from Protasco, Ann Joo Resources Bhd, Texchem Resources Bhd, Malpac Holdings Bhd, Boustead Plantations Bhd, Ivory Properties Group Bhd, and Prestar Resources Bhd are also members of the group of high-yield stocks.

However, it is not always the case that high-dividend yields are due to big dividend increases. Rather, the underperformance of the company’s stock over the past few years could be the main driver.

And in this fickle market, the fund managers The Edge Financial Daily spoke to still prefer the traditional go-to dividend stocks with strong fundamentals.

“Companies with high-dividend yields, we don’t exclude them but we look at them with a more critical eye,” said a fund manager who declined to be named.

“That’s because the share price plays a big role in dividend yield. Dividend yield may look good if the company’s stock price has been falling due to some reasons.

“When it comes to dividend stock picking, I still prefer companies with a track record of paying out dividends (than high-yielding stocks),” he added.

The fund manager cited Matrix Concepts Holdings Bhd, which has a dividend payout policy in place since its listing in 2013. The Seremban-based property developer continues to maintain its dividend payment of up to 40% of its net profit via quarterly dividend distributions to shareholders.

According to its Annual Report 2018, the group paid out four quarterly dividends of 3.25 sen, 3.25 sen, 3.50 sen and 3.50 sen per share respectively amounting to RM95.9 million in the financial year ended March 31, 2018 (FY18), 21.2% higher than in FY2017. The payout is equivalent to 45% of the group’s net profit for FY18.

The fund manager also likes Matrix Concepts for its focus on the affordable housing segment, where demand remains strong and sustainable.

In terms of dividend stocks, he also pointed out that he focuses on the companies’ fundamentals and their prospects.

“Let’s take Ann Joo, for example. Bear in mind that the steel industry is volatile, and this has affected Ann Joo’s share price movement as well. Its dividend yield will increase further if the share price continues to fall,” he added.

Ann Joo has a 12.75% dividend yield based on the 19 sen dividend per share for the financial year ended Dec 31, 2017 and closing price of RM1.49 as of Nov 9. Year to date (YTD), the steelmaker’s share price has plunged 59.8% to close at RM1.55 last Friday.

Malacca Securities head of research Victor Wan said in view of the current challenging environment, he is advising investors to focus on companies that pay good dividends as they are stable in terms of their share price.

“Dividend [stocks] should be seriously considered because it hedges against the current weak market conditions. If anything happens to your portfolio, at least you will get cash flow [dividends] and a stable share price,” Wan added.

He likes consumer staple stocks, noting that these companies are least likely to be affected by changes in the economy and their dividend payout and yield are likely to hold as well.

Wan expects consumer staple stocks will continue to pay dividends going forward provided their financial performance remains stable, citing companies like Nestle (Malaysia) Bhd, Dutch Lady Milk Industries Bhd and Fraser and Neave Holdings Bhd.

Wan also expects stocks such as Carlsberg Brewery Malaysia Bhd and Heineken Malaysia Bhd to continue to pay dividends after they received a reprieve from an excise duty hike for the coming year in Budget 2019.

Areca Capital Sdn Bhd chief executive officer Danny Wong Teck Meng concurs, expecting consumer staple stocks to give better dividends in the third quarter of 2018, underpinned by strong growth in private consumption following the three-month tax holiday period in June to August.

When announcing the third-quarter (3Q) gross domestic growth last Friday, Bank Negara Malaysia (BNM) revealed that private consumption growth accelerated to 9% from 8% in 2Q 2018. Household spending was boosted in July and August, following the zerorisation of the goods and services tax rate, particularly on durable goods such as motor vehicles and furnishings, as well as food and beverages. BNM also commented that continued expansion in income and employment provided key support to household spending.

Wong said dividend stocks that are fundamentally intact remain attractive in the current weak market conditions.

He names Malayan Banking Bhd (Maybank), the country’s largest lender by assets, as his top pick for its strong fundamentals and attractive dividend yield.

Maybank had a 6.2% dividend yield as at Nov 9. YTD, its share price has dropped 2.17% to close at RM9.45 on Friday.

In contrast, Wong is staying away from telecommunication stocks for now due to the challenging operating landscape given intense competition and heavy capital expenditure required for network expansion.

He said this has resulted in fundamental changes and negatively impacted their cash flow, thus telcos may not afford to continue to pay good dividends to shareholders in the near future.

This also applies to gaming stocks, in particular Genting Malaysia Bhd which is seen as the largest loser under Budget 2019 due to the increased tax duties imposed by the government.

“While Genting Malaysia may still have the cash to pay dividends to shareholders, but due to the increase in gaming tax, casino duties and casino licensing fees, it will have to pay more taxes in the future [which will likely impact their cash flow],” said Wong.

Genting Malaysia’s dividend yield stood at 3.06% as at Nov 9. YTD, its share price was down 37.2% to close at RM3.63 last Friday.

Wong noted that numbers forecast operators — Berjaya Sports Toto Bhd and Magnum Bhd, are still attractive as dividend plays as these companies are not affected under the new gaming tax.

Inter-Pacific Securities Sdn Bhd head of research Pong Teng Siew said even large-cap companies may find it difficult to maintain their dividend payouts during the challenging time.

“Looking at the company’s historical records is not a sure-fire way of picking winners. Companies who did worse than before will cut their dividends as well,” he added.

Going into the 3Q earnings season, Pong foresees consumer stocks will continue to pay good dividends, but he does not expect these companies to change their dividend policy for a short-term boost.

“Paying dividends involve cash. It [having insufficient cash in hand) will cap the company’s ability to cushion during adverse conditions. As such, in many cases, many companies are reluctant to pay very good dividends unless the business condition has improved permanently,” he added.

So far this year, the FBM KLCI has lost 90.43 points or 5.03% to close at 1,706.38 points last Friday.

More articles on Corruption and Fraud Probe

Discussions

TA

27-Apr-2018 27-Jun-2018 DIVIDEND Final Dividend RM 0.041 Dividend Detail

19-Apr-2017 28-Jun-2017 DIVIDEND Final Dividend RM 0.017 Dividend Detail

25-Apr-2016 28-Jun-2016 DIVIDEND Final Dividend 0.4000% Dividend Detail

29-May-2015 31-Jul-2015 DIVIDEND Final Dividend 1.8000% Dividend Detail

16-May-2014 01-Jul-2014 DIVIDEND Final Dividend 2.8% Dividend Detail

28-May-2013 16-Jul-2013 DIVIDEND Final Dividend 1.8% Dividend Detail

31-May-2012 11-Jul-2012 DIVIDEND First and Final Dividend 2% Dividend Detail

20-May-2011 05-Jul-2011 DIVIDEND First and Final Dividend 2% Dividend Detail

14-May-2010 28-Jun-2010 DIVIDEND First and Final Dividend 2.5% Dividend Detail

15-Oct-2009 28-Oct-2009 DIVIDEND Others 3 : 5 Dividend Detail

15-May-2009 31-Jul-2009 DIVIDEND First and Final Dividend 4.5% Dividend Detail

16-May-2008 01-Jul-2008 DIVIDEND First and Final Dividend 10% Dividend Detail

17-May-2007 02-Jul-2007 DIVIDEND Final Dividend 7% Dividend Detail

25-May-2006 24-Jul-2006 DIVIDEND Final Dividend 3% Dividend Detail

12-May-2005 01-Aug-2005 DIVIDEND Final Dividend 5% Dividend Detail

11-Oct-2004 01-Nov-2004 DIVIDEND Interim Dividend 1% Dividend Detail

02-Jun-2004 19-Jul-2004 DIVIDEND Final Dividend 2.5% Dividend Detail

12-Sep-2003 14-Oct-2003 DIVIDEND Interim Dividend 5% Dividend Detail

25-Jun-2003 11-Aug-2003 DIVIDEND Final Dividend 1% Dividend Detail

02-Jul-2002 15-Aug-2002 DIVIDEND Final Dividend 1% Dividend Detail

30-May-2001 10-Aug-2001 DIVIDEND Final Dividend 1% Dividend Detail

03-Jul-2000 08-Aug-2000 DIVIDEND Final Dividend 1% Dividend Detail

09-Jul-1999 06-Aug-1999 DIVIDEND Final Dividend

2018-11-19 21:42

CSCSTEEL

27-Apr-2018 27-Jul-2018 DIVIDEND Final Dividend RM 0.05 Dividend Detail

09-Feb-2018 26-Feb-2018 DIVIDEND Interim Dividend RM 0.05 Dividend Detail

22-Feb-2017 28-Jun-2017 DIVIDEND Special Dividend RM 0.04 Dividend Detail

22-Feb-2017 28-Jun-2017 DIVIDEND Final Dividend RM 0.1 Dividend Detail

22-Feb-2016 28-Jun-2016 DIVIDEND Final Dividend 8.0000% Dividend Detail

09-Feb-2015 26-Jun-2015 DIVIDEND Final Dividend 3% Dividend Detail

21-Feb-2014 26-Jun-2014 DIVIDEND Final Dividend 7% Dividend Detail

05-Feb-2013 26-Jun-2013 DIVIDEND Final Dividend 7% Dividend Detail

10-Feb-2012 27-Jun-2012 DIVIDEND Final Dividend 7% Dividend Detail

17-Feb-2011 28-Jun-2011 DIVIDEND Final Dividend 13% Dividend Detail

08-Feb-2010 28-Jun-2010 DIVIDEND Final Dividend 20% Dividend Detail

26-May-2009 26-Jun-2009 DIVIDEND Final Dividend 2% Dividend Detail

07-Aug-2008 27-Aug-2008 DIVIDEND First Interim Dividend RM 0.065 Dividend Detail

12-Jun-2008 26-Jun-2008 DIVIDEND First and Final Dividend RM 0.12 Dividend Detail

23-May-2007 27-Jun-2007 DIVIDEND Final Dividend RM 0.1 Dividend Detail

25-Apr-2006 28-Jun-2006 DIVIDEND First and Final Dividend

2018-11-19 21:45

ECS ICT

08-Nov-2018 03-Dec-2018 DIVIDEND Interim Dividend RM 0.025 Dividend Detail

28-Feb-2018 25-May-2018 DIVIDEND Final Dividend RM 0.025 Dividend Detail

02-Nov-2017 27-Nov-2017 DIVIDEND Interim Dividend RM 0.025 Dividend Detail

15-Feb-2017 30-May-2017 DIVIDEND Final Dividend RM 0.03 Dividend Detail

03-Nov-2016 24-Nov-2016 DIVIDEND Interim Dividend RM 0.03 Dividend Detail

23-Feb-2016 31-May-2016 DIVIDEND Final Dividend RM 0.0300 Dividend Detail

04-Nov-2015 25-Nov-2015 DIVIDEND Special Dividend RM 0.0500 Dividend Detail

04-Nov-2015 25-Nov-2015 DIVIDEND Interim Dividend RM 0.0300 Dividend Detail

11-Feb-2015 03-Jun-2015 DIVIDEND Final Dividend RM 0.03 Dividend Detail

05-Nov-2014 25-Nov-2014 DIVIDEND Interim Dividend RM 0.03 Dividend Detail

13-Feb-2014 03-Jun-2014 DIVIDEND Final Dividend RM 0.025 Dividend Detail

07-Nov-2013 26-Nov-2013 DIVIDEND Interim Dividend RM 0.03 Dividend Detail

20-Feb-2013 29-May-2013 DIVIDEND Final Dividend RM 0.025 Dividend Detail

07-Nov-2012 26-Nov-2012 DIVIDEND Interim Dividend RM 0.03 Dividend Detail

15-Oct-2012 25-Oct-2012 BONUS_ISSUE Bonus Issue 1 : 2 Dividend Detail

21-Feb-2012 29-May-2012 DIVIDEND Final Dividend RM 0.08 Dividend Detail

17-Feb-2011 27-May-2011 DIVIDEND Final Dividend RM 0.04 Dividend Detail

05-May-2010 27-May-2010 DIVIDEND Interim Dividend RM 0.04

2018-11-19 21:46

EKSONS NOW CASH RICH WITH 93 SEN PURE CASH

13-Jun-2018 27-Jun-2018 DIVIDEND Interim Dividend RM 0.05 Dividend Detail

05-Sep-2013 08-Oct-2013 DIVIDEND Final Dividend RM 0.03 Dividend Detail

05-Sep-2012 08-Oct-2012 DIVIDEND Final Dividend RM 0.025 Dividend Detail

29-Feb-2012 26-Apr-2012 DIVIDEND Interim Dividend RM 0.025 Dividend Detail

23-Aug-2011 06-Oct-2011 DIVIDEND Final Dividend RM 0.025 Dividend Detail

25-Feb-2011 23-Mar-2011 DIVIDEND Interim Dividend RM 0.025 Dividend Detail

30-Aug-2010 20-Oct-2010 DIVIDEND Final Dividend RM 0.03 Dividend Detail

20-Oct-2009 06-Nov-2009 DIVIDEND Interim Dividend RM 0.02 Dividend Detail

21-Aug-2008 08-Oct-2008 DIVIDEND Final Dividend RM 0.035 Dividend Detail

21-Nov-2007 07-Dec-2007 DIVIDEND Interim Dividend RM 0.025 Dividend Detail

25-May-2007 06-Jun-2007 CAPITAL_REPAYMENT Others RM 0.2 Dividend Detail

03-Feb-2000 28-Feb-2000 OFFER_SALE Offer for Sale 5 : 1 Dividend Detail

03-Feb-2000 28-Feb-2000 CONSOLIDATION Others 80%

2018-11-19 21:47

DUTALAND WITH NET CASH OVER 60 SEN AND 5 SEN COMING DIVIDEND

30-May-2018 12-Jun-2018 DIVIDEND Special Dividend RM 0.05 Dividend Detail

02-Mar-2007 15-Mar-2007 CONSOLIDATION Others 1 : 4 Dividend Detail

02-Mar-2007 15-Mar-2007 CONSOLIDATION Others 10 : 1

2018-11-19 21:48

LOL. Price drop more than 10 years dividend added up. Heading zero very soon when sheet shoot up the roof.

The moral of the story - Do not let high yield confuse you.

"CKP's" own dividend:

1st Protasco Chong Ket Pen fools everyone. This is his "personal dividend" by taking money from Protasco at your expense.

https://klse.i3investor.com/blogs/truebackground/131967.jsp

2nd, so called Dividend is fake. All added up cannot cover capital loss because Chong Ket Pen fabricate accounts to borrow money and pay dividend (to himself) and corrupted in bribe and crime just to enrich himself. Fools thinking high yield is good but don't know actually empty inside. It's a scam.

https://klse.i3investor.com/blogs/protascocursed/178459.jsp

The Edge actually surfaced Protasco fraud - laundering money through artificial dividend. Good job The Edge.

2018-11-20 10:28

Time is ripe for Bursa/ SC to re-write new policy on dividend which can be paid only if cash rish counters. Many the so-called high yield actually BORROW MONEY TO GIVE ANGPAO. THIS IS UNSUSTAINABLE like JJPTR scheme. SC, Bursa- sleeping at job????? wakaka

2018-11-20 11:19

u refering to Scientx?

chinaman Time is ripe for Bursa/ SC to re-write new policy on dividend which can be paid only if cash rish counters. Many the so-called high yield actually BORROW MONEY TO GIVE ANGPAO. THIS IS UNSUSTAINABLE like JJPTR scheme. SC, Bursa- sleeping at job????? wakaka

2018-11-21 09:27

calvintaneng

These ones with Solid Fundamental & Dividend yields

1) TA ENTERPRIZE

2) DUTALAND

3) EKSONS

4) CSCSTEEL

5) ECS ICT

2018-11-19 21:41