【小型成长股】LKL INTERNATIONAL BERHAD – Recovery on Track with New Technology Manufacturing Boost 30% Capacity

ThemePlay

Publish date: Tue, 16 Oct 2018, 06:18 PM

The below commentary is solely used for educational purposes. This is my point of view using technical analysis and fundamental analysis. The commentary should not be construed as an investment advice or any form of recommendation. If you need an investment advice, please consult a licensed investment advisor. Most important do your homework before you invest. You are liable since you are the one pressing the buy and sell button.

No capital gain tax, fund expect to resume back. What next after Oil & Gas sector? Healthcare sector? Today we gonna discuss about LKL in Aceboard.

Company Core Business and Background:

Today my followers asked me about LKL since this is a newly listed company. What is their principal business? They're principally engaged in the provision of medical and healthcare beds, peripherals and accessories, and is one of the largest local healthcare product manufacturers in Malaysia.

The Group has delivered its products to numerous public and private hospitals and medical centres in Malaysia and to over 30 countries worldwide. The Group had, also in 2017, ventured into the distribution of high-value medical devices through its joint venture company TMI Medik Group Sdn Bhd.

I like their recent collaboration:

New Product Launched (Adopted from recent MOU):

Under the MoU, FKS will be responsible for introducing the dermaPACE® into Malaysia, and both FKS and LKL Advance Metaltech will co-operate together for the promoting and marketing of dermaPACE® in Malaysia. The term of the MoU will be for two years. FKS is a subsidiary of FKS-Life & Health Medical Care Inc., a reputable medical appliance and device manufacturer and distributor based in California, United States. dermaPACE® is a shock wave technology using a patented system of non-invasive, highenergy, acoustic shock waves for regenerative medicine and other applications. The dermaPACE® system is cleared by the United States Food and Drug Administration for marketing in the United States for the treatment of Diabetic Foot Ulcers. The dermaPACE® system is CE Marked for the European Union, and is licensed in Canada, Australia, New Zealand, and South Korea for acute and chronic conditions of the skin and subcutaneous soft tissue indications.

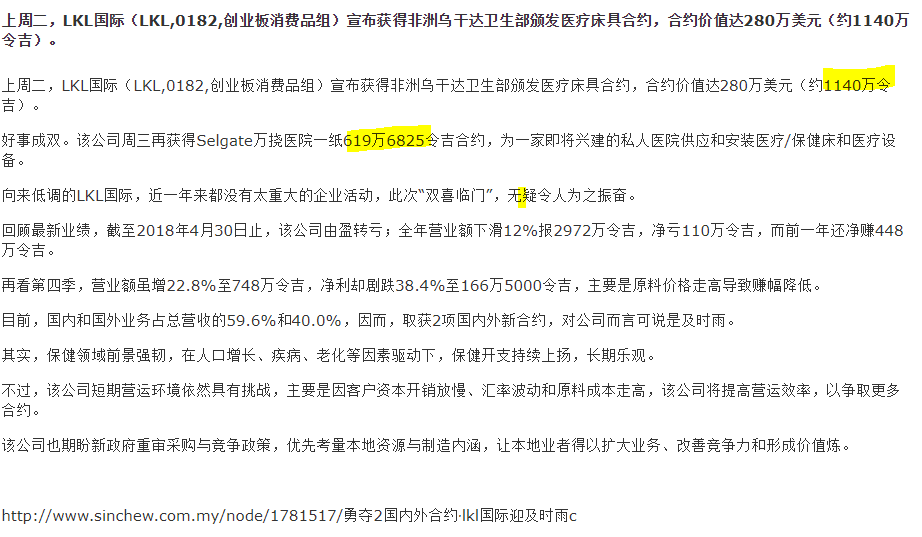

Contract Awarded Started to Contribute to Their Earnings:

Both the contract awarded with more than RM17.6 Mil which will be delivered in FY2019. Please note that the contract was awarded USD1:RM4.064 as at 27 July 2018). Now USD turned stronger with RM4.16.

The more appreciation of USD better for the exporter.

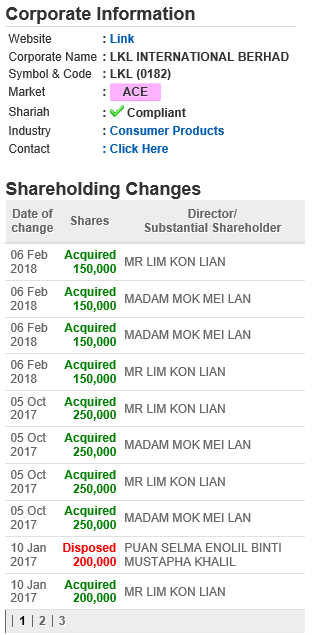

Shareholding

The director has been acquiring at this date. Check on this date, what price they bought? This is will increase your confident level.

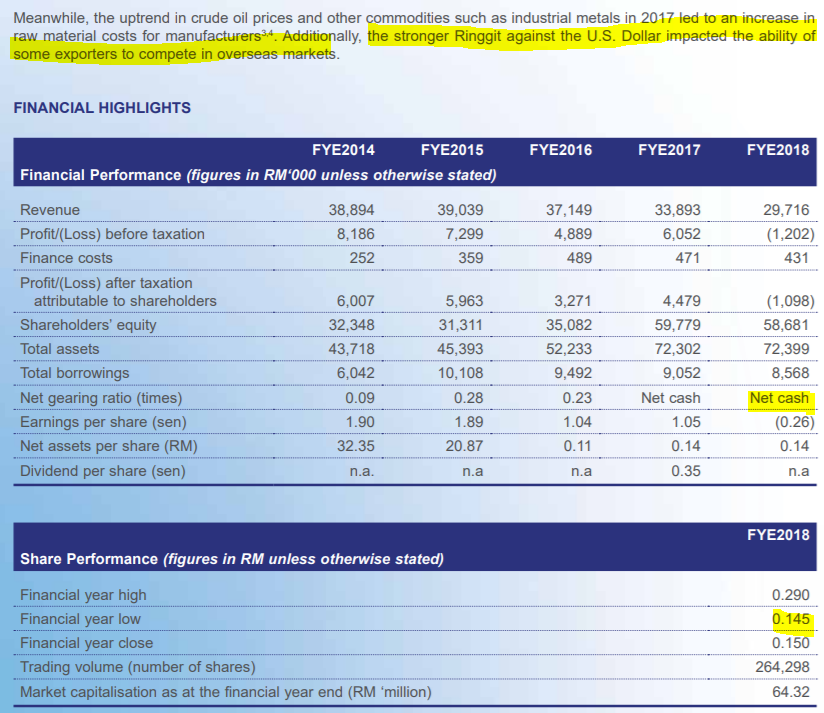

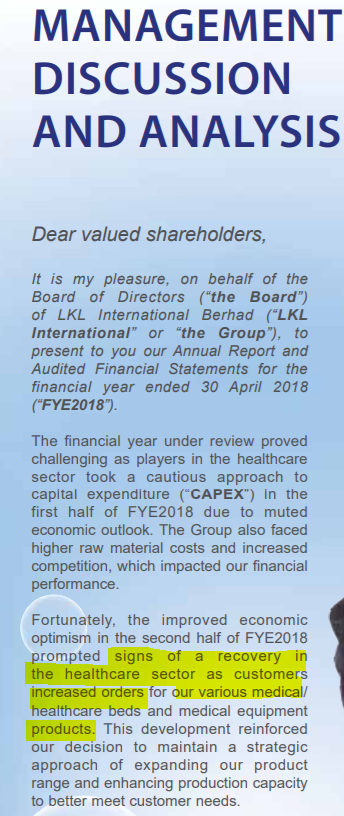

The recent annual report already give a hint of recovery on recent increased orders on their company products.

Technical analysis: The stocks is well supported at 14 cents. Ascending triangle breakout at 15cents.

“Invest happily. Not a good investment if you can’t sleep well after you invested in it”

Stock Theme

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on 【小型成长股】LKL INTERNATIONAL BERHAD – Recovery on Track with New Technology Manufacturing

Created by ThemePlay | Apr 24, 2020

Discussions

https://www.klsescreener.com/v2/tvc/65461

Chart line for 5 soundly ACE-Health care star .

Chart viewing by comparing its share price percentage has appreciated to-date .

wont comment much , you may apply your own opinions !

LKl (Black line)

HLT (Brown)

esceram (L.Blue)

Careplus (D.Blue)

Scomnet (Pink)

2020-07-18 09:05

LKL pp 20% share estimate 53cts current price 535 cts. will this share up?? anyone ?

2020-07-18 09:06

Given market s enthusiasm for

exponentially growth company + beneficiaries of convid19 pandemic

LKL may offer you such charecteristic .

U need to do your own homework as many healtcare stocks has been priced-in their earning to 2021 .

Maybe a price to book values comparison amongts the peer can give you a better direction.

2020-07-18 09:22

VenFx

https://www.theedgemarkets.com/article/lkl-plans-private-placement-raise-rm4545m-capex-expansion

有实力的投资者 进来是一注 强心剂

不然50000张 医疗病床

要如何在 6个月 交货

话说2016年

该公司平均年产4000至5000张病床,

若包括其他特别订制产品及代工(OEM),

年产能约1万个,产品类型120种。

Firing up ! all its cylinders,

to tap bigger pie for domestic & America healthcare market.

2020-07-18 09:04