Update on queries replied from AGESON to BURSA MALAYSIA

KayElleGuy

Publish date: Sat, 01 Oct 2022, 09:53 PM

Despite a clear and transparent proposal/MOU was announced by AGESON, our beloved regulator cum stock exchange BURSA had challenged the MOU and these are the reply from AGESON for the ease of reference of investors.

1. Rationale and background for the Proposed Disposal and the participation of Kobena in the Proposed Development, especially given the fact that SPSB had already secured a “partner” i.e. ShuangLing which has committed to fund 100% of the GDC of the Proposed Development.

The Proposed Disposal represents an opportunity for the Company to raise additional funding for the Proposed Development, if required, general working capital requirements as well as to finance any viable projects or acquisitions and/or investments in any complementary businesses to the Company. Meanwhile, the funding to be provided by ShuangLing shall be channelled towards the development costs of the Proposed Development. Further, the Proposal Disposal would allow the Company to unlock the value and monetize its investment in the Land.

As at the date of this announcement, the Company has yet to identify any specific projects to be undertaken or businesses to be undertaken or invest in.

Pursuant to the MOU, Kobena shall be the purchaser for the Land and is not involved in the Proposed Development.

2.

Detailed breakdown and the bases and assumptions used in deriving at the RM35 million disposal consideration, if such amount is not supported by the independent valuer’s valuation. Where applicable, please provide the reasonable explanation on why no independent valuation was undertaken.

The Disposal Consideration is arrived at, after taking consideration the profit guarantee of

RM10 million to Kobena, gross development value of the Proposed Development and the original cost of investment of the Land amounting to RM1.55 million. The objective of the MOU is to record the mutual understanding and intention of the Parties in relation to the Proposed Disposal, as such, at this juncture, SPSB did not appoint an independent valuer to value the Land. However, SPSB shall appoint an independent valuation to value the Land prior to signing of the sale and development agreement.

3.

Current status of the Collaboration Agreement and whether there is any variation to the salient terms of the Collaboration Agreement arising from the current MoU between SPSB and Kobena.

The Collaboration Agreement is still valid and subsisting and there is no variation to the salient terms arising from the MOU.

4.

To clarify and provide the relevant update, if any, with respect to the funding structure, profit sharing ratio and role and responsibilities of all parties involved. To disclose if the involvement of Kobena would reduce the expected profit to be enjoyed by SPSB from the Proposed Development.

There is no change on the funding structure, profit sharing ratio and role and responsibilities of all parties involved in the Collaboration Agreement. The profit guarantee of RM10 million is part of the gross development costs of the Proposed Development and as such, the expected profit to be generated from the Proposed Development shall be reduced accordingly. This in turn will reduce the expected profit to be enjoyed by SPSB from the Proposed Development.

5.

Status update / progress with respect to the Proposed Development since the Collaboration Agreement.

SPSB is in the midst of appointing the consultants to submit the application for the building plans approval. As to-date, the Proposed Development has yet to commence.

6.

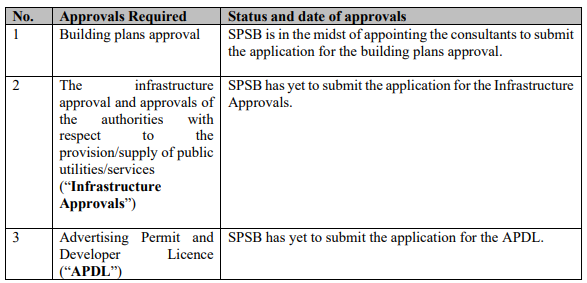

To spell out all relevant authorities’ approvals required together with the development order (“Approvals”) and status and date of Approvals, since the Previous Announcement.

7. To provide the rationale and basis in deriving at the RM10 million profit guarantee to Kobena as well as the potential risk/ consequences to SPSB and/or Ageson Berhad in the event the profit guarantee is not fulfilled as committed.

The profit guarantee of RM10.0 million is an indicative amount that derived based on the negotiation between SPSB and Kobena after taking into consideration the gross development value of the Proposed Development. The Company is still in the midst of discussion with Kobena to finalise the terms and conditions to be included in the sales and development agreement in relation to the Proposed Disposal which include the consequences to SPSB and/or Ageson in the event the profit guarantee is not fulfilled as committed.

8.

In addition to the profit guarantee of RM10 million, please clarify and state whether Kobena will be entitled to any profit sharing from the Proposed Development.

Kobena will not be entitled to any profit sharing from the Proposed Development apart from the profit guarantee of RM10 million.

9.

To provide a brief description on the nature/ subject of the confidentiality clause mentioned in item 3(iii) of the Announcement. In the course of doing so, you may wish to take note of Item 1.15 of Corporate Disclosure Guide issued by Bursa Securities which reads “a listed issuer should also avoid putting itself in a position where it is bound by confidentiality obligations that may defeat its obligation to disclose material information on an immediate basis”.

The confidentiality clause mentioned in the announcement is referring to the information and other data received from or provided to other Party, i.e., technical, business, marketing etc which are deemed as confidential information. The purpose of the confidentiality clause in the MOU serves to regulate a confidential relationship between the Parties as a protection towards disclosure of certain confidential information that are proprietary and business trade secrets in nature. Nevertheless, the information in the announcement does not fall under this confidentiality clause.

More articles on KLSE Money Maker

Created by KayElleGuy | Oct 22, 2022

Created by KayElleGuy | Oct 17, 2022

A Safe Investment Haven Amidst The Chaos

Created by KayElleGuy | Oct 01, 2022