Willowglen: I Buy !!! I Buy !!! I Buy !!!

mwong3

Publish date: Wed, 18 Nov 2015, 10:51 PM

Executive Summary

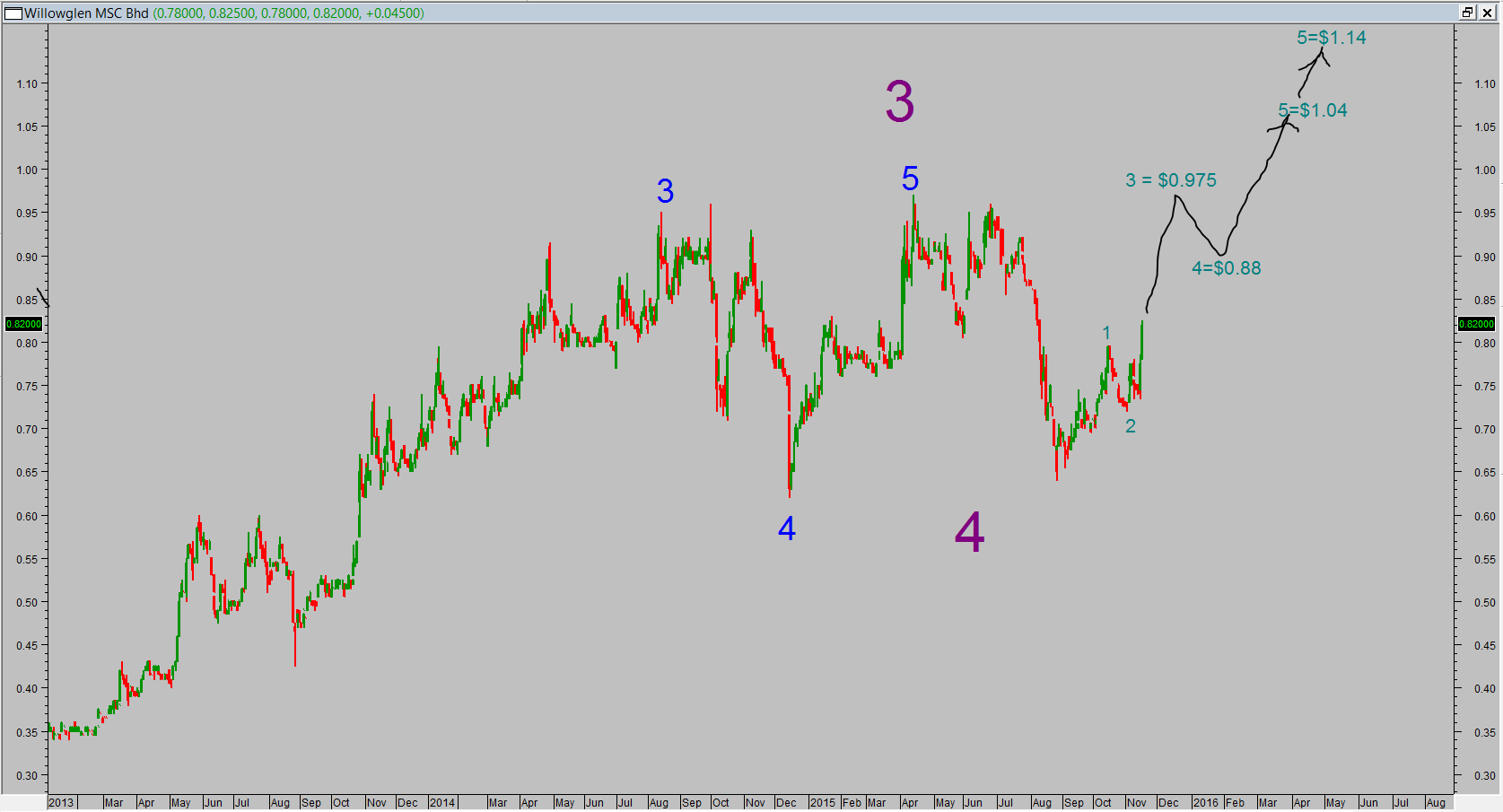

The Bottom found at $0.735 on recent correction wave 2, Wave 3 was kicked in on yesterday and it carry substantial volume to break above immediate resistance at 0.780/0.795/0.800 and reach $0.815 !!! resistance become support and it had very good closing and trade above $0.800, I am anticipate it should move to target of 0.900/0.950/1.00. Along the path to the target it should face resistace at $0.850/$0.920/$0.960. any weakness toward $0.795/$0.800 offer to collect the stock, I will stop loss if close below $0.725.

Technical Justifcation

Elliotwave

Weekly Chat : Wave 4 correction end and bottom found $0.640, wave 5 kick in and heading to $1.07/$1.60.

Daily chart : double wave 3 is comformed and it is most longer and stronger wave degree in EW theory

Technical indicator

1. Candle stick forming 3 white solder and it is very bulish implication, 70% of the probabiity of bull trend will continue

2. Volume and prices breakout !!! it is sold breakout formation, most likely trend will continue .

3. RSI breakout above 50!!! Great momentum will continue the uptrend.

4.MACD golden cross above 0

5. Stochastic cross Over

KLSE Technical Analysis Stock Forum

Jason has launched KLSE Technical Analysis on Telegram Channel as an avenue to disseminate stock & financial markets news; Technical analysis and give members real time update on my trade plan. KLSE Technical Analysis on Telegram Channel will also ease my burden from multiple postings to numerous chatting groups on Telegram, All the groups will remain & continue to be chatting groups as they are now.

To JOIN you need to install telegram either on your mobile phone or desktop.

Aniways Messenger can’t access Telegram Channel. Click the link below to join.

Click the link below to join the KLSE Technical Analysis on Telegram Channel

Trading Challenge

Many people committed to buy stock is very easy, when come to profit taking and cut loss is one of the most difficult part in trading world, talking about profit taking is dealing with greed and stop loss is dealing with fear, cutting loss is a must in trading world because it stopping my capital continue to loss, in order to stay alive in trading world... it is a must !!! it is not an option, else I suggest you get out of the trading and you are not suitable.

I wanted to used simple example to share on the cut loss ... you bought an egg and prepare to used it for fry rice, some how you notice/suspect the eggs you pick was/may turn bad.... the question now is shall out throw/scrap the bad one and pick another .... or nevermind bet or hope the suspicious "bad" egg will be good and risk the good rice which is ready to cook ? you make the call... I am believed in order to win I got to know how to prevent I am loss in the market... if I notice I am wrong... I got to admit and cut the loss and make a next move.

As a reminder for myself

I am always remind myself If the trend is go again me and violated my SL limit, I will cut loss base on the risk preference.

Stop Loss is painful process because I making loss, but it is necessary to take it, it is very important because it protect my capital to ensure I am stay in the market.

DISCLAIMER:

Stock analysis and comments presented on klseelwavetrading.blogspot.com are solely for education purpose only. They do not represent the opinions of klseelwavetrading.blogspot.com on whether to buy, sell or hold shares of a particular stock.

Investors should be cautious about any and all stock recommendations and should consider the source of any advice on stock selection. Various factors, including personal or corporate ownership, may influence or factor into an expert's stock analysis or opinion.

All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

More articles on KLSE Technical Analysis

Created by mwong3 | Nov 21, 2020

Created by mwong3 | Nov 18, 2020

Created by mwong3 | Nov 18, 2020

Discussions

When results good !! some big boy know it is good !!! buy upfront and news out !!! all throw !!! Result not bad stock will go up !!!

2015-11-18 23:07

RosmahMansur

weak quarterly results how to go up?

2015-11-18 23:01