Economic Stimulus Package 2020 – Package PRIHATIN

MalaccaSecurities

Publish date: Mon, 30 Mar 2020, 10:12 AM

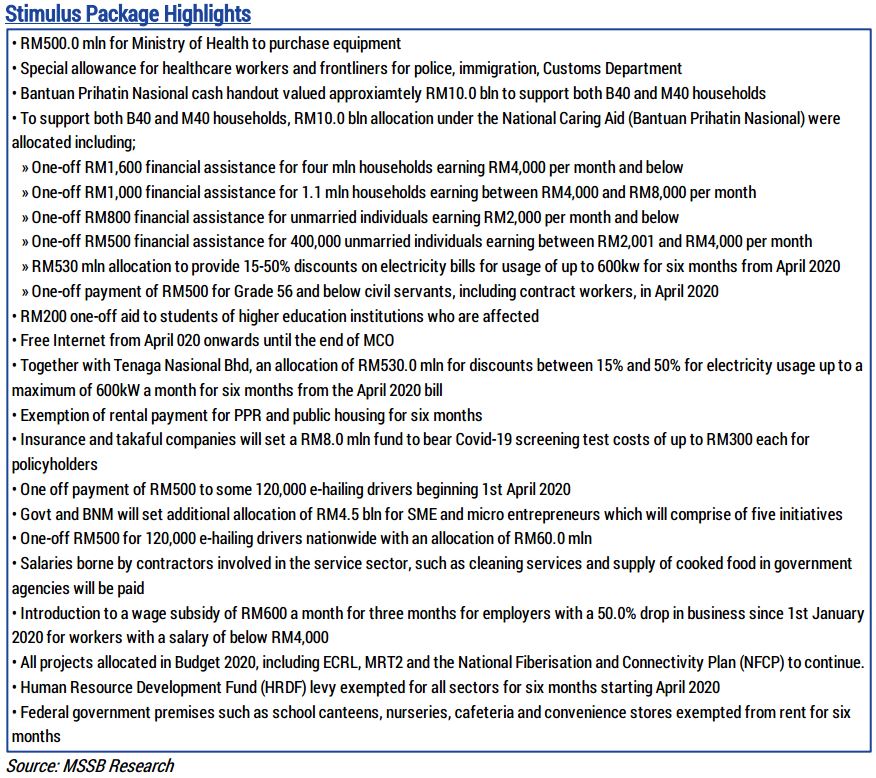

Malaysia Prime Minister Tan Sri Muhyiddin Yassin has unveiled an economic stimulus package known as Package Prihatin or “Caring Package” valued at RM250.0 bln that will benefit all Malaysians. From the amount, RM128.0 bln will be channel to protect the welfare of the people and RM100.0 bln are allocated to support businesses including small and medium enterprises.

The aforementioned economic stimulus package came in a timely manner to address the disruption of economic activities stemmed from Covid-19 that has brought about a standstill in global economic activities. The massive RM270.0 bln stimulus package (inclusive of the previously announced RM20.0 bln earlier) is also the largest ever declared by Malaysia, representing approximately 17.4% of Malaysia’s GDP in 2019. This compared to RM67.0 bln stimulus package announced to combat the subprime mortgage crisis that represented only 8.8% of Malaysia’s GDP in 2008. Nevertheless, the rollout comes at the expense of widening the country’s fiscal deficit beyond the targeted 3.2% level, potentially to 4.0%-6.5% of GDP in 2020 through issuance of debt papers.

On the whole, Package Prihatin is deemed fair to many, addressing the potential decline in private household consumption particularly in the B40 and to certain extent for M40 households, supported by the RM10.0 bln cash handout allocation under the National Caring Aid programme. This comes in light of the reduction in wages (as already adopted by certain industries such as airlines and hotels) or even retrenchment in the cards, particularly in the manufacturing sector amid the disruption of supply chain.

Already, U.S. has reported whopping 3.3 mln unemployment claims last week – beating the previous record of 695,000 claims filed the week ending 2nd October 1982. Back home, the Malaysian Association of Hotels (MAH) has reported that more than 2,000 employees have been laid off following the extension of MCO. We see the numbers continue to rise for the time being as businesses across each sector will continue to struggle over the foreseeable future.

On a brighter note, the continuation of mega infrastructure projects announced under Budget 2020 such as the East Coast Rail Link (ECRL), Klang Valley Mass Rapid Transit (KVMRT) and National Fiberisation and Connectivity Plan (NFCP) may soften the economic blow from the slowdown in consumer spending. Although these projects will proceed, we see deferments in work progress as the nation’s standstill period remained clouded by uncertainties.

For now, it is still too early to tell and assess the impact of Covid-19, given that the curve has yet to flatten with number of reported Covid-19 cases continues to see exponential rise across the globe, hitting close to the 600,000 mark as of 27th March 2020. This has led to more countries adopting the lockdown measure, whilst Malaysia may also see the MCO being extended again – depending on the situation towards mid-April 2020. The longer it takes for the situation to come under control, economics activities may take longer to recover.

Market Outlook

Package Prihatin is touted as an emergency move to cushion the slowdown in economic activities, and not to be mistaken as a move to spur economic growth. Consequently, it is seen as largely neutral with little impact on the stockmarket and we continue to think that the near-term market outlook remains sluggish despite the key index’s recent near term 11.2% recovery from the 1,207.80 level in the past week.

The FBM KLCI managed to recover its’ position above the 1,300 level in recent days, mainly spurred by the U.S. massive 3.0 trn economic stimulus package, coupled with the anticipation of Malaysia’s economic stimulus announcement towards end of the week. As it is, the recovery has left the market at the crossroads again as the focus may return to the rising number of Covid-19 cases, softer economic data performances in coming months and corporate earnings from U.S. next month will partly reflect the impact of Covid-19. Therefore, we think the market may consolidate towards the 1,300 psychological level or even back towards the 1210 support level over the near term in the absence of fresh buying catalyst. Much of the market’s near-term direction will also continue to be dictate by the performance of key overseas bourses.

On the upside, we think there will be limited room for further gains to come by towards the 1,400 and 1,455 levels due to the potentially upcoming insipid earnings performance. Following the conclusion of unexciting corporate earnings growth in 4Q2019 that was impacted by the U.S.-China trade war, we will now beset by further weakness in corporate earnings amid the global economic standstill. Much of the earnings contraction will come from the tourism, leisure, airlines, consumer and retail sectors, while the slumping commodities price performance from both the crude palm oil and crude oil, particularly the latter may see earnings in the plantation and oil & gas sector to remain bleak.

Despite the projected earnings contraction prognosis, the recent stock market slump turned Bursa Malaysia’s valuations slightly attractive, trading at 16.2x and 15.5x for 2020 and 2021 respectively – below the 10-year historical average of 17.0x. Albeit that, further downward revision in earnings estimates may come by should the economic conditions continue to deteriorate. Hence, we reckon that there little room for further upsides as we continue to monitor for developments and impact surrounding Covid-19, whilst market sentiment remain relatively frail at current juncture.

Source: Mplus Research - 30 Mar 2020

More articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024