Louis Yap

Facebook:

https://www.facebook.com/louisinvestment/

Web Site:

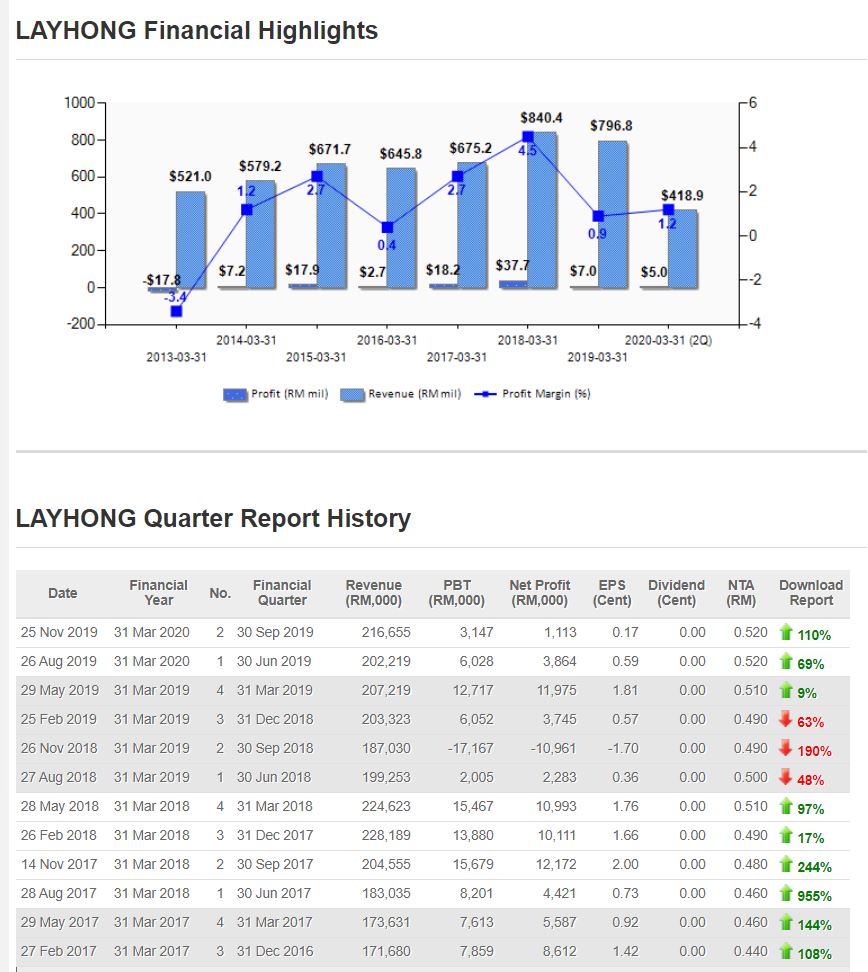

[ LayHong 2Q2020 results finally released! 】

The company recorded a turnover of RM 216.7m, but its net profit was only RM 1.1m.

Compared with the same period last year, earnings increased by 110%, but compared with the previous quarter, it fell by 71%.

The decline in earnings was mainly due to a one-time loss of RM 2m during this quarter.

If taking away the one-time loss of RM 2m, LayHong actual earning is RM 3.1m. Regardless, earnings are still down nearly 20%

The decline in profits is due to higher operating costs, such as transportation, advertising and promotional expenses

According to the quarterly report, management revealed that egg production at Sabah's farm will return to normal. The challenges facing Johor's new liquid egg plant have been resolved and the plant is now ready for commercial production. Estimated turnover of about RM 2.1m per month.

As for a 49% joint venture with Japan's NH Foods Ltd., the company's plan is proceeding smoothly as planned and will soon to be in towards commercial production.

In additonal, LayHong has only 49% equity, so the turnover of the joint venture company will not be entry to LayHong's account, but will show a line of "share of profit of JV"

About 15% of the eggs exported by LayHong are sold to Singapore. HongKong is relatively small. As for China, LayHong is unable to compete with local suppliers, so it does not export to China.

The Klang Valley market is saturated, so management will begin to expand markets on the East Coast, such as Kuantan. LayHong will also launch new products, with the lower price, as the company awaiting for the market response on the new product.

In addition, the company will gradually no longer deal with dealers, because this will lower down their profits. LayHong will be focusing on the products to sell directly to customers. This plan will be in plan to complete within 6 months.

what is Louis Yap track record? Suddenly come out of no where and pretend like a sifu

2019-11-27 12:14

Fabien "The Efficient Capital Allocater"

so far i read are all positive bias.

what about the negative factors? the risks involved?

2019-11-27 13:57

Fabien - Louis Yap only write positive bias things because he living in fantasy not reality

2019-11-27 13:58

Prospect still good la.. as new source income no yet reflect

but they cant control egg price/usd/feed cost., No hedging strategy?

+ Boss personality : selling warrants when they know the qr !

2019-11-27 14:09

HerbertChua....Then can you let us know who are....you are also pretending that you are sifu...

Don;t just criticize, but not giving any value

and your analysis i also don;t see any value too.....

2019-11-28 11:16

HerbertChua

very low quality analysis

2019-11-27 11:21