Yield Curve Steepest In 14 Months: What Happens Next

paperplane

Publish date: Fri, 20 Dec 2019, 02:10 PM

FROM: https://www.zerohedge.com/markets/yield-curve-steepest-12-months-what-happens-next

The Fed, reportedly, took action in 2019 - with its massive flip-flop, cutting rates drastically and expanding its balance sheet at the fastest pace since the financial crisis - in order to 'fix' the yield curve which had dropped into the media-terrifying inverted state... but what investors (and The Fed) appear to have forgotten (or choose to ignore) is that it is now much more concerning.

The last few months have seen the yield curve steepen dramatically, up 35bps from August's -5bps spread in 2s10s to over 30bps today - the steepest since October 2018...

Source: Bloomberg

That is great news, right? No more recession risk, right?

Wrong!

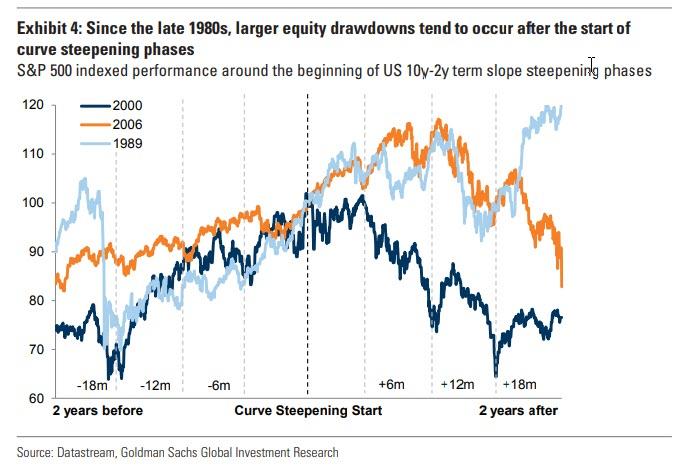

While investors buy stocks with both hands and feet, we take a look at how risk assets perform after the curve flattens and/or inverts. According to backtests from Goldman, while risky assets in general can have positive performance with a flat yield curve, risky asset performances tend to be lower. This is consistent with Goldman's base case forecast combining low (but positive) returns from here given the lack of profit growth and a less favouable macro backdrop.

What is far more notable, as we showed most recently last July, is that since the mid-1980s, significant stock drawdowns (i.e. market crashes) began only when term slope started steepening after being inverted.

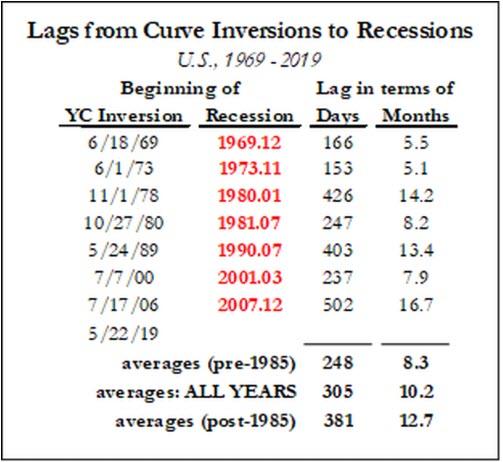

And remember, the yield curve’s forecasting record since 1968 has been perfect: not only has each inversion been followed by a recession, but no recession has occurred in the absence of a prior yield-curve inversion. There’s even a strong correlation between the initial duration and depth of the curve inversion and the subsequent length and depth of the recession.

So, be careful what you wish for... and celebrate; because as history has shown, the un-inverting of the yield curve is when the recessions start and when the markets begin to reflect reality.

More articles on Hedge Funds

Created by paperplane | Feb 04, 2021

Discussions

Very interesting. I have pondered this question over many weeks now that the (bond) yield is now increasing - time to get out of bond and back to equity? Seem like not.

Thanks for sharing.

2019-12-20 14:58

no problem. But seems like many analysts or fund management houses suddenly turned positive....i will share Franklin articles later. Nice to read and digest their different views.

But my base case still recession downturn for 2020.

2019-12-23 14:45

https://www.zerohedge.com/economics/china-orders-stealth-rate-cut-swtiching-benchmark-lending-rate-lowering-funding-costs

CHINA IS TRYING TO AVOID A FINANCIAL CRISIS NOW

2019-12-30 14:23

Taipei Times noted that five regional banks have had "liquidity problems this year, raising the prospect of devastating debt bombs lurking in unexpected corners."

He Haifeng, director of the Institute of Financial Policy at the Chinese Academy of Social Science, said: "Appointing financial vice governors to provinces can help better integrate financial policies into local practice, and to prevent financial risks beforehand."

And while central banks around the world are cutting interest rates and pumping liquidity into markets on the premise of a return to global growth in 2020, China is currently preparing for a slowing economy and financial armageddon.

2019-12-30 14:24

And yet, a wholesale easing, such as cutting the benchmark rate, could potentially spark even more food inflation, setting off violent popular protests. After all, the Chinese population's patience is already running thin, forcing Beijing to scrap import tariffs on US pork exports, a move which Xi Jinping (and Trump) quickly spun as a trade war concession, but in reality was a matter of preserving the peace for China which is desperate for any sources of cheaper protein to keep its 1.4 billion people fed, and happy.

2019-12-30 14:25

In a statement, the PBOC said that financial institutions should stop using the old lending rate as the pricing reference for all credit from January, and gradually convert existing loans to a new base using the loan prime rate, from March to August. The one-year lending rate had provided the previous anchor for loans across the economy.

And since the PBOC is effectively forcing lenders to adopt a reference rate that is 20bps lower than the benchmark, Saturday's announcement is effectively stealth easing, and will lower costs for the roughly 152 trillion yuan ($21.7 trillion) in yuan-denominated outstanding loans held by financial institutions and boost economic growth, even though - as with most things in China - it does not involve a straightforward cut to interest rates.

2019-12-30 14:26

paperplane

trade cautiously

2019-12-20 14:30