KLSE Money Maker

A Safe Investment Haven Amidst The Chaos

KayElleGuy

Publish date: Mon, 17 Oct 2022, 06:19 PM

Investors and traders are certainly fighting against the unprecedented headwinds as well as market turbulence due to the instability of global economic, as well as a soon-to-come recession.

Hence, asset allocation will be the critical play for safeguarding yields and returns.

According to The Motley Fool, most investors does in fact view real estate investment trust, or REIT as one of the safest investment one can get, as the business model of REIT typically lies within generating stable rental income and enabling them to pay out attractive dividends (or otherwise known as distributions).

Generally, there are a total of 19 REITs listed in Bursa Malaysia, where the REITs shall be in the mix of retail, warehouse, commercial assets such as offices, hospitality, hospitals as well as mixed REITs.

The next question investors would ask would be – which is the best REIT to invest in?

My answer would be – go look for niche retail REITs.

For example, Hektar REIT (KLSE: 5121) is the very first Malaysia retail-focused REIT with 5 retail assets including Central Square, Kulim Central, Subang Parade, Wetex Parade and also Segamat Central. The REIT had also holds the Classic Hotel in Muar, which one considered one of the best hotel you can get in the region.

As compared to higher market segment REIT such as IGBREIT (KLSE: 5227) that carries Mid Valley and The Gardens or PAVREIT (KLSE: 5212) that carries the Pavillion brand, it is pretty obvious that the “affordable-premium” market segment of HEKTAR will perform better during a market downturn.

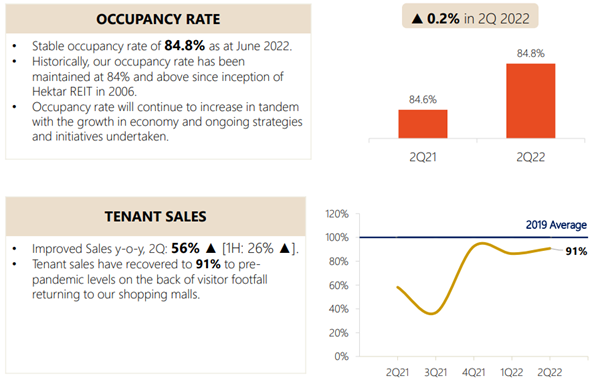

To-date, Hektar REIT enjoys a higher fixed rental proportion where less than 10% of its income are generated by non-fixed revenue / profit sharing with tenants, and they are also seeing an 84.8% overall portfolio occupancy rate.

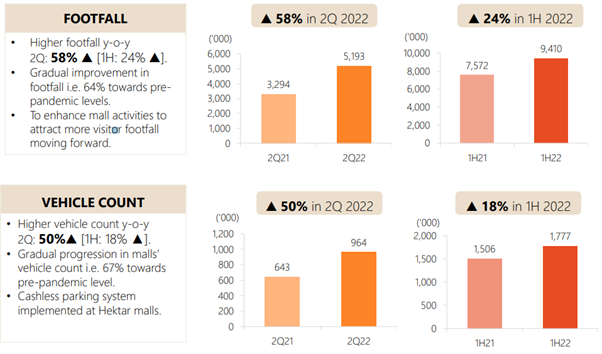

It is also important to mention where the footfall had greatly improved since 2021, as we are moving towards a challenging, yet recovering economy in 2022. For investors to gauge the performance of a retail-REIT, vehicle count may also be implemented to estimate the footfall of the mall.

The juicy part for Hektar is always on the “low risks, high return” part, where this is justifiable with the low valuation of RM1.180 in NTA against the RM0.540 in price, a very steep discount of NTA to price, as well as a stable 5.0% yield.

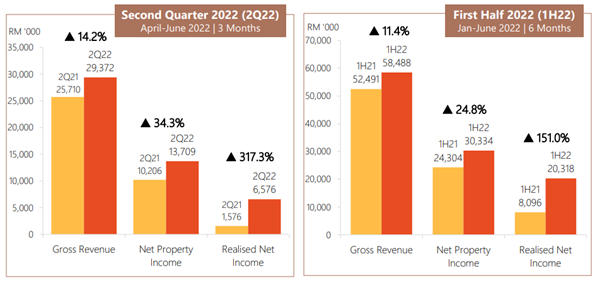

In a market where uncertainty becomes certain, “almost guaranteed” yield always proved more attractive than other investments. If we were to backtrack the performance of Hektar, one can see the company does in fact delivers a stable yield in the form of distributions, where in 1H 2022, the DPU of the company had already surpassed the full-year DPU of 2021.

In conclusion, if you want to safeguard your portfolio or hedge against high volatility, Hektar is one of the best investment vehicle you can get on Bursa Malaysia given its resilient asset portfolio as well as low valuation!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on KLSE Money Maker

What you need to know about Harn Len Corporation Berhad bonus issuance?

Created by KayElleGuy | Oct 22, 2022

Dont rely on traditional source nations alone, Consider hiring foreign workers,

Created by KayElleGuy | Oct 01, 2022

Discussions

Be the first to like this. Showing 0 of 0 comments

.png)