Value Investing also in RISK now

paperplane

Publish date: Sun, 29 Mar 2020, 02:06 PM

https://www.zerohedge.com/markets/only-question-goldmans-clients-are-asking

Let's face it: after the fastest bear market crash in history, which saw the S&P500 tumble 35% from an all time high in less than a month, a faster and more chaotic decline than the crashes of either 1987 or 1929 which set off the Great Depression, culminating with the S&P500 hitting its lowest level since 2016 on Monday...

... this however was followed by the fastest "bull market" in history (as the WSJ declared), with the S&P surging 21% in just four days after the Fed used not a bazooka but a "nuclear bomb", only to be followed by another near-limit down plunge on Friday...

... nobody knows what is coming next, as policy makers literally throw everything - some $12 trillion of everything so far to be precise- in hopes of avoiding a second Great Depression, if not for the economy then certainly for stocks.

Sure, professional traders, strategists, analysts, and drive-by market tourists can speculate, as they have been all of last week ...

... but the reality is that the market is now making it up day by day, watching how many

So great is the confusion among even professional traders, that according to Goldman's chief equity strategist, David Kostin, after the S&P's 18% rally this week, there is just one thing Goldman's clients want to know: “are we past the bottom" and "has a new bull markets started."

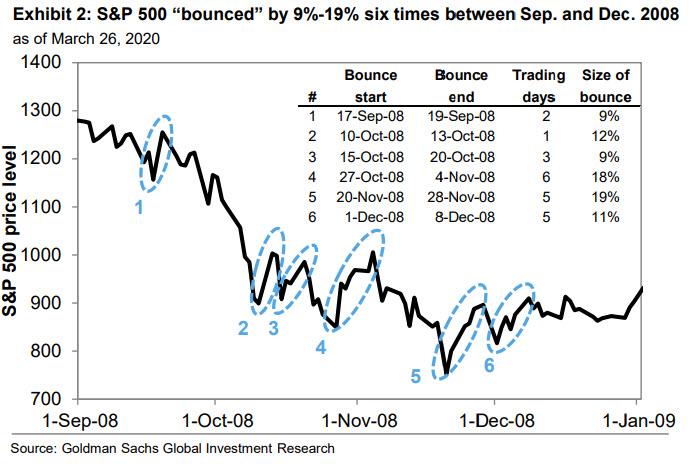

Goldman's answer is that even though the bank still retains its 3000 SPX price target, "tactically, we believe it is likely that the market will turn lower in coming weeks." To justify its bearishness, Goldman looks back at the global financial crisis and reminds us that "between September and December 2008, the S&P 500 experienced six distinct 1-6 trading day bounces of 9% or more, with some rallies as large as 19%. However, the actual market bottom did not occur until March 2009."

Here is how Kostin describes the unprecedented action of the past week:

The pattern of market extremes continued this week. After closing at the lowest level since 2016 on Monday, the S&P 500 rallied by 9% on Tuesday. Stocks continued to rise on Wednesday and Thursday – amounting to the best three-day return since 1933 – as Congress passed a $2 trillion fiscal stimulus package meant to support workers and businesses in the wake of the COVID-19 pandemic. While initial jobless claims spiked to a record 3.3 million, investors have focused on the slowing of the virus’ spread in Italy and Washington state along with the apparent “do whatever it takes” stance of US monetary and fiscal policymakers.

So, perhaps unsurprisingly, after the swift 18% rally in the earlier part of the week, Kostin says that the most common investor question this week was “has a new bull market started?", an optimistic query which echoes the positive tone in most of Goldman's conversations with clients alongside the bullish reversal in positioning, including a sharp rise in hedge fund net leverage and a steep decline in put/call ratios:

For bulls, the combination of policy support and nascent discussion in Washington, D.C. of ending shutdowns within the next month, along with encouraging commentary from firms such as NKE and MU about early business resumption in China, has been enough to reduce the perceived downside risk.

Finally, as we noted last week, the expectations of month-end equity demand from algorithmic and pension portfolio rebalancing further fueled the rally.

Among this client boom, Goldman - which "strategically continues to expect the S&P 500 will rise to 3000 by year-end 2020 as economic and earnings growth rebound from their 2Q trough" is far more subdued:

"We expect the equity risk premium will decline and valuations rise as investors gain visibility regarding the path toward the $170 of EPS we forecast for next year. Tactically, however, we believe it is likely that the market will turn lower in coming weeks, and caution short-term investors against chasing this rally."

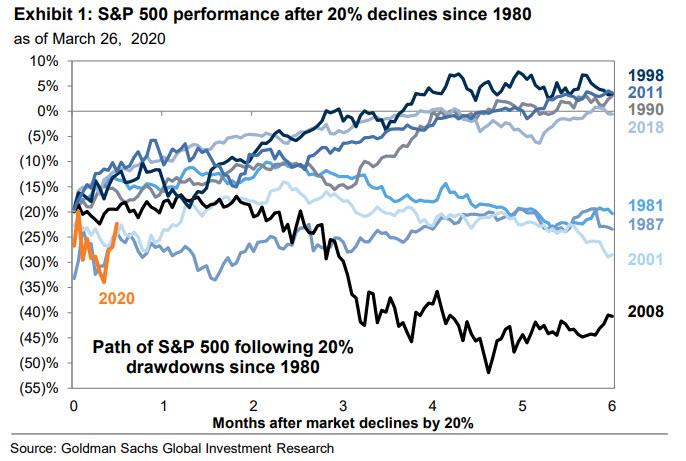

Kostin adds that from a historical perspective, if the worst is indeed behind us, it would mark the fastest and most volatile bear market decline on record, while as noted at the top of the post, the mere 23 trading days between the equity market peak on February 19 and the hypothetical trough this past Monday would mark the fastest peak-to-trough bear market on record.

Alas, the bear market is hardly over because since the middle of the 19th century, the median bear market has taken 17 months to decline from peak to trough, and none has made the trip in fewer than three months. However, history also shows that bear markets are often punctuated by sharp bounces before resuming their downward trajectory. For example, looking at the last great global capital markets crash, "between September and December 2008, the S&P 500 experienced six distinct bounces of 9% or more, with some rallies as large as 19%, during the course of between one and six trading days."

Just like now, most bounces involved optimism around monetary or fiscal policy support. However, the market low did not occur until until March 2009, when the pace of economic contraction finally began to slow (and Obama came on TV saying to buy stocks, something Trump has been doing every single day for the past three years).

* * *

So when will the market bottom be hit? Here Goldman chimes in its own views around a potential turning point in the path of the market during this pandemic, focusing on a three-part checklist:

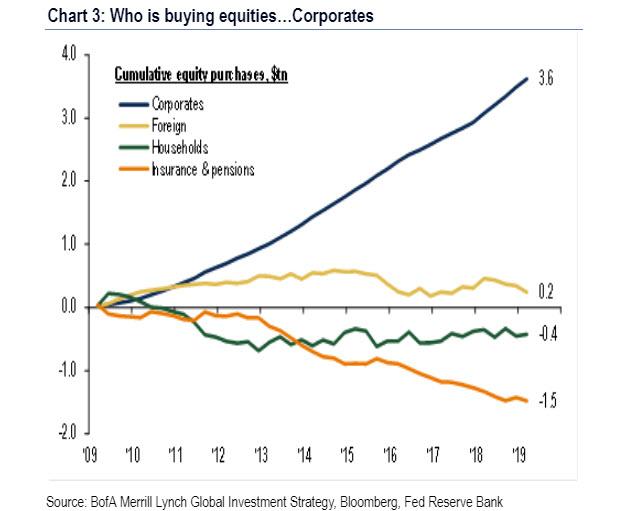

There is one more factor to consider: the effective and indefinite shutdown of the what has been the single biggest source of stock buying for the past decade: buybacks.

As Kostin explicitly warns, in addition to investor money flow, reduced buyback activity from US corporates is also likely to be a headwind to US equities. By the count of the Goldman Sachs Buyback Desk, nearly 50 US companies have suspended existing share repurchase authorizations in the past two weeks, representing $190 billion of buybacks or nearly 25% of the 2019 total.

Worse, the ongoing collapse in cash flows and select restrictions mandated as part of the Phase 3 fiscal legislation suggest more suspensions are likely. Finally, repeated something we have said every single year since 2015, Kostin concludes that "buybacks have represented the single largest source of US equity demand in each of the last several years, and we believe higher volatility and lower equity valuations are among the likely consequences of reduced buybacks." Now if only all those

* * *

One final point from Hatzius: while he remains cautious from a tactical perspective, investors ask what to expect in terms of market performance if and when the S&P 500 has bottomed. According to the Goldmanite, "S&P 500 returns are typically strongest in the month following the trough, but remain above-average for an extended period of time. The S&P 500 has posted a median return of 15% during the month following the trough of eight bear or nearbear markets in the last 40 years. This has been followed by a 5% return between months 1-3 and another 5% from months 3-6."

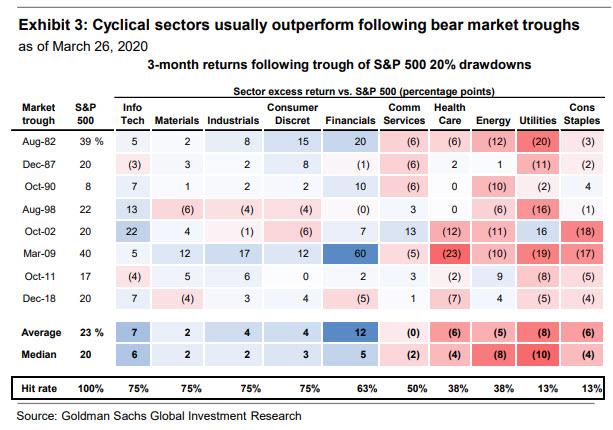

Unsurprisingly, cyclical sectors usually outperform coming out of bear market troughs. Although no S&P 500 sector has a perfect hit rate of outperformance in three-month windows following market troughs, the Info Tech, Materials, Industrials, and Consumer Discretionary sectors have outperformed most frequently. Utilities and Consumer Staples have almost always lagged.

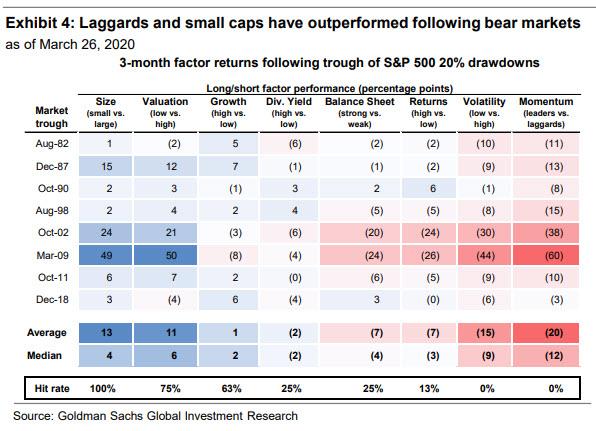

Finally, from a factor perspective, small-caps and anti-momentum laggards have outperformed following each of the eight troughs in the past 40 years. In general, during these periods “high quality” stocks with strong balance sheets and high returns on capital underperform, while Value stocks typically lead.

Which means that if there are still any value investors left out there after the unprecedented devastation their P&L has gone through in the past decade...

... they may finally make a buck one of these years.

billions trillions in new monetary and fiscal stimulus will be thrown at it, and flailing wildly as what happens next is quite literally never seen before: an attempt to kill the global economy, only to restart it a few week (hopefully) later when the coronavirus pandemic is over.

idiots "experts" in the media, on twitter and elsewhere who professed for years that buybacks have no impact on stock prices would have the courage to respond.

More articles on Hedge Funds

Created by paperplane | Feb 04, 2021

Discussions

2007.........they were bailed out by the government.........

2020.....expecting to be bailed out again...........

can meh?

2020-03-29 16:15

qqq33333333

RIP value investors.................

2020-03-29 16:12