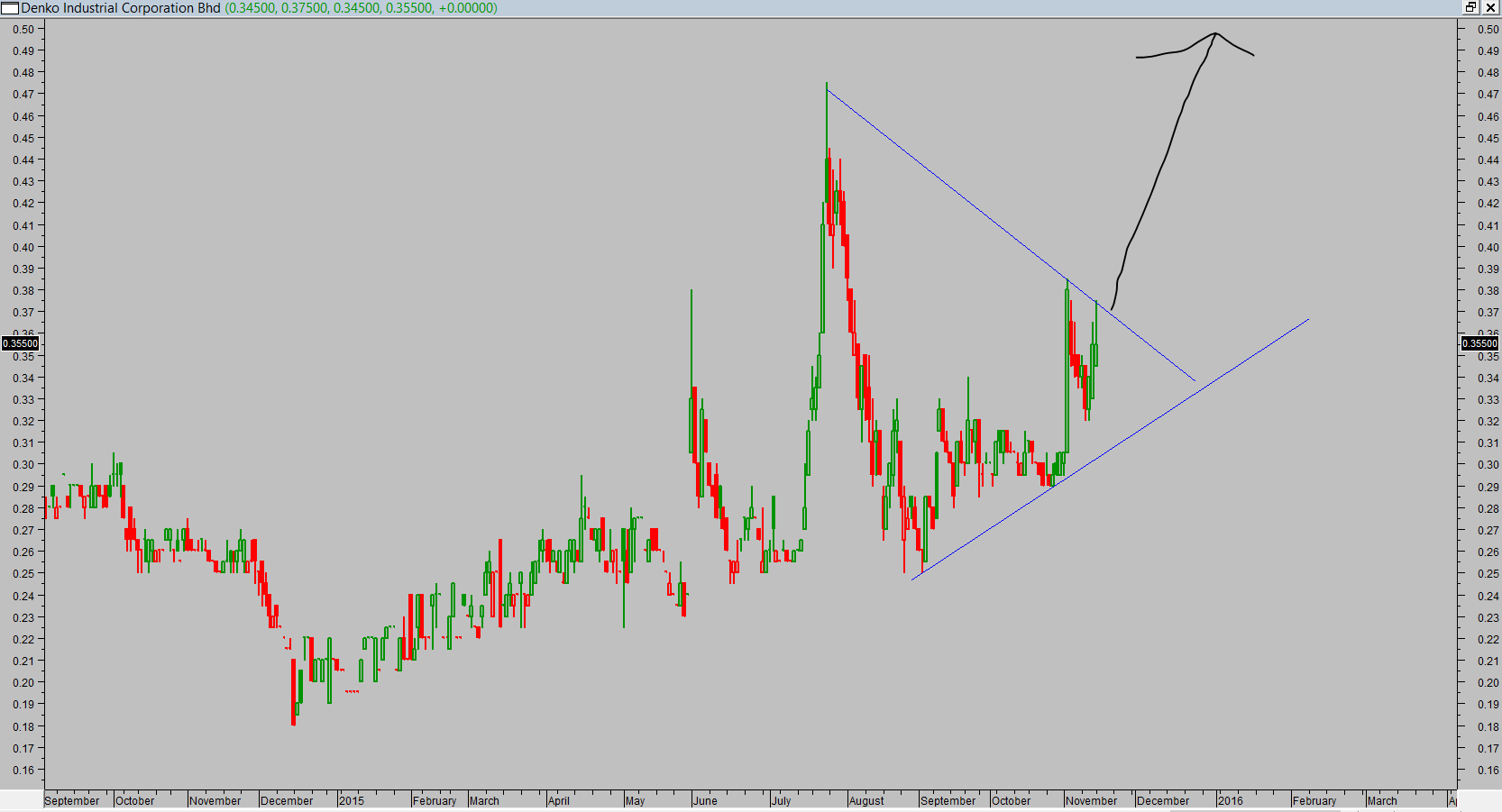

DENKO: Triangle Breakout is on the way of making !!!

mwong3

Publish date: Mon, 16 Nov 2015, 11:35 PM

Executive summary

It was consolidating and forming triangle chart pattern and currently was trade with in the formation, on 3rd of Nov substantial volume kick in with price break above $0.340 which is a bullish indication. Consolidate start on following day till 11/Nov with health volume, Last Friday volume kick in and formed an reversal candle stick pattern and bull ran seem like kick start again. Today(16/Nov) it test triangle trend line but rejected due to some profit taking, I am anticipate most likely it will test again very soon and go beyond $0.380 will move the stock price to $0.415/$0.435/$0.475. I will stop loss if prices go below $0.320

Technica Justification

Elliotwave forming Wave 3 breakout

Chart Pattern

It is traded with the triagle, Breakaway from the triagle will move stock to higher level which is the target of $0.500

Tecnhnical Indicator

1. Health volume during trend correction

2.RSI swing up above 50

3. MACD cross above 0

4. Stochastic is crosing up

KLSE Technical Analysis Stock Forum

Jason has launched KLSE Technical Analysis on Telegram Channel as an avenue to disseminate stock & financial markets news; Technical analysis and give members real time update on my trade plan. KLSE Technical Analysis on Telegram Channel will also ease my burden from multiple postings to numerous chatting groups on Telegram, All the groups will remain & continue to be chatting groups as they are now.

To JOIN you need to install telegram either on your mobile phone or desktop.

Aniways Messenger can’t access Telegram Channel. Click the link below to join.

Click the link below to join the KLSE Technical Analysis on Telegram Channel

Regards

Jason Wong

Trading Challenge

Many people committed to buy stock is very easy, when come to profit taking and cut loss is one of the most difficult part in trading world, talking about profit taking is dealing with greed and stop loss is dealing with fear, cutting loss is a must in trading world because it stopping my capital continue to loss, in order to stay alive in trading world... it is a must !!! it is not an option, else I suggest you get out of the trading and you are not suitable.

I wanted to used simple example to share on the cut loss ... you bought an egg and prepare to used it for fry rice, some how you notice/suspect the eggs you pick was/may turn bad.... the question now is shall out throw/scrap the bad one and pick another .... or nevermind bet or hope the suspicious "bad" egg will be good and risk the good rice which is ready to cook ? you make the call... I am believed in order to win I got to know how to prevent I am loss in the market... if I notice I am wrong... I got to admit and cut the loss and make a next move.

As a reminder for myself

I am always remind myself If the trend is go again me and violated my SL limit, I will cut loss base on the risk preference.

Stop Loss is painful process because I making loss, but it is necessary to take it, it is very important because it protect my capital to ensure I am stay in the market.

DISCLAIMER:

Stock analysis and comments presented on klseelwavetrading.blogspot.com are solely for education purpose only. They do not represent the opinions of klseelwavetrading.blogspot.com on whether to buy, sell or hold shares of a particular stock.

Investors should be cautious about any and all stock recommendations and should consider the source of any advice on stock selection. Various factors, including personal or corporate ownership, may influence or factor into an expert's stock analysis or opinion.

All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

More articles on KLSE Technical Analysis

Created by mwong3 | Nov 21, 2020

Created by mwong3 | Nov 18, 2020

Created by mwong3 | Nov 18, 2020