M+ Online Research Articles

M+ Online Market Pulse - Taking Cue From Positive Overseas Markets - 15 Feb 2016

MalaccaSecurities

Publish date: Mon, 15 Feb 2016, 12:01 PM

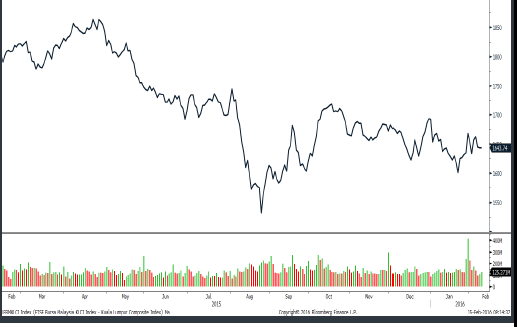

- The FBM KLCI extended its losses for the third consecutive session on the back of the volatile Ringgit and crude oil prices. Concurrently, the lower liners and most of the other sub-indices on the broader market also ended in the negative zone with the exception of Industrial (+0.3%), Consumer Products (+0.2%) and Plantations (+0.3%) subindices.

- Market breadth remained negative as losers outnumbered gainers on a ratio of 517-to-271 stocks. Traded volumes, however, increased by 8.1% to 1.33 bln shares as more market participants return from the Chinese New Year break.

- Genting Malaysia (-12.0 sen) led the heavyweight losers on the FBM KLCI, followed by Maxis and Genting which fell by 8.0 sen each, while Petronas Chemicals slipped 6.0 sen. On the broader market, other major decliners include Shell (-30.0 sen), Scientex (-16.0 sen), MPI (-20.0 sen), Evergreen (-11.0 sen) and Asia File (-10.0 sen).

- On the other side of the trade, the key winners on the broader market were Goldis (+17.0 sen), Kossan (+15.0 sen), Airport (+16.0 sen) and GAB (+10.0 sen). Meanwhile, some of the index-linked heavyweight gainers include MISC (+12.0 sen), KLCC (+9.0 sen), Hong Leong Financial Group (+10.0 sen) and CIMB (+6.0 sen).

- Following the 4.8% drop on Friday, the Nikkei has already tanked 21.0% YTD, while the Hang Seng Index fell by 5.0% over the past week. The mainland indices, however, were closed for the week-long Lunar New Year holidays. ASEAN indices, meanwhile, ended mostly in the red.

- Although the U.S. stockmarkets managed to end their five-day losing streak they, however, extended their weekly losses for the second straight time. Most of the gains on Friday came from financials, materials and energy sector, while utilities underperformed.

- The FTSE marked its best daily gain in about six months, while the DAX and CAC rose 2.5% each amid GDP growth data that met consensus expectations. Separately, however, the Eurozone’s industrial production fell by 1.0% M.o.M in December vs. an increase of 0.3% as expected by many analysts.

THE DAY AHEAD

- After successive days of weakness, the FBM KLCI may stage a rebound over the near term as it takes cue from the positive overseas market performance last Friday to head higher. Although we expect the market to rebound over the near term, the general market environment remains difficult amid the continuing effects of the low crude oil prices and unsettled global economic environment.

- At the same time, there are also few positive domestic catalysts for investors to follow for now and investors are awaiting for the upcoming round of corporate results reporting to gauge how corporate earnings will perform in 2016. On the upside, the resistance is at the 1,650 level, followed by the 1,680 level.

- Meanwhile, we think stocks on the broader market will also head higher as more retail players re-enter the market after the Chinese New Year break and there should be renewed interest among the lower liners that would also contribute to a pickup in trading activities.

COMPANY BRIEFS

- Bursa Malaysia Securities Bhd has queried Yen Global Bhd over the rise in its share price and volume recently. The regulator had advised investors to take note of the integrated apparel manufacturer’s reply to the query when making their investment decision. (The Star Online)

- Tenaga Nasional Bhd (TNB) has signed a new power purchase agreement (PPA) with Malakoff Corp Bhd’s indirect wholly-owned subsidiary, Port Dickson Power Bhd (PD Power) that provides for a three-year extension to 28th February 2019. The new PPA governed the rights and obligations of both parties throughout the term of the extension for the generation and sale of electricity and for PD Power to make the generating capacity available to TNB from its 436MW open-cycle power plant.

- Malakoff had acquired PD Power from Sime Darby Bhd for RM300.0mln cash back in 2014. The plant has been supplying electricity to TNB under a 21-year PPA that expired January 2016. (The Star Online)

- The company’s intermediate subsidiary, Maxwell (Xiamen) Co Ltd had executed six contracts with six marketing agents in China for promoting and setting-up 390 marketing billboards and LED (light-emitting diode) signboards for a period of one year. The total amount paid for this in 2015 was RMB92.4 mln (RM58.5 mln). (The Star Online)

-

AmFIRST Real Estate Investment Trust’s (AmFIRST REIT) 3QFY16 net property income declined 11.2% Y.o.Y to RM14.5 mln due to lower gross revenue from lower occupancy rate at Prima 9 and Menara Ambank and higher interest expense. Revenue for the quarter contracted 9.8% Y.o.Y to RM24.2 mln.

-

For 9MFY16, cumulative net property income fell 13.0% Y.o.Y to RM44.6 mln. Revenue for the period decreased 9.2% Y.o.Y to RM73.8 mln. (The Edge Daily)

-

Businessman Datuk Jayakumar Panneer Selvam has emerged as a substantial shareholder in computer software application solutions provider Excel Force MSC Bhd.

-

This follows his acquisition of 514,600 shares in the company on 10th February 2016, boosting his equity interest in the company to 10.4 mln shares or 5.0%. (The Edge Daily)

-

Mayflower Acme Tours Sdn Bhd, a wholly-owned subsidiary of Warisan TC Holdings Bhd, is proposing to acquire a 55.0% stake in GoCar Mobility Sdn Bhd, a new startup company that currently operates a web-based platform for car rental business.

-

Mayflower Acme has entered into a conditional sale and purchase agreement and conditional subscription agreement to acquire 10,000 shares or 5.0% in GoCar from Ideal Force Sdn Bhd and to subscribe for 100,000 new shares or 50% in GoCar for a total consideration of RM450,000. (The Edge Daily)

-

Special purpose acquisition company (SPAC), Sona Petroleum Bhd is negotiating further on the value of its proposed acquisition of Australia’s stag oilfield after independent valuers deemed the transaction unfairly priced. Sona Petroleum has received conditional approval from the Securities Commission of Malaysia (SC) for the acquisition on 12th February 2016, but has noted that an independent technical and asset valuation report by Gaffney, Cline and Associates (Consultants) Pte Ltd on 20th January 2016 that the purchase price was considered “not fair”, as it was above fair market value of the oilfield in question.

-

Meanwhile, SC’s approval is subject to several conditions. Among them is that Sona Petroleum is expected to utilise up to 80.0% of the amount in its trust account for the acquisition of the Stag oilfield and to finance part of the infill development. The company must also appoint an additional Independent Non-Executive Director who has the appropriate qualification and experience to effectively discharge the role of an Independent Director of a listed company, prior to the issuance of the circular to shareholders.

-

To recap, Sona had, on 2nd November 2016, announced it is planning to buy Australia’s Stag oilfield from Quadrant Northwest Pty Ltd and Santos Offshore Pty Ltd for collectively US$50.0 mln (RM208.0 mln). The acquisition was expected to be completed by 31st March 2016, following which Sona Petroleum is expected to have access to 13.0 mln stock tank barrels (MMstb) of proved (1P) oil reserves, 16.2 MMstb of proved plus probable (2P) oil reserves and 24.0 MMstb of proved plus probable plus possible (3P) oil reserves. (The Edge Daily)

-

Sunway Property, the property unit of Sunway Bhd, has clinched a 95.0% sales level at the launch of its retails units in a mixed development project in Bangi, Selangor. The 34 units, collectively known as Sunway Gandaria’s Retail, ranges from 983 sq.ft. to 6,071 sq.ft. and are priced from RM832,000.

-

Since their preview in mid-December 2015, 32 units have been sold.

-

Sunway Gandaria Retail is the RM54.0 mln Gross Development Value (GDV) retail component of the mixed development, dubbed the “Peak of Bangi”. The entire development has a GDV of RM228.0 mln and is expected to be completed by 2020. (The Edge Daily)

Source: M+ Online Research - 15 Feb 2016

More articles on M+ Online Research Articles

UOA Real Estate Investment Trust - Below Expectations: Hit by Higher Operating Expenses

Created by MalaccaSecurities | Jul 26, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments