Malaysia Stock Analysis Report – MI Technovation Bhd (5286)

LouisYap

Publish date: Tue, 26 Nov 2019, 02:26 PM

Malaysia Stock Analysis Report – MI Technovation Bhd (5286)

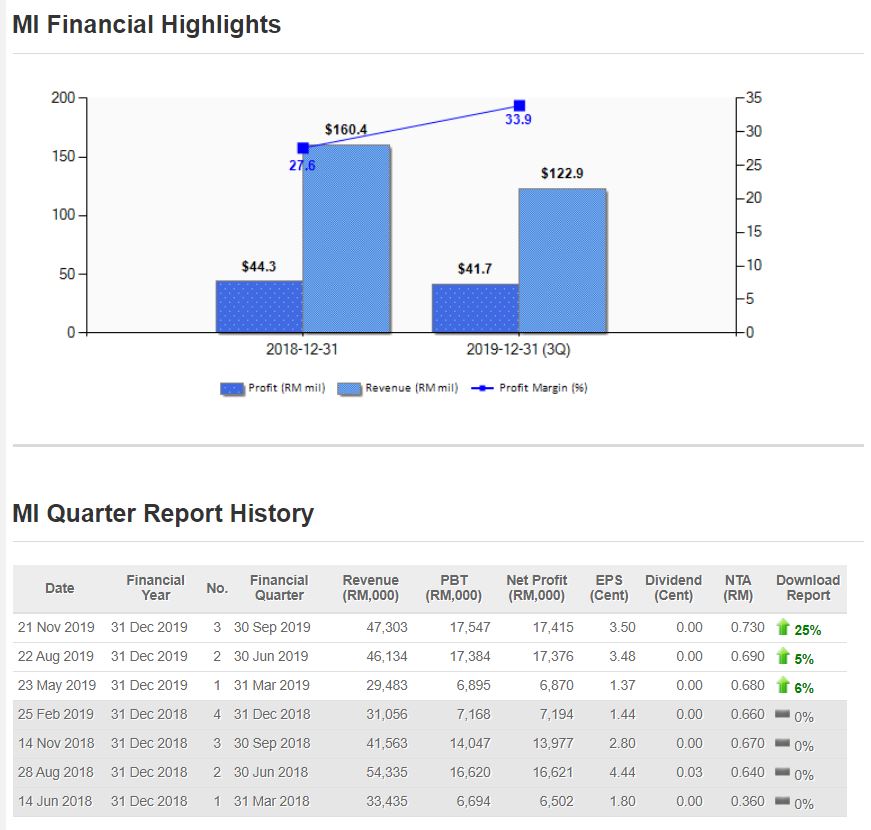

September 2019 Performance

Turnover: RM 47.3mil, YoY fell -5%, QoQ rose +3%

Net profit: RM 17.5mil, YoY rose +12%, QoQ rose +1%

Formerly known as MI Equipment Holdings Berhad, established in 2013, is a semiconductor technology company based in Penang Island, and was listed on the main board of the Malaysian stock market in June 2018.

MI's business includes designing and manufacturing Wafer Level Chip Scale Packaging machines and providing inspection and testing capabilities for the semiconductor industry. The company also provides maintenance services and technical support for these machines and sells related spare parts and The company's main product is the MI series. In 2018, the company launched 4 new products, namely Assembly & Packaging segment (Ai and Li Series), Final Test segment (Si Series) and Vision Inspection segment (Vi Series).

As the first WLCSP manufacturer in Malaysia, Zhengqi Technology successfully entered the international market with their flagship product Mi Series, occupying a place in the field of OSAT and IDM, with customers in 10 countries including China Korea, Taiwan, etc.

Company management also actively participates in international exhibitions to promote their own products. At the same time, Mi itself raised research fees in 2018 to develop new products. In the past two years, the company is also actively applying for patents.

As the semiconductor industry is a cyclical industry, coupled with the uncertainties of the US China trade war in year 2018 and 2019, the overall technology sector is continued slowdown.

Part of the funds collected from the IPO has utilized for 5 story factory in Bayan Lepas, and it has been completed Q2 2018. The new plant's production capacity is 4 times as large as in the past, which will allow the company to receive more orders in order to quickly occupy more market share in the industry's rising cycle. The company is also actively preparing for another factory in Batu Kawan. Automation and Robotics businesses will be moved in the new factory.

Future Prospect:

Major customers will increase capital expenditures and increase WLCSP technology adoption in the second half of 2019, and it is expected that the company's performance in the second half of the year will be improved.

Management is also optimistic about the trade war situation, because most customers have already considered the worst case and restructured the global supply chain. They believe the company can benefit from it.

5G roll out will lead to better prospect to overall semiconductor equipment maker. As higher performance gadgets will require more advanced technology and higher density of semiconductor content, which is supported by advanced level packaging equipment manufacturers such as Mi Equipment

Louis Yap

Facebook:

https://www.facebook.com/louisinvestment/

Web Site:

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|