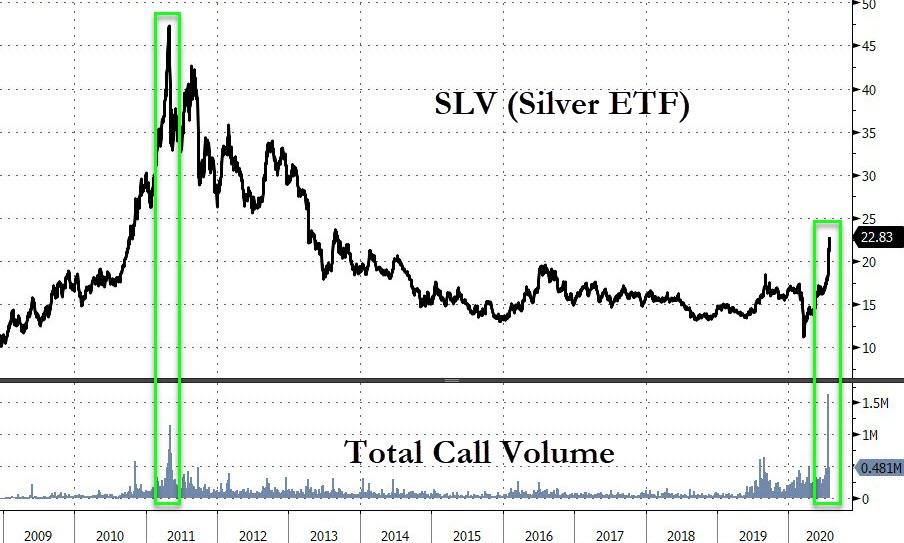

YOU MISS GOLD? Silver then!

paperplane

Publish date: Tue, 28 Jul 2020, 08:38 AM

ETF record high

GOLD/SILVER should go back longterm avg of 60-50

More articles on Hedge Funds

Created by paperplane | Feb 04, 2021

Discussions

GOLD/SILVER LONGTERM AVG SHOULD BE AT 60.

If Gold is 2000, silver=2000/60=33

2020-07-28 08:50

whre to buy silver? physical or on paper better (silver investment from maybank only) better...still got upside?!

2020-07-28 08:55

physical is good to keep but the spread is just too wide. paper carry some risk, but if for trading purpose of course buy those ETF or CFD

2020-07-30 08:40

If Gold is 2000, silver=2000/60=33, simple logic, dont complicate yourself.

So some said 2021 time, Gold to be 3000-3500, silver then?

50-58?? I assume thats the best case??

2020-07-30 08:41

Silver's rise maybe due to supply problem in Peru and speculation of Gold/Silver relationship.

Gold rises due to money printing by US Fed.

Silver rises due to rise in Gold + supply disruption in Peru. Silver has nothing to do with US Fed.

Gold is more money printing sensitive.

Silver is more supply/demand sensitive.

Silver will rise not as aggressive as gold. If there is a recession and US Fed is no longer printing money, gold and silver price will diverge. But US Fed may print money until US is out of the recession.

2020-07-30 08:48

paperplane

USE YOUR BRAIN!

2020-07-28 08:47