On the validity of top picks of the year

Ricky Yeo

Publish date: Sat, 31 Dec 2016, 03:10 PM

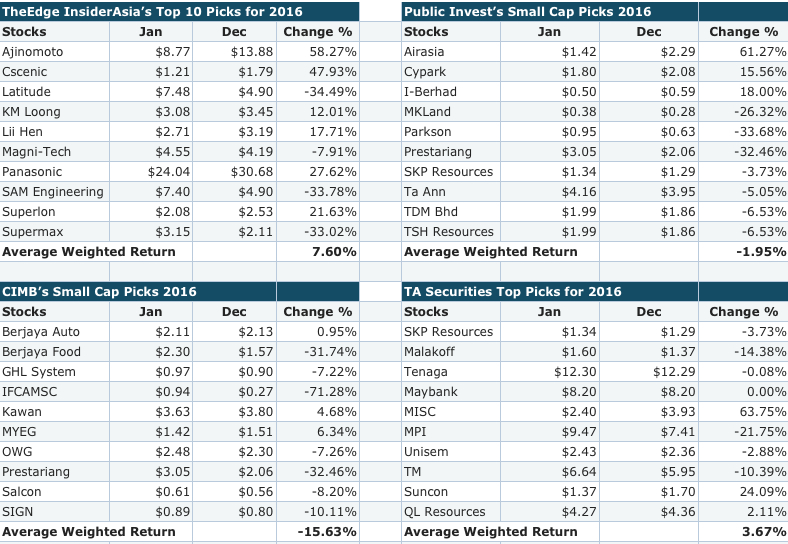

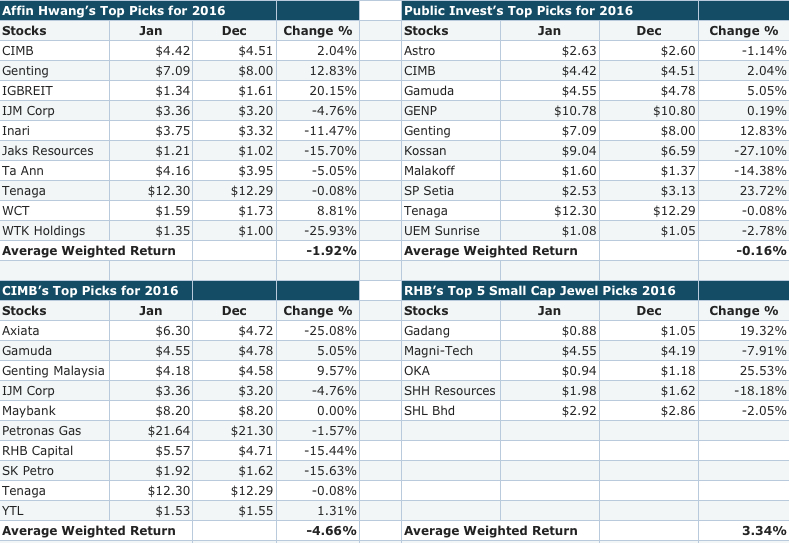

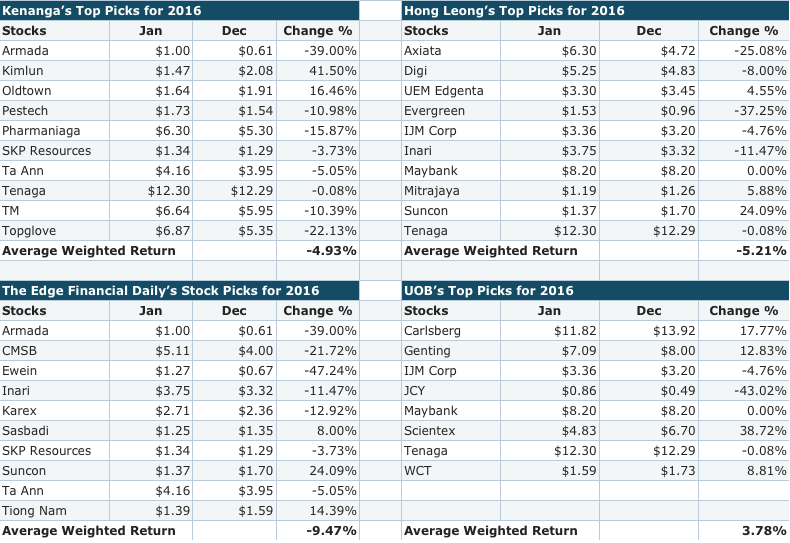

Heading into 2017, we are all eager to find out what are the potential winnings stocks and generally, fund managers’ top picks is a starting point for most investors. But before we look forward, let’s look backward. There’s much more things to learn looking backwards. Below are some of the top picks from research house, newspaper publications and their stock performance.

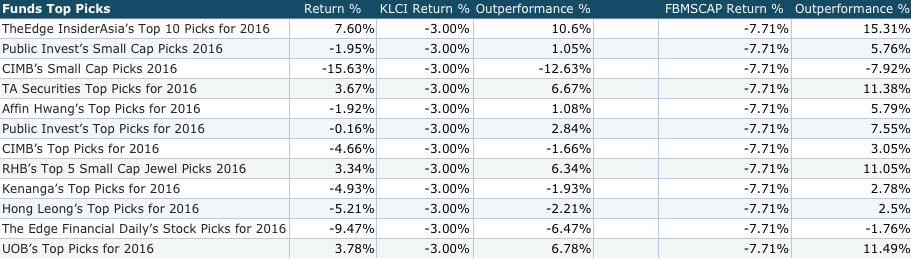

Out of the 12 lists of top picks, 4 managed to have a positive return this year. Make no mistake, it is a tough year, KLCI is down 3% this year and FBMSCAP is even worse, capping -7.71%. Out of the 80 top picks stocks, 34 had positive returns compare to 46 that register negative return. Overall return sits at -2.20%. Below is how they had performed against the benchmark. Against KLCI performance, only 1 list managed to outperform the index by 10%, and 4 out of 12 when compared against FBMSCAP or Small Cap Index.

Now this is not a question if they had done a good job this year but more of a question if these research houses are finding it hard to pick the right stocks that are considered defensive, growth or strong potential, what is the validity of having a list of top picks every year? And this rightly goes into the mentality of most investors that cycle through stocks every year. How did the construction theme perform this year? Pretty decent with average of 5.24%, but probably below what most investors would expected, considering it is the theme of the year.

The lesson here is Picks of the year doesn’t guarantee winners. It is better to sticks to your own strategy and stocks you understand well. And the fund managers’ failure to dramatically outperform the index isn’t because they are incompetent, it just means anything can happen in a year. But the most important thing is you don’t need to have an informational (insider information) or analytical edge to pick winners. There are another edge that is free to you - investment horizon.

I have no doubt given all the top picks in these lists, the odds that their return will improve increases once you expand your horizon from a year into 3, 5, 10 years. And if you do that to the stocks you are familiar with, you will do even better! Thinking long term, beyond 5, 10 years is a rarity in investing, which also makes it an extremely powerful edge if you can will it. Expanding your investment horizon starts from restricting rubbish stocks into your portfolio and using tools like decision tree or checklist is a good place to start. When you expand your horizon, you will unlock another edge - psychological. You can read more here.

If you find this helpful please share it and subscribe to our list http://eepurl.com/b93qbH

All the best for 2017. May the force be with you.

More articles on Intelligent Investing

Discussions

Their clients are institutions.

They just wanted market performance/

higher returns comes from higher risk

2016-12-31 16:20

In the case of Marcus Chan CFA

He didn't play the game properly and was fired.

2016-12-31 16:21

To be fair, don't we should take into account the 'share split' and ' Dividen paid ' for individual counters

2016-12-31 17:16

Did I critic? I'm just stressing the impossibility of picking stocks based on yearly time frame.

2017-01-01 07:29

Excellent analysis and excellent commentary. Keep up with your good work, which is very useful for the general investing community.

"Investing is not easy, anyone who thinks it is easy is stupid." Charles Munger

“Investing should be more like watching paint dry or watching grass grows. If you want excitement, take $800 and go to Las Vegas.”

– Paul Samuelson

2017-01-01 08:43

In my opinion, this analysis merely shows that IBs are lousy in selecting top picks.

It does not really prove that picking stocks based on yearly timeframe does not work.

For every lousy IB 2016 portfolio , there is a counter argument in the form of paperplane, Tee Tom and OTB, which shows that paying attention to latest FA signals have chance of generating above average return

I am writing an article on this

Posted by Ricky Yeo > Jan 1, 2017 07:29 AM | Report Abuse

Did I critic? I'm just stressing the impossibility of picking stocks based on yearly time frame.

2017-01-01 12:43

I think even if the time horizon expands from one year to 3 years or 5 years, the stock picks by the investment bankers above also can't show good return. Thus, it is not a time horizon issue for their bad result in 2016.

2017-01-01 13:10

If it is short time horizon issue, why so many i3 stock pickers in 2016 contest can beat the professional investment bankers by that much. Their stock picks also base on 1-year period.

2017-01-01 13:11

I think

With responsibility comes caution

With caution comes mediocre

They rather hunt in the middle of the pack than on the fridges

It is the way it is.

You laugh, but when the lions come, they laugh.

2017-01-01 13:24

Icon said:

"For every lousy IB 2016 portfolio , there is a counter argument in the form of paperplane, Tee Tom and OTB, which shows that paying attention to latest FA signals have chance of generating above average return"

The above is called majority's perception based on (1) "latest available information".....its quite easy to understand why an improving earnings has the biggest impact on the stock price as it is "the most influential variable mathematically to change the IV of the stock". It changes the FCF in the DCF model...or whatever model one may have...having a good common sense on probability of what this means to the future.

To gain from above strategy - on has to be at the sharp edge of the information flow - the earliest to receive & analyse correctly this date - not everyone can be at the top of this game...and its like the sinusoidal wave of zero sum...for everyone top fellow there will be a bottom fellow...and many sitting in different region of the wave amplitude. i,e for every winners there is an equal loser.

As such the above falls under speculation...if i stretch it a little.

What we need is (2) "long term improvement of the companies earnings"...and who can provide that? - they are the gurus which all the long term "investors" seek.

These are gurus who can share why they think the companies has MOAT & has huge reinvestment potentials..i.e growth and that its selling super cheap currently.

2017-01-01 13:33

icon

You cannot compare a monopoly money portfolio done by an individual with a model portfolio done by an institution.

The latter has a lot of institutional constraints.

2017-01-01 13:34

Instead what "we" need is (2)...i should have stated what "long term investors" need.

I fall into speculator category...its the readers choice...no right or wrong.

2017-01-01 13:36

icon

no risk no rewards

higher returns comes from higher risk

you see only what you see

but the unseen is equally important.

For example, OTB portfolio was third from bottom earlier part of the year.

2017-01-01 13:36

I believe there is no perfect stock pick unless you are dynamic to change your pick when you see opportunity. Who ever has pick Ekovest, Mycron, Gamuda from begining till end are the true winner

2017-01-01 15:58

If true in real life, why IBs' never plan to hire i3 contestants? They should sack their own fund managers.

Posted by paperplane2016 > Jan 1, 2017 08:57 AM | Report Abuse

Wow. Our contestants outperform them a lot!

Posted by Icon8888 > Jan 1, 2017 12:43 PM | Report Abuse

In my opinion, this analysis merely shows that IBs are lousy in selecting top picks.

It does not really prove that picking stocks based on yearly timeframe does not work.

2017-01-01 16:06

I heard Icon8888 still own BIMB-W and paperplane2016 BJ Corp and Perak Corp. Why not show them in stocks picks?

2017-01-01 16:14

Icon bought Bimb wa at 0.40 http://klse.i3investor.com/blogs/icon8888/78939.jsp

Posted by sell > Jan 1, 2017 04:14 PM | Report Abuse

I heard Icon8888 still own BIMB-W and paperplane2016 BJ Corp and Perak Corp. Why not show them in stocks picks?

2017-01-01 16:19

because the qualifications to work in a large organisation is different from being a blogger.

Want_to_know > Jan 1, 2017 04:06 PM | Report Abuse

If true in real life, why IBs' never plan to hire i3 contestants? They should sack their own fund managers.

2017-01-01 16:40

There's no definitive answers to why fund managers haven't done that well against benchmark, it is like how are you going to separate luck from skills. It can be that indeed these managers are so bad, or it can be that one year is too hard to prove anything, or it can even be that their picks are to encourage investors to trade to increase fee commission instead of picking true winners. Or it can be a mix of all.

@eagle71 - If you go to casino and notice a gambler just win 200% return on his original capital, would you conclude that gambler is a legend? If not then why are you asking questions like why many ppl in i3 can outperform these research houses. I can just as easy find a noob that makes 100% on the last week of December alone, would you say he is better than these analysts?

@eagle71 - Since you mention time horizon doesnt matter. If you hold all the 78 stocks, excluding Suncon and OWG that are not listed 5 years ago, your return for the past 5 years will be 177.5% or average 35.5% including -3.18% this year. You will be the judge if 35.5% per year is considered good or bad.

Even if I only included the 44 stocks that registered negative return this year, their 5 years average is still 31.8% per year or 159.04% overall. Average can be bias when there are stocks that gain alot like IFCAMSC over the 5 years, even using median, you get 9.8% for all negative performing stocks.

2017-01-01 17:22

Ricky yeo, keep it up...very informative article...hope to see more posting from you, bro....

2017-01-01 23:58

IB's can suggest...but they can't predict the outcome...as what warren buffet say “You can't produce a baby in one month by getting nine women pregnant.”...that's right...Time horizon plays a crucial part in your success as an investor over the long term.

2017-01-02 00:07

glad so many agree time is important.

An 83 years old man certainly agree

2017-01-02 00:10

Ricky is smart. Old man return is also poor in a year period albeit saying he is a superior investor vs chartist or whoever comparatively. If old man is pro investor which I doubted and thinking about my pocket, with low foreign holding n poor return could this means bursa is at a lower range of a cycle readily to be going north? I pun tak Tahu...

2017-01-02 13:12

Sum up Ricky Yeo intention of this article: making wealth in stock market is a long term commitment, a year result give no judgement about the investor decision process whether is on the right path or wrong path. perhaps he is really skillful, perhaps he is lucky this year, perhaps he is lucky n skillful. Only Allah know. But when you hit it luckily or luckily with skill please write an article saying how you ignore the chartists n fundamentalislt advise n hit home run. Last statement I added myself. Hopefully then got a PLP guy keep supporting my home run article.

2017-01-02 13:41

truth is many are losers in i3 trying to say IB not good at picking good stocks so that innocent people will fall victims and support their buy calls here.

2017-01-03 07:19

good sharing ricky... mind to share with us what are your top picks for 2017?

2017-01-06 15:47

CharlesT

No wonder some once said monkey may do a better guess

2016-12-31 15:35