The INEVITABLE Upcycle of the Logistics Industry

Kellar82

Publish date: Sun, 02 Jun 2024, 05:38 PM

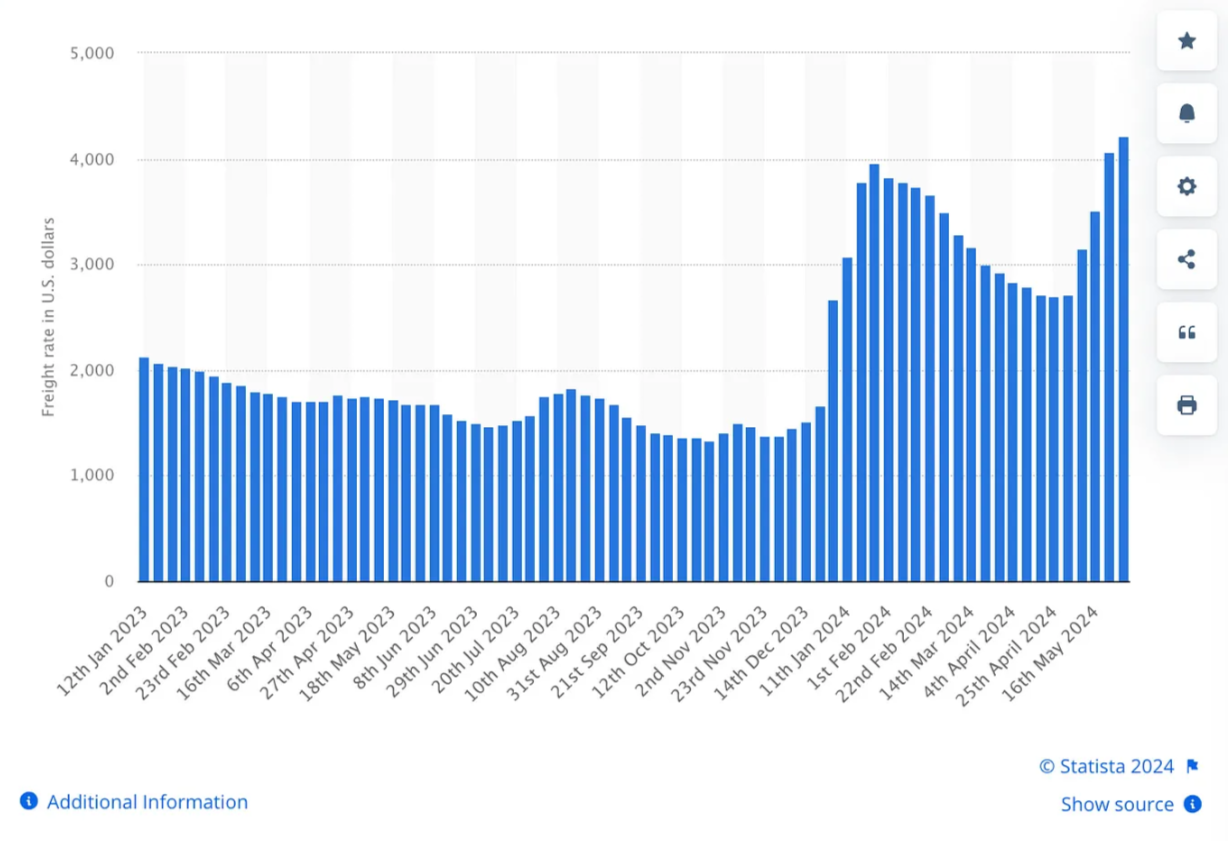

The logistics industry is experiencing a significant recovery as global shipping companies announce rising fees for container transportation. Major players like France's CMA CGM Group, Germany's Hapag-Lloyd AG, and Denmark's Maersk Line have all reported substantial rate increases. These hikes, in some cases reaching up to $2,000, span numerous routes connecting Asia with Europe, North America, and South America. For example, CMA CGM has adjusted rates for a 20-foot equivalent unit (TEU) on the Asia to North Europe route to $2,700 and for a 40-foot container (FEU) to $5,000.

Amid these rising fees, Chinese exporters are adapting by postponing shipments, switching transportation strategies, or preemptively handling orders for the second half of the year. Rollmax Shutter Component Co Ltd, based in Ningbo, Zhejiang province, has delayed several shipments due to nearly 50 percent surges in ocean freight costs. To mitigate these costs, the company is exploring alternatives such as cargo freight and China-Europe freight train services.

Impact of Geopolitical Tensions and Global Demand

Geopolitical tensions, particularly in the Red Sea region, have resulted in cargo ships being rerouted around the Cape of Good Hope in South Africa. This has increased navigation distances and days, driving up shipping container prices. The situation is expected to persist for another two to three months, with July and August being traditional peak seasons for shipments, and August and September being peak seasons for e-commerce businesses globally.

In Singapore, port congestion has led to shipping delays and higher consumer prices. PSA Singapore is working closely with shipping lines to mitigate disruptions by ramping up capacity and implementing smart technologies in their terminals. The Maritime and Port Authority of Singapore (MPA) reported a significant increase in vessel arrivals, causing longer waits for berths and increased container handling capacity.

THIS Company Might be a Gem

KGW Group Berhad, a Malaysian listed company, is poised to benefit significantly from the recovery of the logistics industry. The company recently reported a profitable quarter, with a revenue of RM29.36 million for Q1 2024, compared to RM18.04 million in the same period the previous year, marking an impressive 62.75% increase. The company's logistics services segment, particularly ocean freight, contributed 95.88% of the total revenue in Q1 2024.

Despite the increase in revenue, the Group’s profit before tax (PBT) for Q1 2024 was RM1.34 million, slightly down from RM1.68 million in Q1 2023. This decline was primarily due to an escalation in administrative expenses. However, compared to the immediate preceding quarter, the Group saw a significant turnaround, with PBT rising from a loss before tax of RM0.46 million in Q4 2023 to RM1.34 million in Q1 2024.

Future Outlook

KGW Group Berhad's future outlook remains positive, supported by several strategic initiatives aimed at enhancing long-term operational and financial performance. These include:

Relocation to a New Warehouse: The Group is relocating to a new warehouse cum office in Hicom Glenmarie Industrial Park, Shah Alam, Selangor. This move will enable the company to scale up operations and accommodate an increase in headcount. The new facility will also feature solar panels in line with ESG compliance.

Enhancement of Warehouse Facilities: The Group is enhancing its warehousing services to cater to evolving market demands, particularly for healthcare-related products and devices.

Expansion into Value-Added Services: KGW is expanding its portfolio to include value-added services, offering comprehensive logistics solutions that optimise supply chain efficiency.

Venturing into E-commerce Solutions: The Group is entering the e-commerce domain, aligning with industry trends and expanding its service portfolio to meet the changing needs of clients.

Special Handling and Storage Solutions: KGW is investing in specialised handling and storage solutions, including temperature-controlled storage facilities and secure handling procedures, to maintain product integrity.

With these strategic initiatives and the anticipated resurgence of the global and local economy, KGW Group Berhad is well-positioned to achieve satisfactory financial performance in the coming years. The company’s adaptability and forward-thinking approach ensure it remains at the forefront of the dynamic logistics industry.