M+ Online Research Articles

M+ Online Technical Focus - 20 Jul 2015 - FBM KLCI | DNONCE | GKENT | BARAKAH

MalaccaSecurities

Publish date: Mon, 20 Jul 2015, 04:42 PM

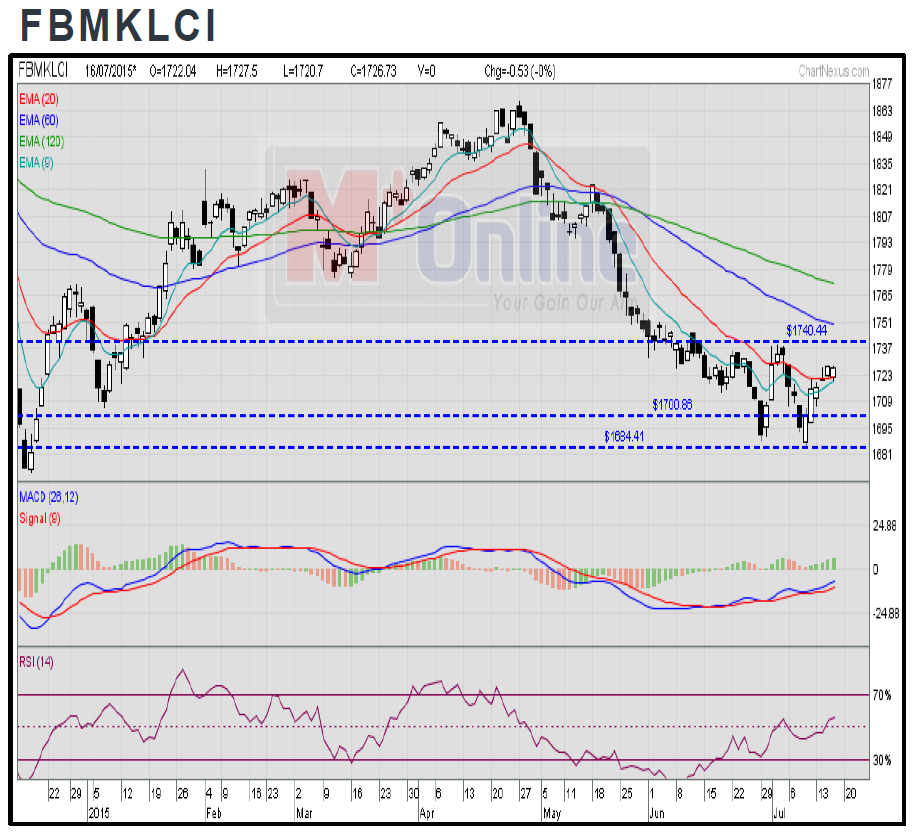

The FBM KLCI slid marginally by 0.53 pts to 1,726.73 pts on a shortened trading day ahead of the Hari Raya holiday last Thursday. The MACD Histogram, however, extended another green bar, while the RSI has crossed above 50. Resistance will be pegged around 1,740. Support will be located around 1,700.

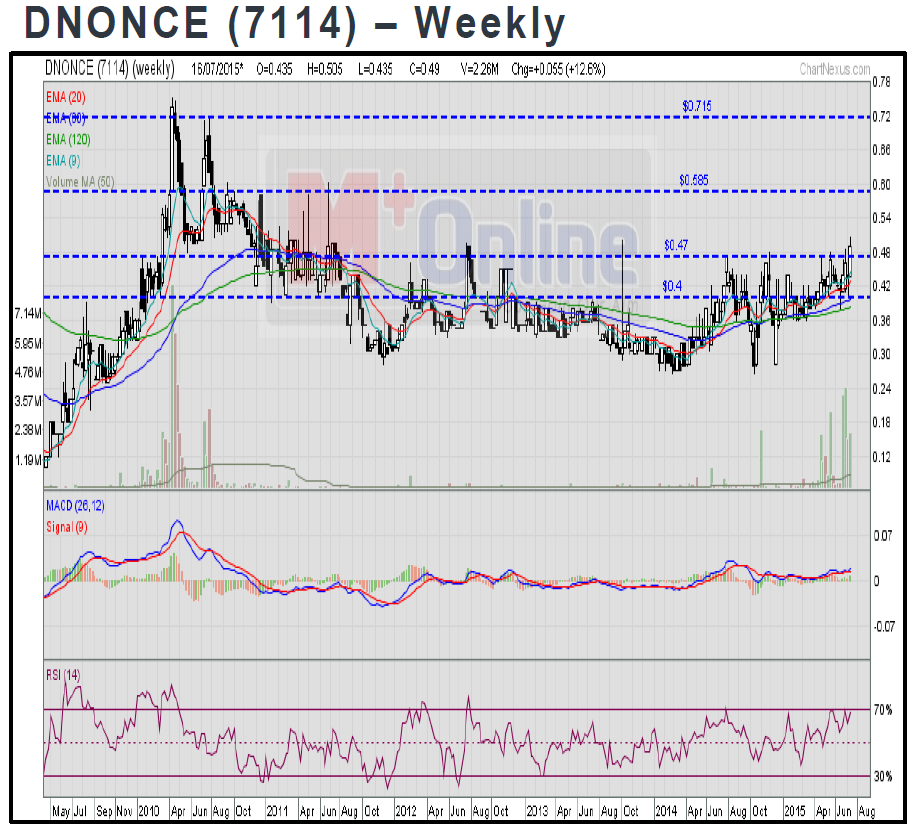

DNONCE has experienced a breakout above the RM0.47 level accompanied by higher-than-average volumes. The MACD Indicator has expanded positively above zero, while the RSI is trending above 50. Price target will be envisaged around the RM0.565 and RM0.715 levels. Support will be set around the RM0.40 level.

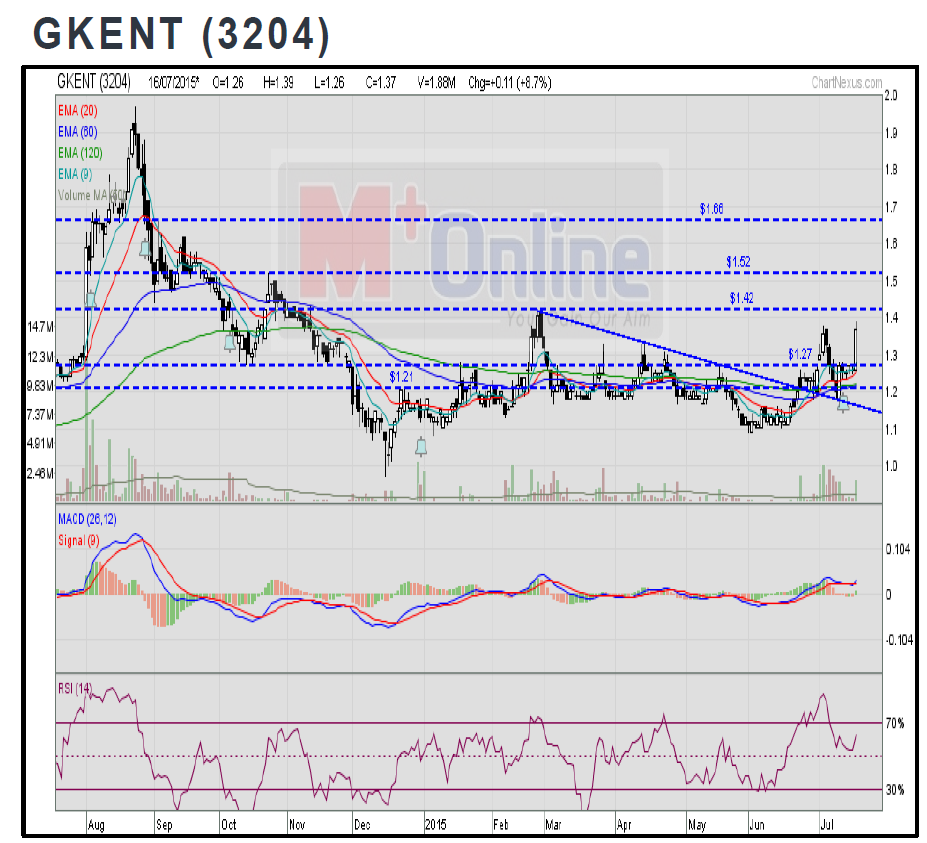

GKENT has formed a Breakout-Pullback-Continuation pattern above RM1.20 and experienced a consolidation breakout above RM1.27. The MACD Indicator has issued a “Buy” signal, while the RSI continues to stay above 50. Resistance will be pegged around RM1.52 and RM1.66. Support will be anchored around RM1.27.

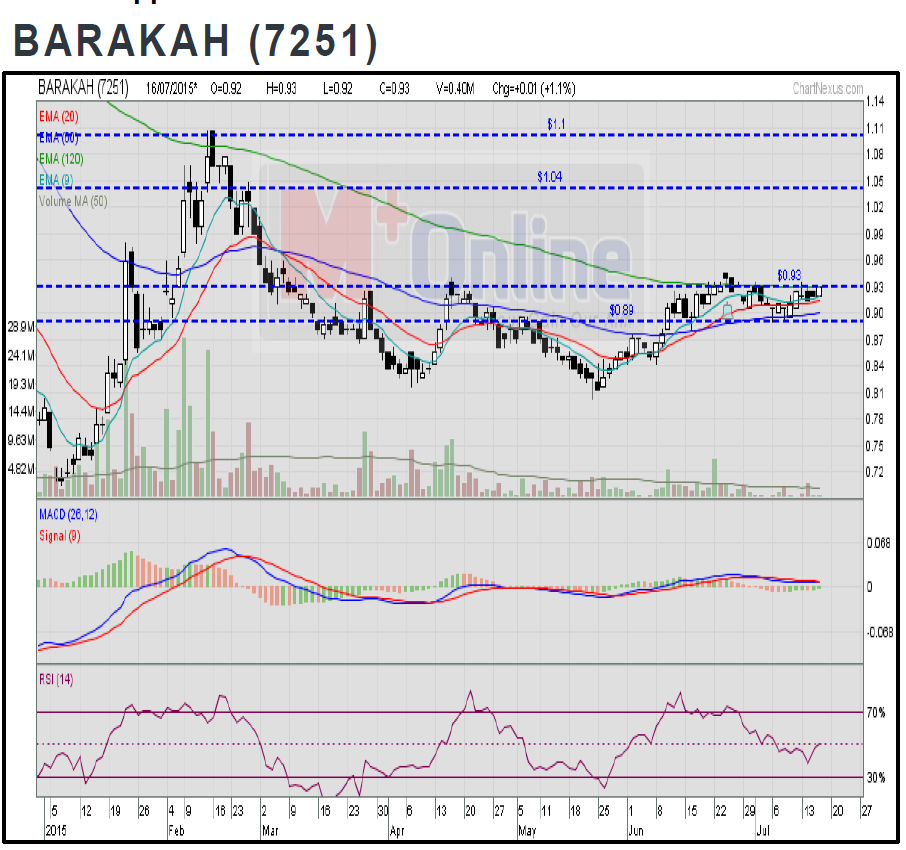

BARAKAH has trended sideways between the RM0.89 and RM0.93 levels over the past three weeks. The MACD Line is hovering above zero. The RSI, however, is slightly below 50. Monitor for a breakout above the RM0.93 level, targeting the RM1.04 and RM1.10 levels. Support will be located around the RM0.89 level.

Source: M+ Online Research - 20 Jul 2015

More articles on M+ Online Research Articles

UOA Real Estate Investment Trust - Below Expectations: Hit by Higher Operating Expenses

Created by MalaccaSecurities | Jul 26, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments