Pro Guide to Invest in Penny Stocks

KayElleGuy

Publish date: Tue, 27 Sep 2022, 08:00 PM

The term penny stocks is more commonly used overseas in the US, UK or Europe, but you could have also heard the phrase in Malaysia too. So what are they?

What are penny stocks?

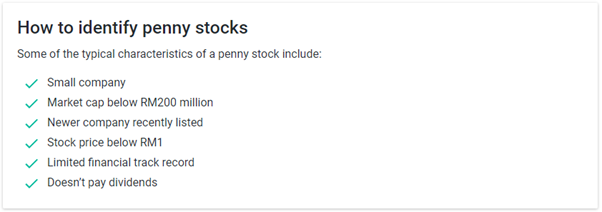

“Penny stocks” is a loose name for cheap, low-priced stocks of small, often newly listed companies. There are a few different ways to define Malaysia’s penny stocks. Some definitions say it’s listed companies with a market cap of less than RM200 million, which is why in Malaysia penny stocks are also commonly referred to as small-cap stocks.

Another definition is they are stocks with a price of less than RM1. However, this is also a rather vague definition as some penny stocks have prices that go way higher than RM1.

Investors are often attracted to penny stocks for their cheap prices and potential growth opportunities, though there are risks involved with penny stocks, too.

How to buy penny stocks in Malaysia

1. Open your CDS and trading account. You’ll need to provide your personal details, proof of ID and bank details.

2. Confirm your payment details. You’ll need to fund your account with a bank transfer, cheque or cash deposit at branch.

3. Find the stocks you want to buy. Search the platform and buy your stocks. It’s that simple.

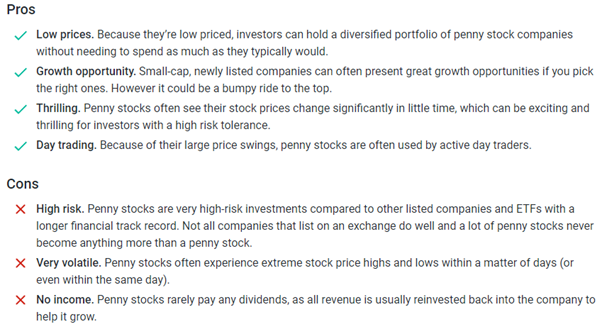

Pros and cons of penny stocks

Here are some of the benefits and risks of investing in small-cap Malaysian penny stocks:

Penny stocks versus blue chip stocks

On the opposite side of the scale to penny stocks are blue chip stocks. In comparison to penny stocks, blue chip stocks are large listed companies that have been around for a long time and have a long, stable financial track record.

Some of Malaysia’s biggest and most well-known companies are considered blue chip stocks, such as Malayan Banking Bhd (MAYBANK), TopGlove Corporation Bhd (TOPGLOV), Tenaga Nasional Bhd (TENAGA) and Petronas Chemicals Group Bhd (PCHEM).

While penny stocks in most cases pay no dividends, blue chips stocks almost always do.

Should you invest in penny stocks?

· You could consider investing in penny stocks if:

· You have a high risk tolerance

· You’re an experienced investor

· You’re willing to cut your losses if the stock price falls significantly

· You have a long investment time frame and are willing to ride out the volatility

·

You’re happy to take a bit of a “gamble”

What stocks can you look into now?

One of the top penny stocks that has great earnings potential as well bright prospects will be G3 Global Bhd. The company had secured multiple contracts from the government and they are partnering with HK-Listed SenseTime with a market capitalization of 61.64 billion in HKD value. The biggest issue is the selling pressure from another listed-status company that had some shares and warrants in G3.

More articles on KLSE Money Maker

Created by KayElleGuy | Oct 22, 2022

Created by KayElleGuy | Oct 17, 2022

A Safe Investment Haven Amidst The Chaos

Created by KayElleGuy | Oct 01, 2022