M+ Online Research Articles

East Malaysia Focus - Infrastructure projects green light

MalaccaSecurities

Publish date: Wed, 10 Jun 2020, 05:15 PM

Trading Catalyst

- Cahya Mata Sarawak Bhd (CMSB) is one of the biggest infrastructure players in East Malaysia. The recent weak financial performance was largely dragged down by cost revision of Pan Borneo Highway and the increased in production cost of the cement segment. Albeit that, we note that CMSB is participating in the tender related to Sarawak’s coastal road network and second trunk road projects.

Technical Outlook

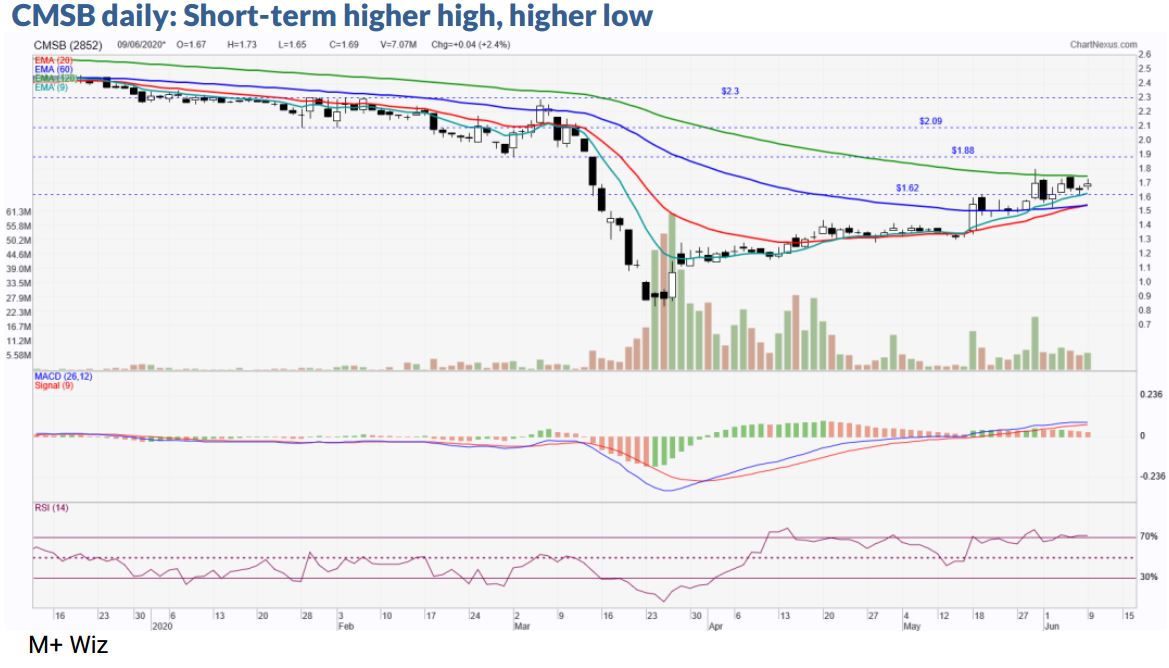

- Price has made a decent recovery since end-March 2020, bottoming out from the RM0.835 level. Price subsequently marched higher before finding some resistance along the EMA120 level. A breakout above the RM1.80 resistance level may trigger price higher towards the next resistance of RM1.88-RM2.09, levels with long term target at RM2.30. Support is located at around RM1.62 level, while cut loss point at RM1.60.

Source: Mplus Research - 10 Jun 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on M+ Online Research Articles

UOA Real Estate Investment Trust - Earnings Came In Within Expectations

Created by MalaccaSecurities | Nov 15, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments