Mplus Market Pulse -Pullback in store

MalaccaSecurities

Publish date: Wed, 08 Jul 2020, 09:34 AM

Market Review

Malaysia: After marching higher for seventh day, the FBM KLCI (-0.7%) took a pause, reversing all its intraday gains as Bank Negara announced another 25 basis points of interest rate cut to historic low of 1.75%. The lower liners finished lower, while the healthcare sector (+1.9%) continues to thrive on the mostly negative broader market.

Global markets: US stockmarkets retreated overnight as the Dow slipped 1.5% on concern over a potential second wave on lockdowns following the recent rise in new cases that offset the better-than-expected jobs data which saw jobs opening unexpectedly rise to 5.4m in May 2020. European stockmarkets faltered, while Asia stockmarkets finished mostly lower yesterday.

The Day Ahead

We think that the pre-emptive move by Bank Negara may provide some support to the local market as investors shift their portfolio to alternative investments in search for higher yields. For now, a consolidation could be due following the recent stretch of rally that allows investors to digest the recent gains, while the renewed volatility on Wall Street may permeates to stocks on Bursa Malaysia.

Sector focus: The renewed volatility, coupled with Bank Negara’s move to cut benchmark interest rate by another 25 basis points may see investors shifting the focus to companies that historically deliver decent yields such as the utilities and REIT sectors. In the meantime, gold prices edging towards US$1,800 may spur trading interests in gold-related stocks.

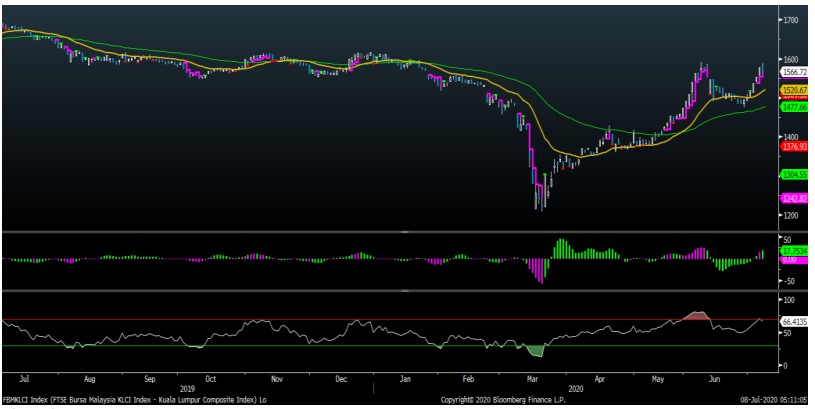

FBMKLCI Technical Outlook

The FBM KLCI reversed its position after hitting the 1,580 resistance level as the key index is potentially forming the double top formation. As buying momentum appears to have fizzled, further pullback may see the key index supported at the 1,530, followed by 1,515. Upside resistance is located at 1,580 and 1,590. Nevertheless, indicators are still positive as the MACD Histogram has extended another green bar, while the RSI has retreated from the overbought region

Market Scorecard

Source: Mplus Research - 8 Jul 2020

More articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024