M+ Online Research Articles

1H20 Review and 3Q20 Outlook - T-H-K-S to Gloves Lifting the Market Sentiment

MalaccaSecurities

Publish date: Wed, 15 Jul 2020, 09:49 AM

- Consensus are expecting a slowdown in economic activities for 2020, but we believe the stimulus packages from several central banks would be able to cushion the downside risk and may translate to a potential recovery in 2021. For the local markets, we expect the trading interest to crowd around gloves or healthcare stocks. However, we believe some defensive picks under the consumer (LHI, NOVA, POHUAT), healthcare-proxy (HEXZA, TEKSENG), payment solutions (REVENUE) should have decent reward to risk for trading opportunities.

Economic review and outlook

- The emergence of Low-Touch-Economy. With Covid-19 pandemic likely to stay for the short- to mid-term, we opine that it would drive changes in business environment, translating to both short and mid-term impacts on the consumer behaviours and economy. Hygiene guidelines, social distancing regulations, travel restrictions will translate to more cost for corporates and may contribute to slowdown in economic activities moving forward.

- Contraction mode in 2020… Based on consensus data, World GDP growth is expected to dip -3.8% in 2020 before recovering 5.1% in 2021. Similarly, IMF has revised down its 2020 global growth forecast to -4.9% from -3.0% previously in June, while Malaysian economy may decline -2.9% in 2020 and recover by 5.4% in 2021.

- …but expansion likely to be seen in 2021. We opine that the gradual recovery likely to be seen when Covid-19 cases start to ease or positive developments on vaccine emerge in 4Q2020 onwards. We opine that several stimulus measures that have been implemented by most of the countries in 1H2020 are likely to cushion the downside risk at least for year 2020.

Market review and outlook

- Market V-shape recovery… Global markets trended lower, forming a bear market in 1Q2020, but the trend quickly reverse in 2Q2020 on the back of (i) unlimited liquidity injection from the Federal Reserve, (ii) the Fed to maintain its dovish stance till 2022 and (iii) follow-suit of the same stance by most of the central bankers globally. Hence, the increase in liquidity has put a stop to the bleed in the market from Mar- 2020, lifting global markets in 2Q2020. MSCI World Index charged 18.7% higher in 2Q2020, while most of the indices are traded positively ranging from 3.5% to 23.9%.

- …and gloves giving a lift for Malaysia’s stock market. Bursa exchange were impacted externally (Covid-19 pandemic, ongoing trade war) and internally (political developments) throughout 1Q2020 and KLCI trended negatively in 1Q2020 before rebounding in tandem with the global markets when central bankers globally supported the economy with liquidity injections. Several relief packages were executed to cushion the downside risk in Malaysia. In 2Q2020, KLCI rose 11.1% with the help from healthcare sector (+80.3%) such as glove sector due to the rise in demand for gloves, followed by the technology sector (+38.6%).

- Foreign participation remains net outflow for 2020. YTD, foreign net outflow stood at RM16.8bn (2015: oil crisis foreign outflow was c.RM19.5bn).

- Significant retailers’ participation. Meanwhile, retailers’ participation was crucial throughout the MCO/ CMCO period, where it has surge to 38.3% (vs. range 20-27% in 2019), while YTD average daily traded value (ADTV) increased 68.4% to RM3.25bn (vs. average ADTV of RM1.93bn in 2019). This has provided healthy trading tone to the broad recovery of market in 2Q2020.

3Q20 Strategy – key investment themes

- Although we think there is some upside for gloves and warrant some trading opportunities in 2H2020, but it may not have a decent reward to risk after a strong rally since 1Q2020.

- Hence, traders and investors should look out for defensive characteristics stocks under consumer segment (i.e. high dividend yield, net cash and stable business model), as well as themes that are related to re-opening business activities and segments that emerged under the Covid-19 environment such as tech automation, e-commerce sectors.

- Besides, solar theme would bode well for 2H2020 with the LSS4 contracts expected to be announced by Sep-2020.

Sector and stock picks for 3Q20

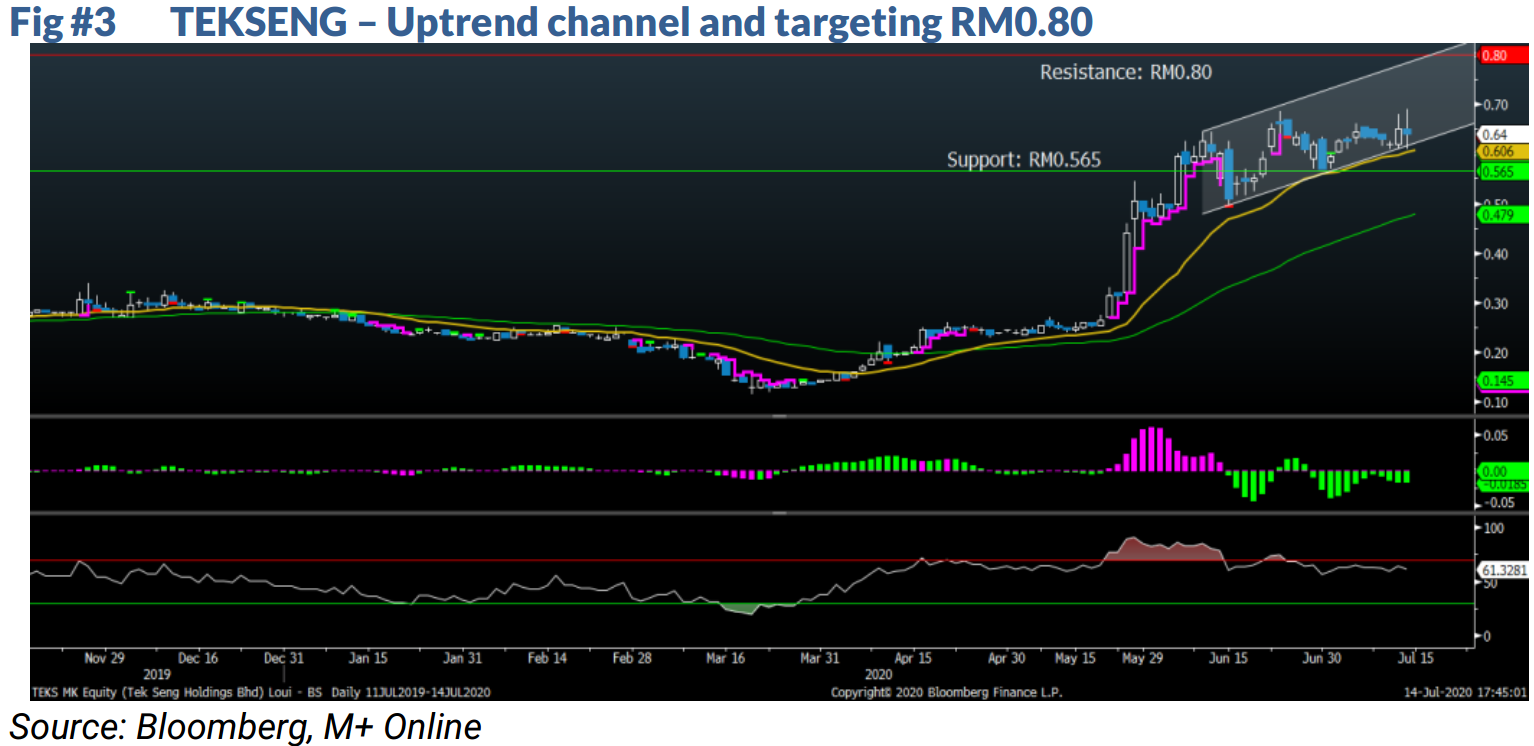

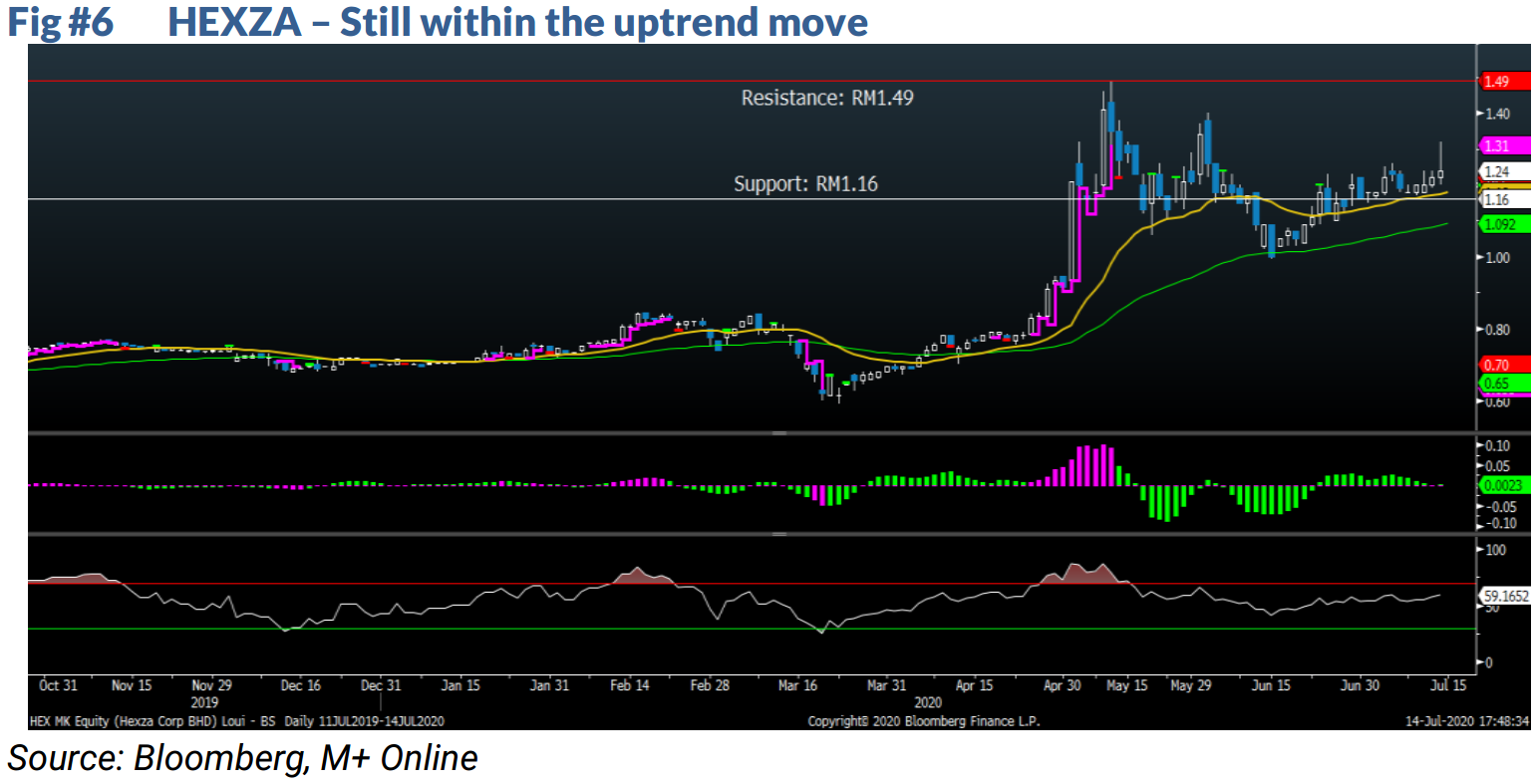

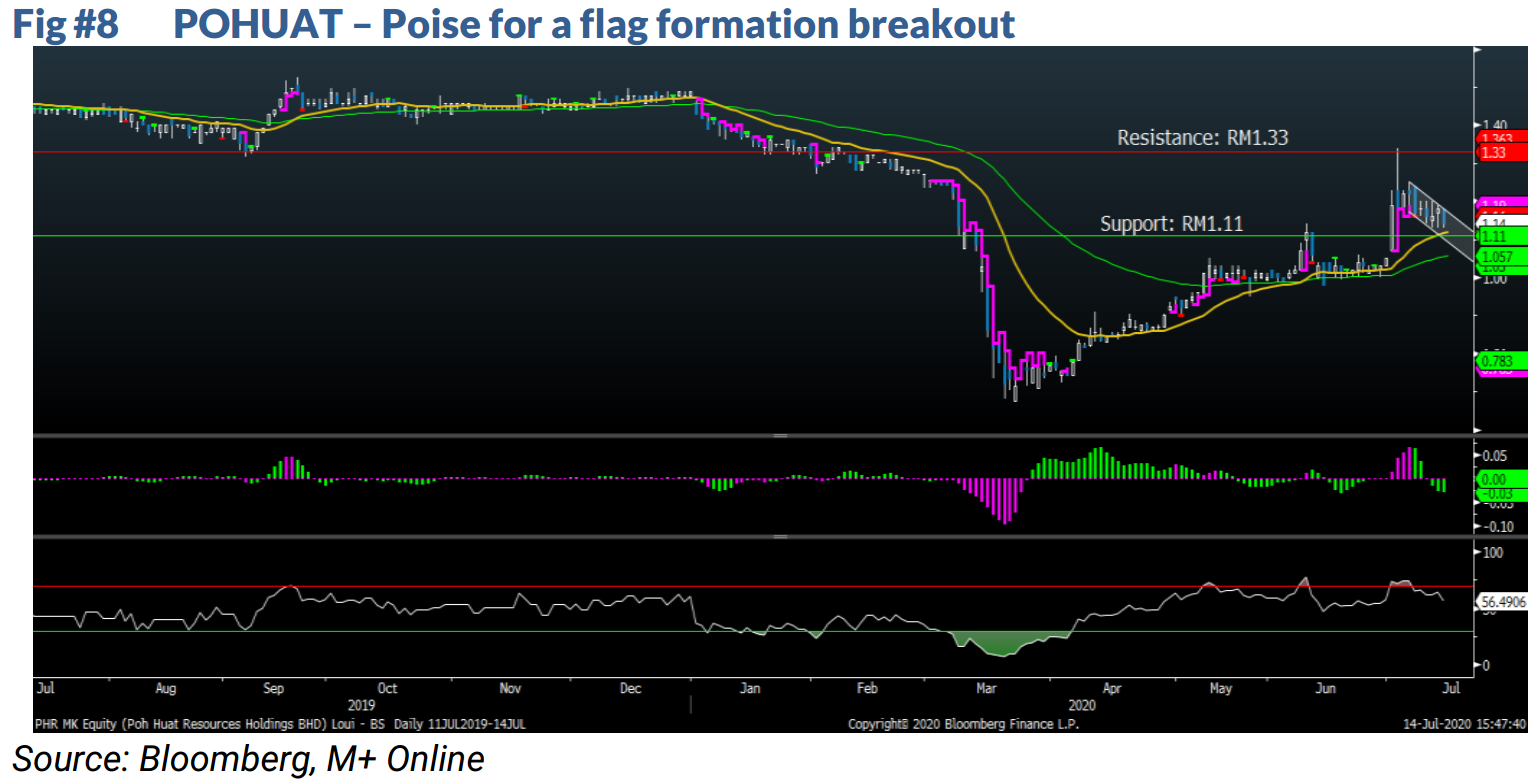

- Covid-19 induced stock picks: Sanitiser - raw material (HEXZA), face masks and shields (SCGM and TEKSENG), nutraceutical (NOVA), plastic packaging manufacturers (SLP and TGUAN) and furniture manufacturers (POHUAT).

- Solar-related could benefit from LSS4: CYPARK, SOLARVEST and TEXCYCL.

- Technology segment as automation, data centres and e-commerce trends on the rise: UWC, GREATEC, MI, DUFU, REVENUE and JCY.

TEKSENG – Part of the PPE ecosystem

- TEKSENG under its PVC segment produces PP non-woven fabric for hygiene (wet wipes, disposable bath and face towels and etc…), medical (surgical gowns and medical packaging and etc…) and filters (pharmaceutical industry, gasoline, oil and air – including HEPA filtration and etc…) usage. We understand that the fabric prices have increased significantly throughout Covid-19 pandemic period.

- TEKSENG also rented out one of its factory buildings to generate income from solar energy segment (solar panel installation).

LHI – Chicken prices on the way up after reopening of business

- Leong Hup’s was affected on the back of closure of business overall and declining demand throughout MCO/ CMCO period. However, we noticed chicken prices are back on the rising trend following the reopening of business. Hence, we should anticipate mild recovery towards their earnings moving forward.

NOVA – Rising awareness for nutritional products

- NOVA is a nutraceutical company that sells dietary supplements, food and skincare products as well as hand sanitiser. Furthermore, they are launching new healthcare products as NOVA observed the interest in preventive healthcare is growing under this new normal.

- With its IPO proceeds, they are expanding its factory (phase 1 completed and phase- 2 ongoing) and production capacity has grown by 5 times. Besides, they have been rewarding shareholders with dividends since listing.

HEXZA – Living under the new normal with sanitisers

- HEXZA is one of the key ethanol (major component of sanitiser) manufacturers in Malaysia and was not affected under MCO period as they are being viewed as essentials. We believe HEXZA will be one of the beneficiaries amid the rising demand for sanitiser moving forward.

- As of 3Q20, HEXZA has a decent net cash of RM90.2m (45.0 sen or 34% of share price) and has been rewarding shareholders 4-5 sen per annum since FY10.

REVENUE – Proxy for the 3 Es (e-payment, e-wallet, e-commerce)

- REVENUE is involved in payment solutions segment, providing the EDC terminals for electronic transactions services for credit/ debit cards or e-wallet. Besides, their revPAY platform is able to cater for the e-commerce transactions over the internet.

- Hence, with the rising adoption for e-payment or e-wallet trends domestically, coupled with the e-commerce boom (further expedited by the Covid-19 pandemic), we opine that REVENUE will be one of Covid-19 induced stock picks for now.

POHUAT – “Stay home” trends to promote home improvements

- POHUAT produces furniture that caters for home and office segments. We understand after the Covid-19 outbreak, most of the corporates advocated for work from-home and consumers tend to “stay home” allowing more home improvements moving forward.

- We opine this should give rise towards higher demand for home furniture as well as office work stations upgrades, where POHUAT will have the capability to tap along with the trend.

- Although its result has dropped in 2Q20, POHUAT is likely to sail through these trying times smoothly with its solid net cash of RM140.1m (57.2 sen, or 49.3% of share price). In FY19, they have rewarded 7.0 sen to shareholders as dividend, translating to around 6.1% DY.

Source: Mplus Research - 15 Jul 2020

More articles on M+ Online Research Articles

UOA Real Estate Investment Trust - Below Expectations: Hit by Higher Operating Expenses

Created by MalaccaSecurities | Jul 26, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments