The Next IPO with Huge Multibagger Potential

ExecutionTrade

Publish date: Mon, 22 Apr 2024, 08:42 AM

At the time of writing this, we've seen 14 IPOs hit Bursa Malaysia from January to April 2024, and they've really been knocking it out of the park, reigniting investor interest in the IPO “sector”.

To be frank, not every IPO has the makings of a multibagger in Malaysia.

But, in my very humble opinion, the company we're discussing today shows a promising foundation to become the next big multibagger on Bursa Malaysia.

Introducing: Farm Price Holdings Berhad (“FPHB”).

For those who may not be familiar with the company, FPHB is preparing to launch their prospectus next week.

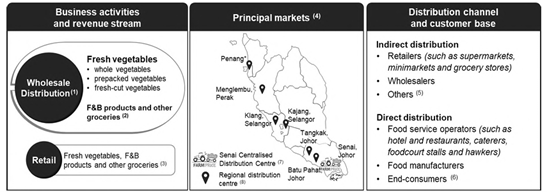

The company is a heavyweight in the wholesale distribution of fresh vegetables, F&B products, and groceries—ranging from packaged beverages to spices, seasonings, and personal care products.

Regionally, FPHB serves both the Malaysian market (across the northern, central, and southern regions of Peninsular Malaysia) and the Singapore market.

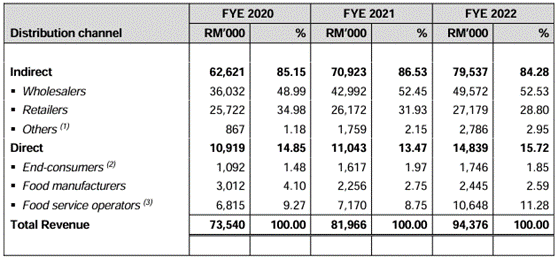

In FYE2022, a substantial 74.68% of the company’s revenue came from Malaysia, with the remaining 25.32% contributed by Singapore.

The company also operates a retail store in Ulu Tiram, Johor, that sells fresh vegetables, F&B products, and other groceries.

I believe FPHB has the potential to be a multibagger largely because their business revolves around wholesaling and retailer consumer staple products.

Having experienced COVID-19, we know that certain businesses can weather any market condition, and FPHB is one of them.

Back to business; FPHB mainly adopts two selling strategies.

They use an indirect distribution channel to market and sell their products to intermediaries such as other wholesalers, retailers (supermarkets, minimarkets), and even to ship chandlers or army camps.

On the direct sales front, they market and sell directly to consumers including caterers, hotels, hawkers, food court stalls, restaurants, and food manufacturers.

It's fair to say that FPHB plays a significant role in Malaysia's fresh food/produce market.

Could any competitor swoop in and capture FPHB’s market share?

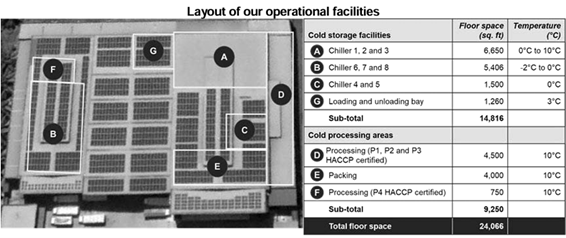

The answer is NO. FPHB has been in the game for over 19 years and is equipped with cold room facilities, ambient temperature storage, and processing and packaging facilities for fresh vegetables.

As of the prospectus exposure cut off date, they own six regional distribution centres and a fleet of 36 trucks, including 12 refrigerated and 24 delivery trucks, across Malaysia and Singapore.

Moreover, FPHB has built an extensive network of suppliers in Malaysia and abroad, ensuring a stable supply of fresh vegetables.

These vegetables are regulated under the Price Control and Anti-Profiteering Act 2022, which are price-controlled products, significantly reducing the opportunity for new competitors.

According to the IMR report, the agriculture sector contributed 8.9% to Malaysia’s GDP, with only 12.9% of Malaysia’s agricultural land used for fresh vegetable crops.

Between 2020 and 2022, the production value of fresh vegetables grew at a CAGR of 10.6%, outpacing the production volume growth of 6.7%, indicating that demand is increasing faster than supply.

The same report highlighted that the market size in Malaysia alone is RM6.32 billion, with FPHB commanding less than 1% of the total market share, suggesting ample room for brand visibility and expansion post-listing.

Notably, there's also significant growth in imports of fresh vegetables, which FPHB also sources, amounting to RM3.5 billion in 2022.

Remember, this sector is irreplaceable, and demand is consistently growing as it is an essential industry.

With the younger generation increasingly opting for healthier lifestyle (read: eating more fresh vegetables), this trend could further increase total consumption value.

Compared to other peers in Malaysia, FPHB boasts one of the highest net profit margins due to their effective management strategy.

Honestly, I doubt any other fresh vegetable companies could get listed, as this is not an easy industry to formalise and operate as a listed company.

All in all, while we don’t yet know the valuation of FPHB for their IPO, it's clear the company is poised for strong growth regardless of market conditions given the rising demand for food.

If you're interested in IPOs, make sure to keep an eye on FPHB!

More articles on IPOWatcher

Created by ExecutionTrade | Jul 12, 2024

emsvsi

Perishable foods is risky can't keep long quick to rot

2024-04-23 22:12