Mplus Market Pulse - 13 Oct 2020

MalaccaSecurities

Publish date: Tue, 13 Oct 2020, 10:14 AM

Dragged down by profit taking

Market Review

Malaysia: The FBM KLCI (-0.8%) started off the week lower due to profit taking activities in the market following two consecutive days of rally last week. The lower liners ended mixed, while the broader market was mostly lower with the exceptions of healthcare (+2.5%), transportation & logistics (+0.7%) and industrial products & services (+0.3%) sectors.

Global markets: US stockmarkets notched higher as the Dow climbed 0.9% as Democrats and Republicans inched closer to a stimulus compromise, whilst Apple is set to unveil new products. Meanwhile, European and Asia stockmarkets both finished mostly in green as China returns from 8-day mid-autumn festival break.

The Day Ahead

Expectedly, the FBM KLCI staged a pullback as investors opted to lock in recent gains following a two-day of rally. At the same time, the rising number of Covid-19 cases triggered the re-implementation of conditional movement control order (CMCO) in Selangor, Kuala Lumpur and Putrajaya may deter the pace of economic recovery. Still, the vibrant trading activities will continue to provide rotational play amongst the lower liners, capitalising on the firmer momentum in recent times.

Sector focus: With the rising number of Covid-19 cases (both local and international), we reckon that demand for healthcare sector remain firm for a longer period, whist the search for vaccine remain clouded by uncertainties. The higher CPO prices, hitting the RM3,000/MT level could provide further trading interests within the plantation sector.

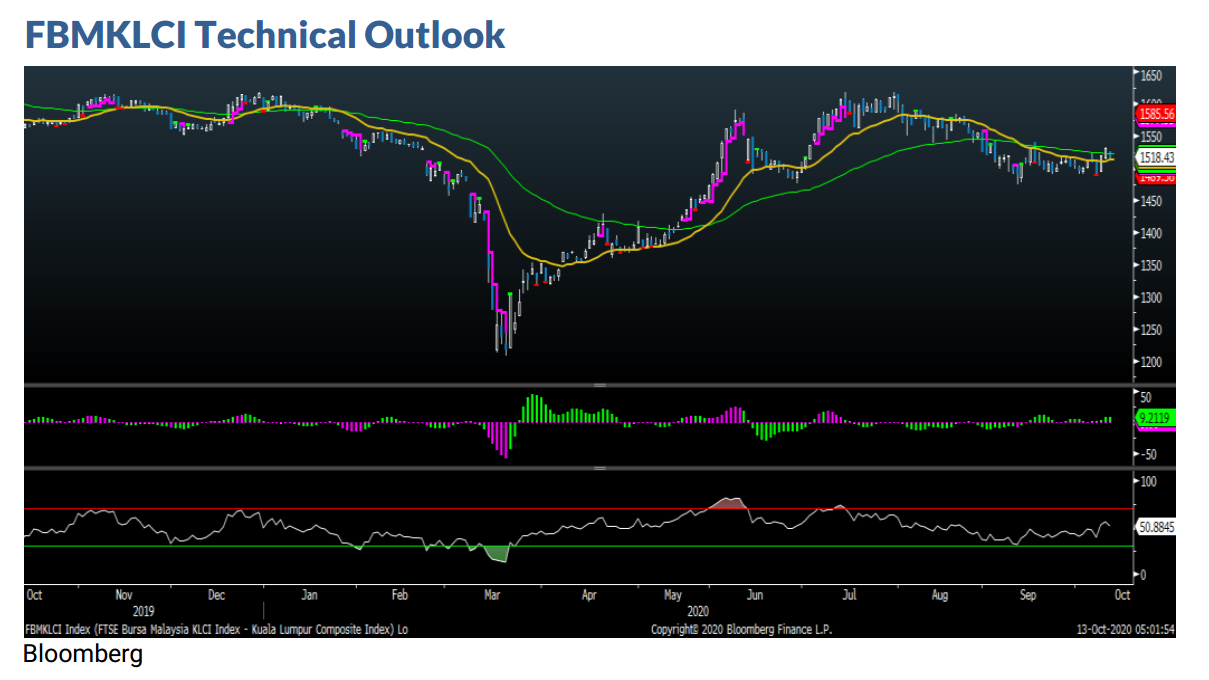

The FBM KLCI took a dive at the start of the trading bell as the key index formed a bearish candle to close below the daily EM1A20 level. The pullback may trigger suggests that buying momentum has weakened with the immediate support pegged at 1,490, followed by 1,480. In contrast, the resistances are at 1,540, followed by 1,555. Indicators have turned mixed as the MACD Histogram has turned red, while the RSI remains above 50.

Company Brief

Two officials of Lotus KFM Bhd; Wong Sak Kuan and Yau Ming Teck have launched a mandatory takeover offer for the remaining shares of MESB Bhd after they raised their combined stake to 44.1%. They are offering 31.5 sen per MESB share and 1.5 sen per warrant.

They had on Monday acquired 29.5m MESB shares or 27.8% for RM8.8m or 30 sen per share from Angsana Inai Sdn Bhd, Konwa Industrial Sewing Machines (M) Sdn Bhd and Yew Kuok Yee. After the acquisition, Wong owns 33.4% or 35.5m MESB shares and Yau, 10.7% or 11.3m shares. (The Star)

MyNews Holdings Bhd will operate and sub-franchise South Korea’s popular convenience store brand CU under a 10-year agreement with BFG Retail Co. Ltd. CU has more than 15,000 stores in South Korea is expected to be opened in Malaysia in early 2021. Under the licensing agreement, it will be 10 years with an additional renewal term of 10 years and it will operate and sub-franchise CU outlets in Malaysia. (The Star)

Top Glove Corp Bhd is evaluating a dual primary listing on the Hong Kong Stock Exchange (HKEX). The proposed HKEX listing is still at a preliminary stage and the structure has not been finalised. Top Glove is said to be considering raising more than US$1.0bn from the listing. (The Edge)

UMW Holdings Bhd automotive market share in Malaysia achieved a new record high of 53.7% in August 2020, and that the group registered a higher automotive sales volume in the 3Q2020 following stronger sales performance of Toyota and Perodua cars. The sales tax exemption, in force from 15th June 2020 to 31st December 2020, helped lift car sales. (The Edge)

Tiong Nam Logistics Holdings Bhd has proposed the issuance of 67.1m shares, representing 15.0% of its current share base, to raise RM29.2m for capital expenditure to expand its business. Of the total proceeds to be raised, RM28.8m will go towards the acquisition and/or construction of additional warehouses to meet the increased demand for storage surfaces. (The Edge)

Source: Mplus Research - 13 Oct 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-18

TOPGLOV2024-11-15

LOTUS2024-11-14

TOPGLOV2024-11-13

TNLOGIS2024-11-13

TNLOGIS2024-11-13

TNLOGIS2024-11-13

TNLOGIS2024-11-13

TOPGLOV2024-11-12

TNLOGIS2024-11-11

TOPGLOV2024-11-11

TOPGLOV2024-11-08

LOTUS2024-11-08

LOTUS2024-11-08

TOPGLOV2024-11-08

TOPGLOV2024-11-07

TOPGLOV2024-11-07

TOPGLOV2024-11-07

TOPGLOV2024-11-07

TOPGLOV2024-11-06

MYNEWS2024-11-06

MYNEWS2024-11-06

MYNEWS2024-11-06

MYNEWS2024-11-06

MYNEWS2024-11-06

MYNEWS2024-11-06

TNLOGIS2024-11-06

TOPGLOV2024-11-06

TOPGLOV2024-11-05

LOTUS2024-11-05

LOTUSMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024