M+ Online Research Articles

M+ Online Technical Focus - 12 August 2020

MalaccaSecurities

Publish date: Wed, 12 Aug 2020, 04:51 PM

Energy sector

Rising demand lifting crude oil prices higher

- Demand for crude oil is expected to improve over the foreseeable future, backed by the positive streak of China’s economic data that suggest the world’s biggest oil consumer may ramp up their purchases. At the same time, Iraq’s move to pledge their support by cutting additional 40,000 barrels/day may provide some alleviation to the on-going demand-supply imbalance.

- Also, the larger-than-expected drawdown in US inventory level coupled with the recent weakness in US Dollar against a basket of currencies will grant further upside over the near term. We reckon that Brent oil prices may sustain above US$40 per barrel owing to the improvement in macroeconomic conditions.

Trading Catalyst

- Hibiscus Petroleum is targeting a reduction in unit production cost (UPC) in FY20 for both the Anasuria Cluster and North Sabah. The UPC reduction will be materialised through the deferral of non-critical activities and prudent management of general and administrative expenses. Presently, the group has locked in future sales of 750,000 barrels at an average price of US$35/bbl for North Sabah. Moving forward, Hibiscus Petroleum will be committed to deliver 3.2m barrels of oil by end-2020.

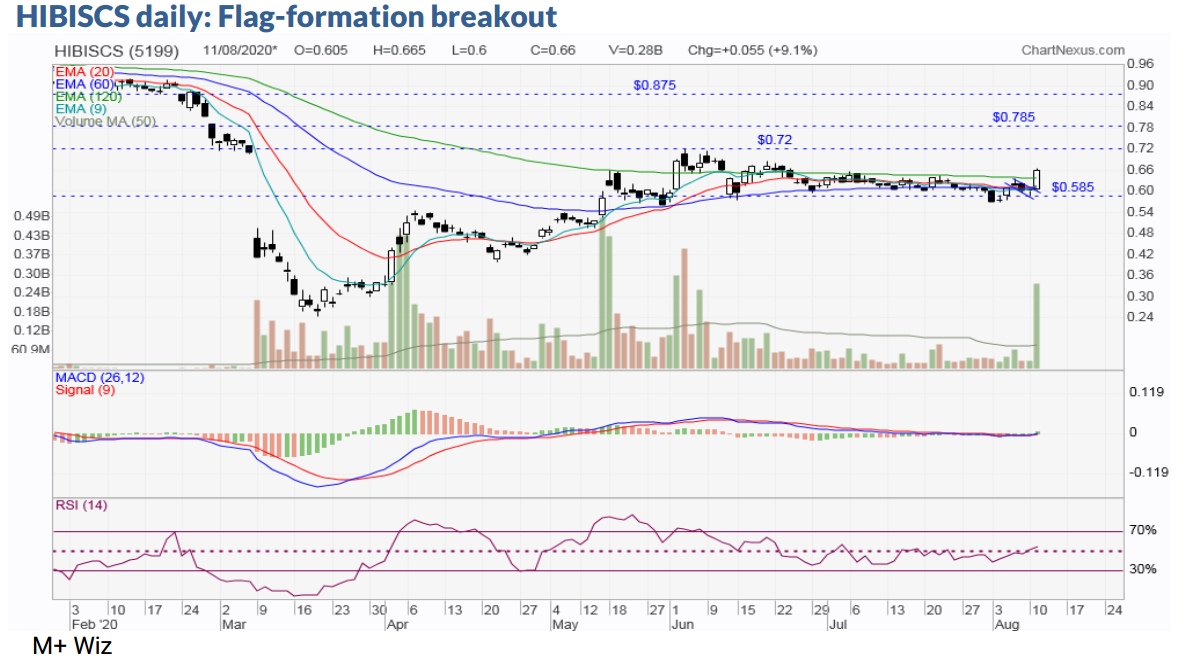

Technical Outlook

- After two-month long of consolidation, price has staged a mild recovery, closing at around the daily EMA120 level accompanied by high volumes. Price has recently formed a flag-formation breakout, potentially targeting the next resistance of RM0.72-0.785, with long term target at RM0.875. Support is set at around RM0.585, while cut loss is pegged at RM0.58.

Trading Catalyst

- Despite the prolonged downturn in oil & gas sector, DAYANG has been relatively resilient; with bottom line remain in the black throughout the past two years. The sound performance is mainly backed by the uninterrupted positive operating cash flow. At present, DAYANG’s earnings will be sustained by a solid outstanding orderbook of approximately RM4.00bn, translating to a healthy cover ratio of 3.8x of FY20 revenue of RM1.05bn. At the same time, DAYANG is supported by a healthy balance sheet with relatively low net gearing of 0.1x in 1QFY20.

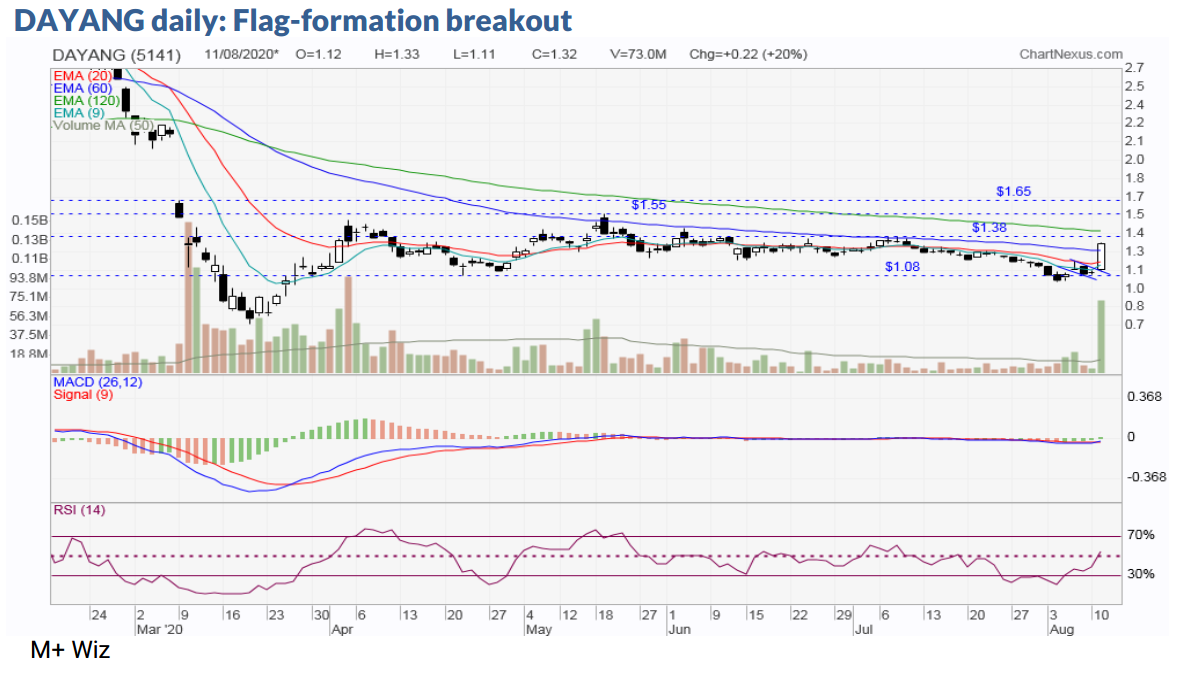

Technical Outlook

- DAYANG is still on a pullback phase before finding a footing at the start of August 2020. Price has rebounded, forming a flag-formation breakout to re-test the daily EMA20 level. Further recovery may give rise to price to head towards the next resistances located around the RM1.38-1.55 levels, with long term target set at RM1.65. Support is pegged at around RM1.08, while cut loss point is located at RM1.07.

Source: Mplus Research - 12 Aug 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-16

HIBISCS2024-11-15

HIBISCS2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

HIBISCS2024-11-12

HIBISCS2024-11-06

DAYANG2024-11-06

DAYANG2024-11-05

DAYANG2024-11-05

DAYANG2024-11-05

DAYANG2024-11-05

DAYANG2024-11-05

DAYANG2024-11-05

DAYANG2024-11-05

DAYANGMore articles on M+ Online Research Articles

UOA Real Estate Investment Trust - Earnings Came In Within Expectations

Created by MalaccaSecurities | Nov 15, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments