Malaysia Stock Analysis – UWC (5292) November 2019 Performance

LouisYap

Publish date: Tue, 19 Nov 2019, 10:55 AM

Malaysia Stock Analysis – UWC (5292) November 2019 Performance

UWC Berhad (UWC) is one of the most popular IPOs in 2019.

The company was founded in 1990 and listed on the Malaysian stock market on July 10, 2019.

And UWC is successfully listed on the stock price at RM 0.82, however, the stock price jumped from RM1.10 on the first day and closed at RM 1.40 with a premium of 70%. In within a few months, it has risen by 258% to a maximum of 2.94, and the current stock price is standing at 2.77

UWC Berhad (UWC) is a precision sheet metal manufacturer for semiconductors, life science, medical technology, and heavy equipment. UWC's customer base is distributed in North America, South America, Europe, Southeast Asia and Australia.

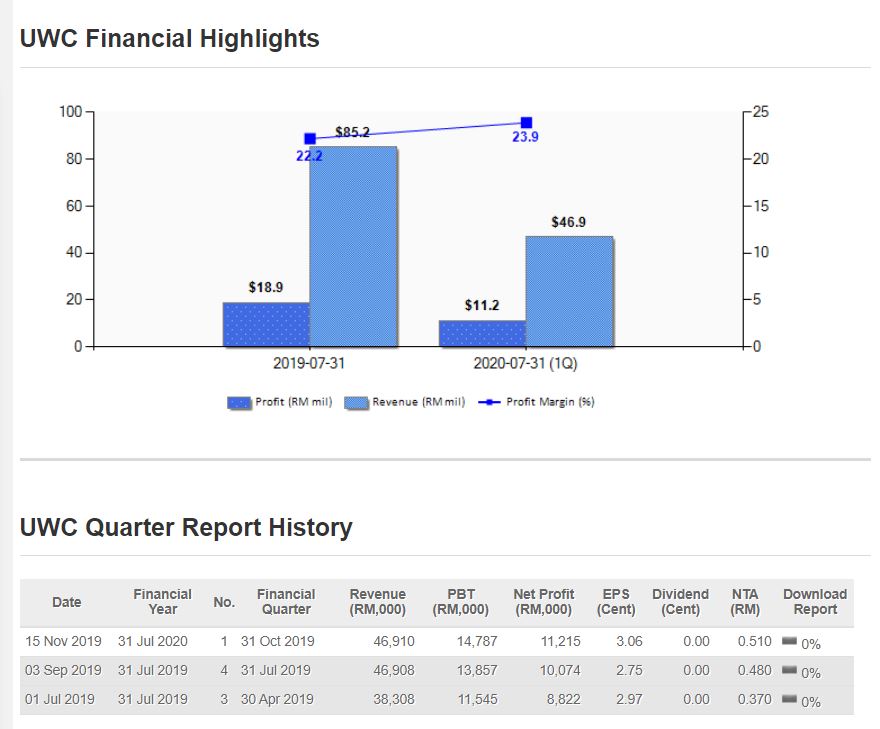

Performance:

Turnover: RM 46.9mil

Net profit: RM 11.2mil

It was stated in the quarterly report that the turnover in this quarter is mainly contributed by customers from the semiconductor industry, especially the high demand for semiconductor test machines. In addition, the demand for the life sciences and medical technology industries remains solid.

Assets and debts statement:

Comparing Jul 2018, UWC's debt has dropped significantly, mainly because the company used the listed capital to repay RM 18mil debt. The company's current cash flow is at a healthy level and is a net cash company.

Listed funding:

UWC raised RM 57.4mil from the listing and has already used RM 27.4mil. The company spent about 4mil on machinery, 18mil to repay debt, the listing cost about 4mil, capital turnover 1mil

The 32mil is intended to be used to purchase CNC machines and Robotic arms within three years in order to expand capacity. Currently, CNC machines have used 13.7% of the funds, and Robotic arms used 6.3%.

One-time profit/loss:

UWC does not make a one-time profit or loss

Main Reason:

UWC recorded RM 46.9m turnover, RM 14.8m pre-tax profit, mainly contributed to customers from semiconductors

The current demand for products is still strong, especially from the semiconductor industry, accounting for about 90%

Future Prospect:

UWC remains optimistic about the 2020 financial year despite the market sentiment and the trade deficit between China and the United States.

UWC will continue to work hard to find new customers while strengthening the company's capabilities.

In addition, the newly purchased equipment will increase production efficiency, and UWC will also continue develop new products for new and existing customers and further expansion for the company.

Louis Yap

Facebook:

https://www.facebook.com/louisinvestment/

Web Site:

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|