Examining the earning power of Focus Lumber

Ricky Yeo

Publish date: Tue, 22 Nov 2016, 09:06 PM

Earning power, or normalised earnings, refers to a company’s underlying strength to make money under various economic conditions. It is different from reported earnings which can be temporarily obscured by external factors. As Ben Graham wrote in Security Analysis over 80 years ago, if you look beyond the numbers, you will find the qualitative side of a business that tells you something more fundamental.

Some fact checks first. Focus Lumber is a price taker. Plywood, or any type of woods, is a commodity business and the price is more or less dictated by market. They’re not in a luxury business so they don’t have a say on how much they can charge for selling plywoods. The only control they have is operation efficiency by keeping cost as low as possible.

When you study a business, you want to find information that are as ‘clean’ as possible to start with. Net profit tend to be the number everyone has their eyes fixate on, thus the obsession with EPS but it is a very ‘noisy’ number. It is affected by forex, tax, non-operating profit/loss, one-off gain/loss, and all kinds of expenses just to name a few. The lower you go in the income statement the noisier it gets. So where’s the best way to start? Right at the top, revenue! Revenue is one of the key driver for valuation and it is considered ‘raw’ as it doesn’t get tainted easily.

For FL, revenue is a function of volume x price. Just like if you sell milk tea, your revenue will be how many milk tea you sold x price of each cup. Very straight forward.

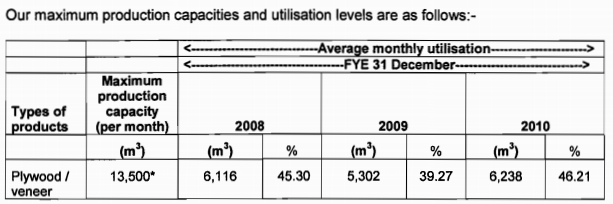

FL has a maximum production capacity of 13,500 (m3) a month or 162,000 (m3) a year. Watch it before you call this number old, which is from IPO prospectus. It is running at 46.21% capacity in 2010 when business started picking up following the GFC. Now we have the first number to the equation, capacity. Next we need price.

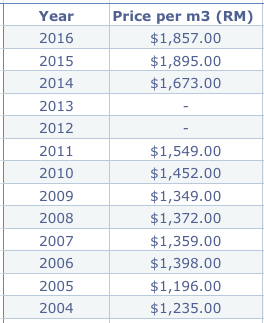

You can easily find the export price for plywood on Malaysian Timber Industry Board (MTIB) website.

This is the plywood export price from Sabah on a yearly basis, which is different in price from Sarawak and Peninsula, and the highest of all if you wonder. There can be many factors for price increase from drop in supply to higher demand and every year there’s up and down but in general the 10 years trend is heading north. And FL normally has the power to pass on any log price increase to their customers within 2-3 months lead time.

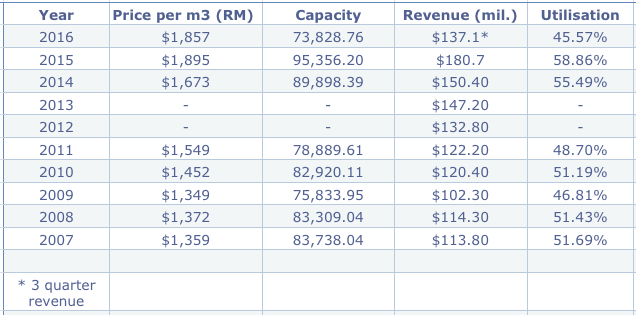

By deducing capacity from reported revenue and price, we can see the qualitative side of the business.

As mentioned in the prospectus, FL capacity has been sitting at around half of its maximum capacity of 162,000, or 81,000. And over the past 7-8 years, capacity sits between 82-89,000. Year 2009 is a down year due to GFC and 2015 is an abnormal year affected by forex to a certain degree. Utilisation rate gives you an amount of 50-55% over time, of course it will change in the future, but you are talking about 5-10 years time.

So if the utilisation rate is 50-55% over time, capacity will sits at 82-89,000 (m3). Given the price of plywood of around RM1,800+, you have an earning power of $147.6 - $160 mil in revenue for the business. A range of number you expect FL can earn going forward unless they undertake some drastic strategy shift.

As for the profit margin. There’s no need to be precise here. Just have to be roughly right. FL average profit margin sits around 10-11% over the past few years before full tax rate was introduced few months ago. Factor in the full tax rate, 7-9% is about right.

7-9% margin gives you 10.3 - 14 mil in profit a year or an earning power of 10 cents to 13.6 cents per share on 103 mil outstanding.

At $1.55, FL has a market cap of $160 mil. Take out its cash of $84 mil, that’s left with 76 mil or 74 cents a share.

So at this price, you are paying 74 cents for a business that has an earning power of 10-13 cents. Or roughly 5-7x. Now you have to judge if this is the right price to pay for a business like FL. But if you’re the one that pays $3 for it, that’s close to 18x. Definitely hefty by any measure.

When you study a business, look at things that don’t change, in this case the plywood price and capacity which are relatively ‘stable’. Of course there are always other kinds of business risk i.e. high concentration of US clients etc that can impair their earning power but as a general starting point, look behind the numbers and start from the top. Find something you can anchor on and start thinking about the business earning power. And think what can potentially affect the earning power.

If you find this helpful please share it and subscribe to our list http://eepurl.com/b93qbH

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Intelligent Investing

Discussions

better run away, sekali US impose duty on the wood import like steel, FLB will be affected

2016-11-22 21:21

Ricky, high cash is belong to the company, not the shareholders, if they dun return to you, then is no point

2016-11-22 21:22

Thats why warren buffet always try to tell investor....owning share ...must think like owning of business mah....!!

Thus FLB with good business with hefty cash is a good business to own for long term loh....!!

2016-11-22 21:26

Not easy to find a good business & at undervalue price like FLB loh...!! With no borrowing and with cash of Rm 0.86 per share mah....!!!

Div likely to be around Rm 0.08...u get a div yield of 5%pa better than fd loh....!!

Strong buy loh....!!

2016-11-22 21:33

ricky is definately going to be a great investor. only thing lacking is time. but he has plenty... great effort by ricky.

2016-11-22 22:31

I have been obsessed to see people saying the price is to less out cash per share, then the net will be the one that you paid for. It is true if you buy the whole business & have control over the cash & business.

But for normal investors like us who can never be the one who can touch the cash, which is beyond our reach, so it is meaningless to say our price is to pay for the net of cash.

In reality, you still pay for the full amount, not the one that less cash.

2016-11-23 02:25

Posted by ABCDEFGHIJKLMN > Nov 23, 2016 02:25 AM | Report Abuse

I have been obsessed to see people saying the price is to less out cash per share, then the net will be the one that you paid for. It is true if you buy the whole business & have control over the cash & business.

But for normal investors like us who can never be the one who can touch the cash, which is beyond our reach, so it is meaningless to say our price is to pay for the net of cash.

In reality, you still pay for the full amount, not the one that less cash.

===================================================================

That is not correct.

Why is the role of Cash in a business?

1) Cash is used to reinvest back into the company - when a business uses the cash to reinvest into itself, it is able to expand the business, launch more product range, etc. This translates into higher profit in the future.

2) Cash is is distributed as dividends. Ever wondered where the money from dividend comes from? This is your answer.

So shareholders DO indeed receive the cash, but in the form of dividends.

3) When a company is liquidated, cash will most likely be returned to it's creditor first or any preferred shares shareholder, then accompanied by shareholder.

Since FLBHD has no debt, so there are no creditor. So shareholders DO indeed receive the cash.

2016-11-23 02:52

May I know where about in MTIB you found the prices? Or did you work out from per piece price?

2016-11-23 17:10

http://www.mtib.gov.my/index.php?option=com_content&view=article&id=2034&Itemid=65&lang=en

Go there > Advanced search > Select year > View > Download file. Yea I calculate price per m3 unit. They only give total export amount on the month from a region on a particular type of wood.

2016-11-23 17:36

Posted by Ezra_Investor > Nov 23, 2016 02:52 AM | Report Abuse

Posted by ABCDEFGHIJKLMN > Nov 23, 2016 02:25 AM | Report Abuse

I have been obsessed to see people saying the price is to less out cash per share, then the net will be the one that you paid for. It is true if you buy the whole business & have control over the cash & business.

But for normal investors like us who can never be the one who can touch the cash, which is beyond our reach, so it is meaningless to say our price is to pay for the net of cash.

In reality, you still pay for the full amount, not the one that less cash.

===================================================================

That is not correct.

Why is the role of Cash in a business?

1) Cash is used to reinvest back into the company - when a business uses the cash to reinvest into itself, it is able to expand the business, launch more product range, etc. This translates into higher profit in the future.

2) Cash is is distributed as dividends. Ever wondered where the money from dividend comes from? This is your answer.

So shareholders DO indeed receive the cash, but in the form of dividends.

3) When a company is liquidated, cash will most likely be returned to it's creditor first or any preferred shares shareholder, then accompanied by shareholder.

Since FLBHD has no debt, so there are no creditor. So shareholders DO indeed receive the cash.

RAIDER COMMENT;

THE ABOVE ARE SILLY ARGUEMENT LOH....!!

A COMPANY HAVING ALOT OF CASH IS BETTER THAN A COMPANY HAVING ALOT OF BORROWING LOH....!!

A COMPANY HAVING NET CASH PER SHARE OF RM 0.86 IS BETTER THAN A COMPANY HAVING ONLY RM 0.30 NET CASH PER SHARE LOH.....!!

SO WHAT IS THERE TO COMPLAIN OF COMPANY HAVING ALOT OF CASH AND U BUY IT CHEAP....?? IT IS NOT BETTER THAN COMPANY HAVING ALOT OF DEBTS AND U BUY IT CHEAP LEH ??

2016-11-23 18:41

stock raider sifu, the receivable of FLB oso like cash account loh. you check check their debtors aging analysis and see... and oso hor, the Balance Sheet of FLB is clean until dunno how to describe. Wolun Buffeet said buy simple busines, no?

2016-11-23 20:35

plus hor the company held a lot of USD in the past, I assume it still doing so.

2016-11-23 20:36

today I bot a bit oso. slow slow buy, in case penggoreng wanna bombed again, then still slow slow buy, buy until penggoreng fainted

2016-11-23 20:37

Hi Rick Yeo - tq for sharing. You are a very good value investor. A very good article indeed.

Apprec if you can guide me how do you determine eg 2015 price of $1895.

I tried using the link you provided -Go to> Advanced search>various statistic check boxes like 1)country/state 2)category 3)Issued year 4)Issued month 5) View

I am confused. Apprec ur help. Thks.

==========================================

Ricky Yeo http://www.mtib.gov.my/index.php?option=com_content&view=article&id=2034&Itemid=65&lang=en

Go there > Advanced search > Select year > View > Download file. Yea I calculate price per m3 unit. They only give total export amount on the month from a region on a particular type of wood.

2016-11-24 00:19

Thanks Bizfuneng.

Here. http://www.mtib.gov.my/repository/e-stat%20export%20jan-dec%202015.pdf

Page 3 - Sabah Plywood column

2016-11-24 08:18

Blink22

A simple business and hedge for currency as export earnings.

2016-11-22 21:13