Mplus Market Pulse - Sentiment remains subdue

MalaccaSecurities

Publish date: Mon, 10 Aug 2020, 12:36 AM

Market Review

Malaysia: The FBM KLCI (-0.7%) failed to build onto its previous session gains after erasing all its intraday yesterday in tandem with the weakness across regional peers. The lower liners ended mixed after trading volumes surged to fresh record high with 26.65bn shares exchanging hands, while the broader market was splashed in red.

Global markets: US stockmarkets were mostly higher on a choppy trading session as the Dow climbed 0.2% to mark its biggest weekly gain (+3.8% WoW) in 2 months despite White House failed to produce the anticipated stimulus bill. European stockmarkets also edged higher, while Asia equities finished mostly lower amid rising tension between US and China.

The Day Ahead

Although the trading activities rose to fresh record high, we see signs of pullback taking shape as traders were quick to lock in gains in the overheating market environment. On the local bourse, the lack of fresh catalyst and political uncertainties may keep any gains in check. We also think that a pullback is due owing to the overbought condition amongst the lower liners as evident on the negative market breadth.

Sector focus: Amid the renewed volatility, we see safe haven-related stocks to outperform, supported by the gold prices hovering near all-time high. Healthcarerelated stocks may also come into play again amid the rising number of Covid-19 cases across the globe.

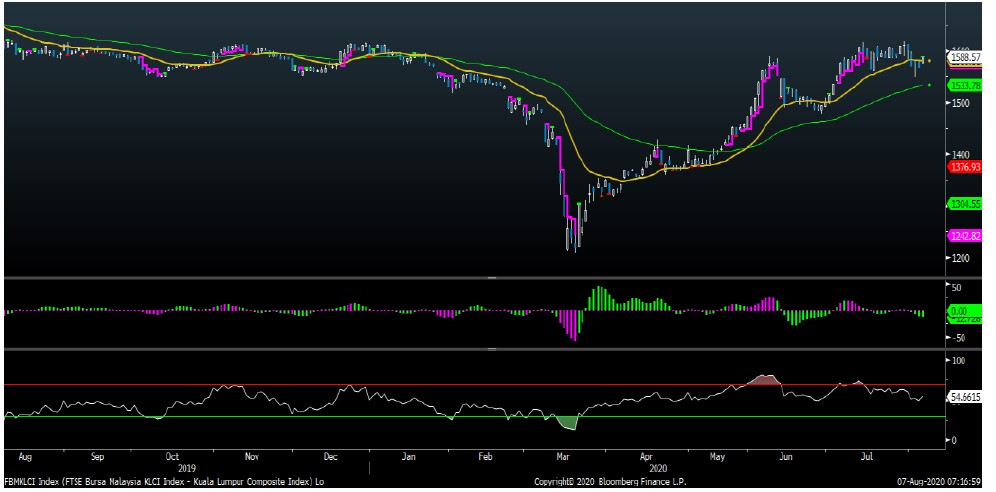

FBMKLCI Technical Outlook

The FBM KLCI has formed a bearish candle to close below the daily EMA9 level as quick profit taking activities took place. Amid the lack of follow-through buying support, we continue to see the 1,600 as the immediate resistance, followed by 1,615. The immediate support is pegged at 1,550, followed by 1,530. Indicators are still weak with the MACD remains below the Signal Line, while the RSI has tripped below 50.

Source: Mplus Research - 10 Aug 2020

Source: Mplus Research - 10 Aug 2020

More articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024