What you need to know about Harn Len Corporation Berhad bonus issuance?

KayElleGuy

Publish date: Sat, 22 Oct 2022, 05:07 PM

To those who are new to Harn Len Corporation, let us first take a brief view of the principal activities of the company :-

The principal activities of the Harn Len Group are in the cultivation of oil palm plantations, operation of palm oil mill, provision of plantation development services, palm oil estate and plantation management, investment holding, real property investment and operation of a food and beverage outlet.

As at 30 June 2021, the Harn Len Group has a total planted acreage of 17,091 hectares of oil palm plantations, situated mainly in Pahang and Sarawak. 85% of the palms are mature while 15% of the trees are immature. It owns a 60 metric tonne FFB per hour oil mill located in Sarawak.

Beside owning a 25-storey office building known as Johor Tower, Harn Len also owns six (6) units shophouses, three (3) units of factory buildings and two (2) pieces of vacant land which are all located in the commercial business district of Johor Bahru city and within the Iskandar Development Region, Johor. The Company also owns a seven-storey office cum residential building in Kuching, Sarawak.

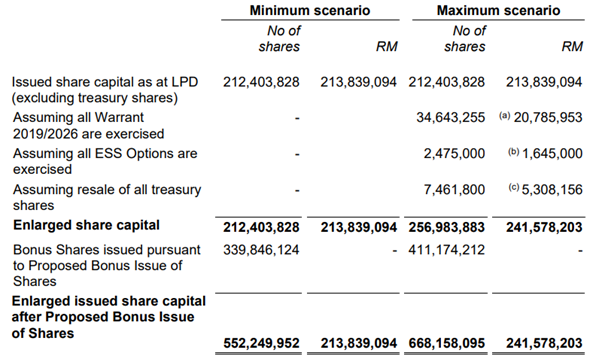

And this would be the current share structure and bonus issuance (in accordance to minimum and maximum scenario) for the company.

To date, the company had 2,475,000 shares under employees’ shares scheme, 34,643,255 unexercised warrants for 2019/2026 and 7,461,800 treasury shares. In the event where conversion of shares are executed, then the bonus issuance will be subjected to maximum scenario.

However from investor’s point of view, there will be no dilution of your shareholding under the proposed bonus issue. The EPS and NTAPS may change due to an increased share base, but your shareholding rights will not.

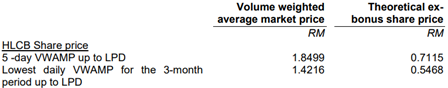

The adjusted share price or theoretical ex-bonus share price of the company is RM0.5468 and RM0.7115 based on lowest daily VWAMP for the 3-months period and 5-day VWAMP respectively.

With the new Company Act, companies are no longer required to capitalize on their reserves or retained earnings, hence there will be no impact on the ability of dividend pay-out for the company in the future.

All in all, this is expected to be beneficial for Harn Len Corporation’s shareholders, where it could also cultivate more investors to participate in the investment of the company due to increased number of shares and lowered entry costs.

More articles on KLSE Money Maker

Created by KayElleGuy | Oct 17, 2022

A Safe Investment Haven Amidst The Chaos

Created by KayElleGuy | Oct 01, 2022

.png)