KLSE Technical Analysis

Nov 19th : Market Report on Vivocom. Close $1.92 volume 84.3m.

mwong3

Publish date: Thu, 19 Nov 2020, 08:56 PM

Despite the KLSE losing 21 points, Vivocom was still up by 6c with strong volumes

and a 51%, buy-up rate that exceeded selling by 2%.

$2.00 was indeed a tough nut to crack despite traders & investors attempts to break it in both sessions.

The $2.00/2.05 price levels were in fact penetrated a few times but each time the price retreated late in each of the trading sessions.

I anticipate that aggressive market players will continue to break the stubborn price levels in the coming few sessions in order to attempt to breach it, cross over it with determination & conviction before heading towards Elliott wave target of $2.51- $2.80.

I believe it is only a matter of time as the Technical Analysis below outlines :-

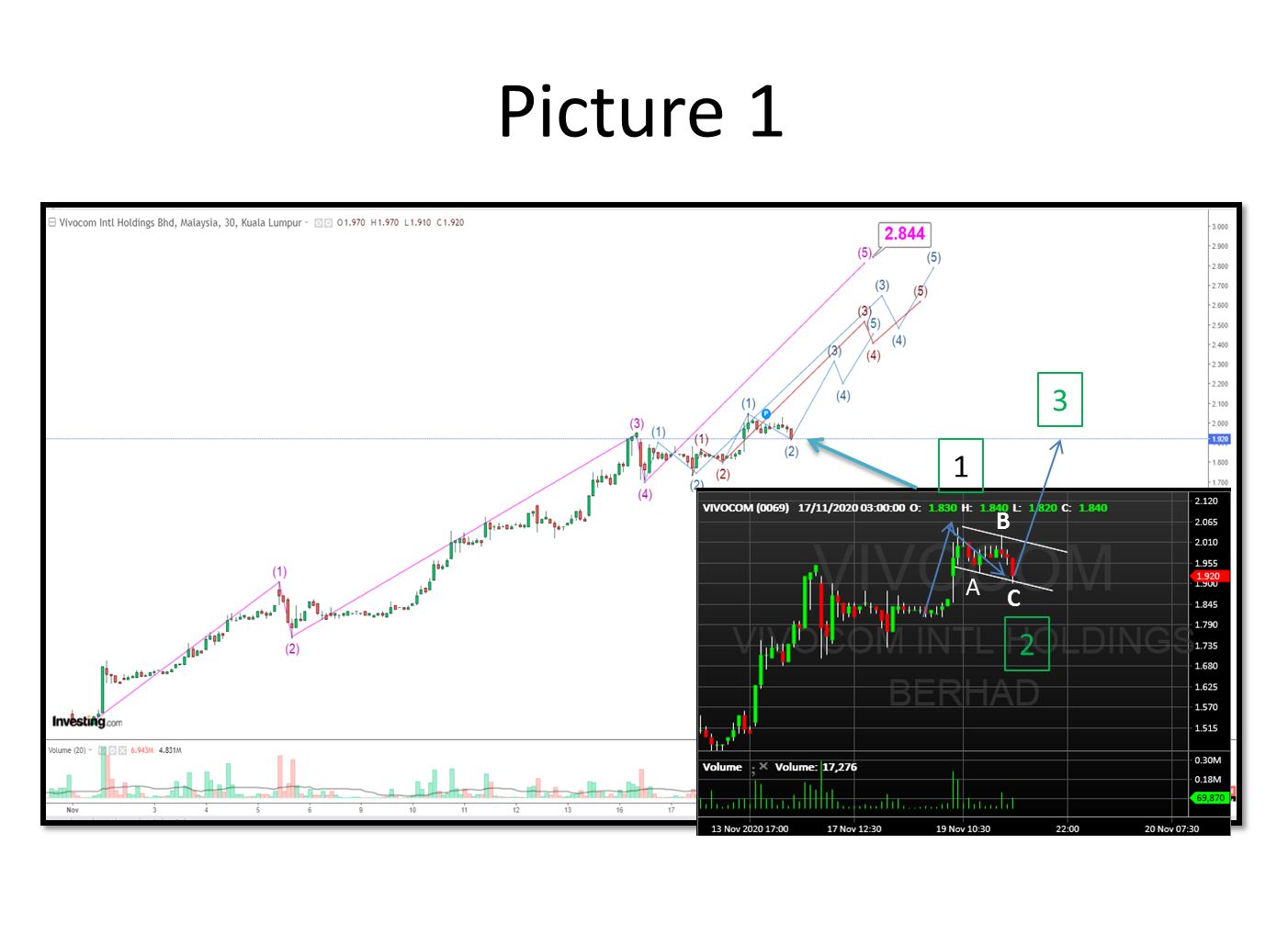

EW Trading Methodology ( Picture 1)

1. Wave ABC was formed right after price 2.00 was rejected in the afternoon session, the price reached fibo 61.5% retracement of wave 1 ($1.91)

2.The 61.8 % pull back was in fact a very common event and usually occurred in wave 2.

3. Now we are still riding Wave 2/3/3/5/3 formation, and moving towards a complex consolidation (sideway and tight range trading) on wave 2.

4. It is actually a brilliant formation to retest & break $2.00, once it crosses $2.05 it will serve to confirm n trigger the formation of 5 consecutive impulse wave up trend.

5. The target price for wave 3/3/3/5/3 will range from $2.51 - $2.80.

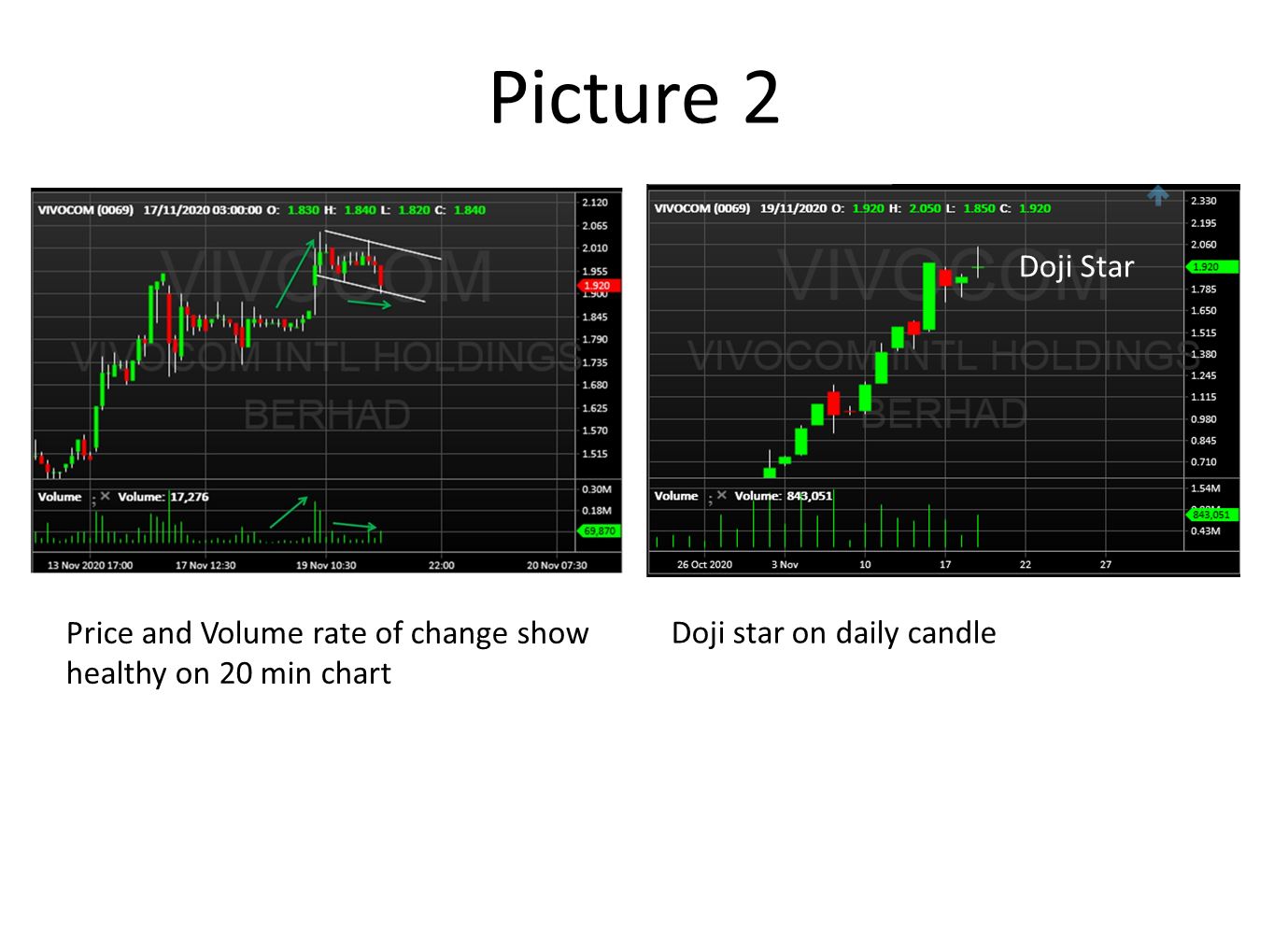

PVA Technical analysis( Picture 2)

1. Today daily candle closed in a doji, which is a sign of indecision … no idea market will go up or down ?

2. Price and Volume rate of change was healthy as we observed that Price and volume both increased simultaneously. Likewise when volume reduced when price declined, it served a solid indication that the underlying sentiment is still very bullish & constructive, with aggressive Bulls still very much dominating the Vivocom trading landscape.

I foresee more sideway toward upward bias in the next few trading sessions with Elliot wave target and Pennants breakout target still intact.

Going forward, Vivocom will eventually break the price levels at $2.00/2.05 with ease n stay above it consistent next week.

Market psychology does take time to steady itself because there are still suspicion out there that Vivocom is a Pump & Dump play, which it most categorically is not.

Vivocom is a genuine and sustainable SuperBull Rally and time will prove that soon.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on KLSE Technical Analysis

Nov 20th : Market Report on Vivocom. Close $1.74 with volume 68.24m.

Created by mwong3 | Nov 21, 2020

Nov 18th : Market Report on Vivocom. Close $1.86 with volume 33.4m.

Created by mwong3 | Nov 18, 2020

Nov 18th :Morning Session Vivocom cosed $1.83 with volume of 23.1M.

Created by mwong3 | Nov 18, 2020

Discussions

Be the first to like this. Showing 0 of 0 comments