M+ Online Technical Focus - 30 Nov 2018

MalaccaSecurities

Publish date: Fri, 30 Nov 2018, 12:27 PM

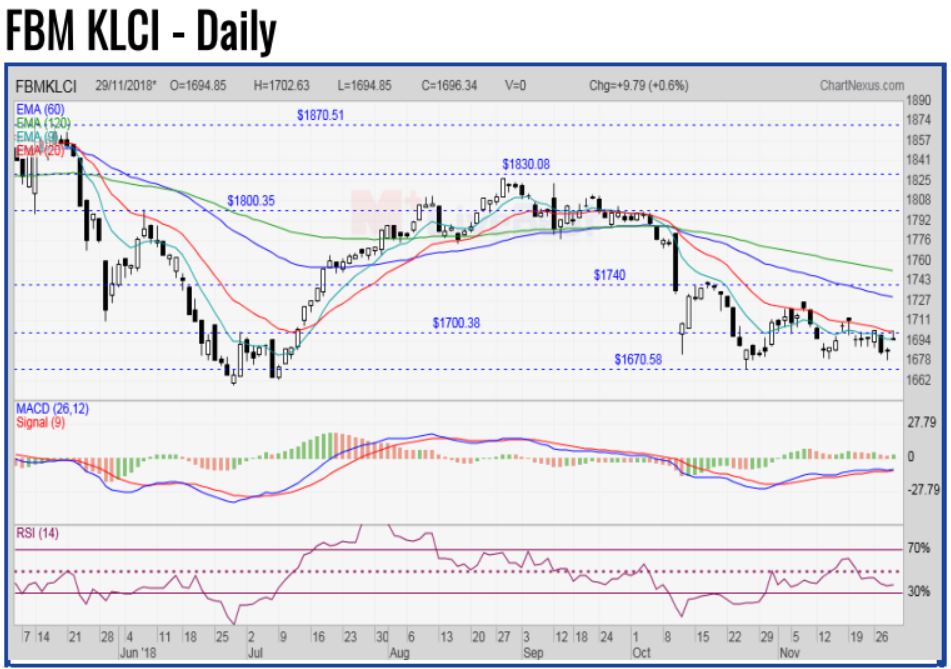

Tracking the sharp gains on Wall Street overnight, the FBM KLCI gapped up and lingered in the positive territory, before closing higher to around the 1,696.34 level yesterday. The MACD Histogram has turned green, but the RSI remains below 50. Resistance will be pegged around the 1,710-1,730 levels. Support will be set around the 1,670 level.

3A has experienced a breakout above the RM0.795 level with rising volumes. The MACD Histogram has extended another green bar, while the RSI remains above 50. Price may rally, targeting the RM0.86 and RM0.90 levels. Support will be set around the RM0.76 level.

IGBREIT has experienced a breakout-pullback-continuation pattern above the EMA20 level with improved volumes. The MACD Histogram has extended another green bar, while the RSI remains above 50. Price may trend higher after minor pullback, targeting the RM1.80-RM1.85 levels. Support will be anchored around the RM1.67 level.

INARI has advanced to close above the EMA9 level with improved volumes. The MACD Histogram has turned green, while the RSI has recovered from oversold. Monitor for a trendline breakout above RM1.76, targeting the RM2.04-RM2.17 levels. Support will be pegged around the RM1.60 level.

Source: Mplus Research - 30 Nov 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-15

IGBREIT2024-11-14

IGBREIT2024-11-14

IGBREIT2024-11-14

INARI2024-11-14

INARI2024-11-14

INARI2024-11-14

INARI2024-11-13

IGBREIT2024-11-12

IGBREIT2024-11-12

IGBREIT2024-11-12

INARI2024-11-12

INARI2024-11-12

INARI2024-11-11

IGBREIT2024-11-11

IGBREIT2024-11-11

IGBREIT2024-11-11

INARI2024-11-11

INARI2024-11-08

IGBREIT2024-11-08

INARI2024-11-08

INARI2024-11-08

INARI2024-11-07

IGBREIT2024-11-07

IGBREIT2024-11-06

IGBREIT2024-11-06

IGBREIT2024-11-06

IGBREIT2024-11-06

INARI2024-11-06

INARI2024-11-05

IGBREIT2024-11-05

INARI2024-11-05

INARIMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024