Mplus Market Pulse - 9 Jul 2020

MalaccaSecurities

Publish date: Thu, 09 Jul 2020, 09:56 AM

Market Review

Malaysia: The FBM KLCI (+1.1%) resumed its positive momentum to recover all its previous session losses as the key index is now a hair away from erasing all the YTD losses. The lower liners which was largely in focus as they closed higher accompanied by record high trading volumes, while the broader market closed mostly higher with the telecommunication and media sector (+4.7%) leading the pack.

Global markets: US stockmarkets notched higher as the Dow (+0.7%) re-claimed the 26,000 psychological level, largely boosted by gains in technology stocks that offset another record daily number of new Covid-19 cases. Earlier, European stockmarkets retreated on concerns over the resurgence of Covid-19 cases, while Asia stockmarkets closed mixed.

The Day Ahead

The prevailing low interest rate environment enticed investors’ portfolio allocation to other asset classes, including the equities market in search for higher yields. We think that the positive momentum as foreign funds net buying hit the highest level since 17th January 2020, coupled with the surge in trading activities will enable the Malaysian stockmarket to trend higher.

Sector focus: Gold-related stocks remain in focus after gold prices breached USD1,800, while the technology sector may flourish after global semiconductor sales rose 5.8% YoY in May 2020. The consumer sector broadly will be benefited on the back of potential higher disposal income amid the recent OPR cut.

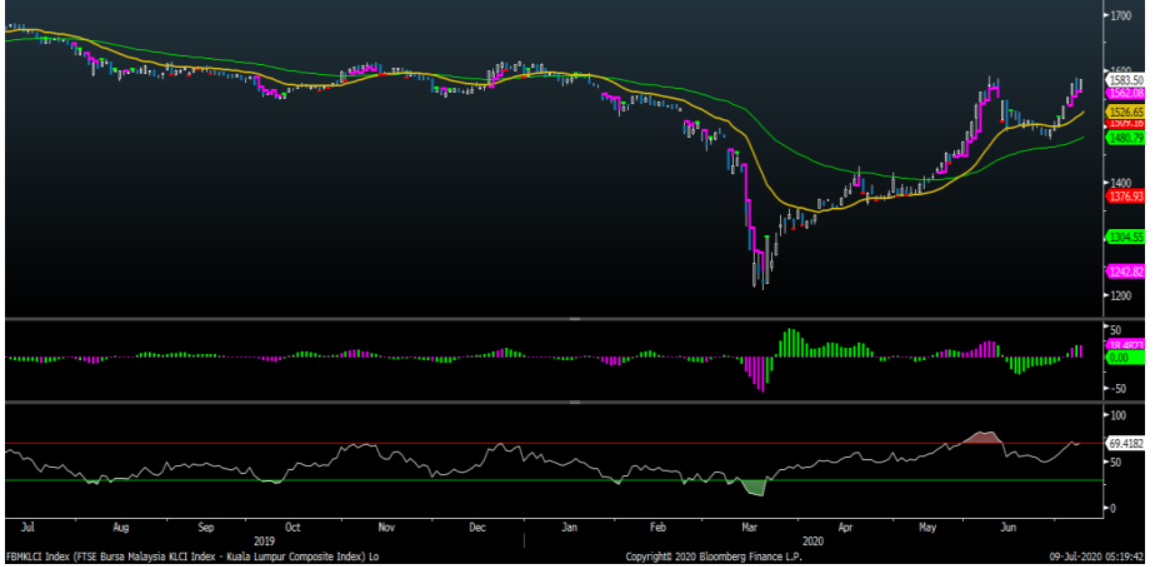

FBMKLCI Technical Outlook

The FBM KLCI rebounded to recover all its intraday losses to form a bullish engulfing candle; suggesting an upward bias tone. We think that the 1,590 will serve as the immediate resistance, followed by 1,615; the level was recorded during pre-Covid-19. Downside risk is now pegged at 1,550, followed by 1,530. Indicators are still positive as the MACD Histogram has extended another green bar, while the RSI remains above 50.

Source: Mplus Research - 9 Jul 2020

More articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024