M+ Online Technical Focus - 27 Apr 2018

MalaccaSecurities

Publish date: Fri, 27 Apr 2018, 10:26 AM

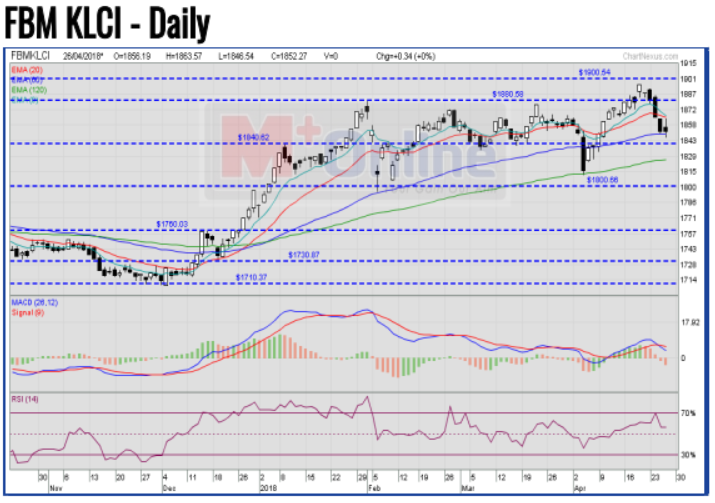

The FBM KLCI pared most of its intraday gains before closing marginally higher as the key index halted a four-day losing streak, closing at 1,852.27 pts yesterday. The MACD Histogram has extended another red bar, but the RSI remains above 50. Resistance will be pegged around the 1,870-1,880 levels. Support will be set around the 1,840 level.

D&O has formed a bullish engulfing candle and closed above the EMA20 level with some improved volume. The MACD Histogram has extended another red bar, while the RSI remains above 50. Monitor for a breakout above the RM0.63, targeting the RM0.675 and RM0.71 levels. Support will be set around the RM0.605 level.

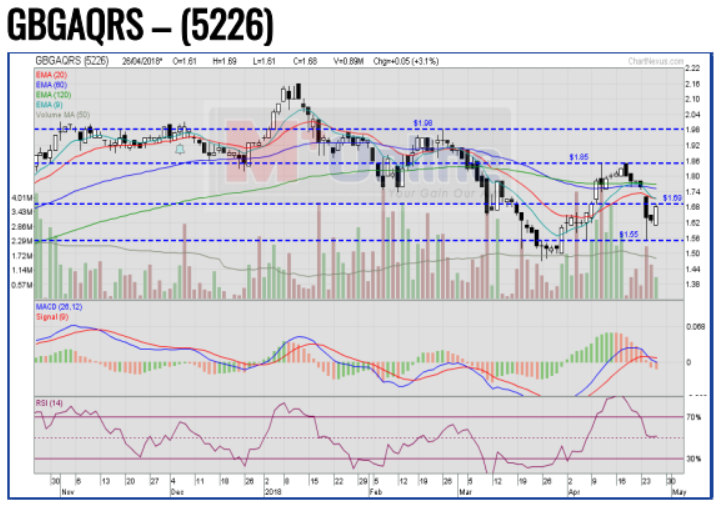

GBGAQRS has rebounded to form a bullish engulfing candle. The MACD Histogram has extended another red bar, while the RSI is treading marginally above 50. Monitor for follow-through buying interest above the RM1.69 level, targeting the RM1.85-RM1.98 levels. Support will be anchored around the RM1.55 level.

ANCOM has experienced a flag-formation breakout above the RM0.58 level with high volumes. The MACD Histogram has turned green, but the RSI is overbought. Price may stage a mild pullback before targeting the RM0.635-RM0.67 levels. Support will be anchored around the RM0.555 level.

Source: Mplus Research - 27 Apr 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-15

ANCOMNY2024-11-15

D&O2024-11-15

D&O2024-11-14

ANCOMNY2024-11-14

D&O2024-11-13

ANCOMNY2024-11-13

D&O2024-11-13

D&O2024-11-12

ANCOMNY2024-11-12

D&O2024-11-11

ANCOMNY2024-11-08

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-06

ANCOMNY2024-11-06

ANCOMNYMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024