Mplus Market Pulse - 22 Mar 2022

MalaccaSecurities

Publish date: Tue, 22 Mar 2022, 08:36 AM

Taking a breather

Market Review

Malaysia:. The FBM KLCI (-0.3%) halted a 3-day winning streak on the back of quick profit taking activities in selected plantation and banking heavyweights as foreign funds snapped a 30-day net buying position. The lower liners, however, edged higher, while the broader market ended mostly positive, led by the technology sector (+3.7%).

Global markets:. Wall Street turned volatile as the Dow (-0.6%) slipped, dragged by the hawkish remarks from the US Federal Reserve Chairman Jerome Powell in regards to the interest rate direction. Elsewhere, both the European and Asia stockmarkets ended mixed.

The Day Ahead

Profit taking emerged on the FBM KLCI following the three straight sessions of rally on the back of mixed sentiment across the regional markets. However, we expect the key index to maintain its positive bias move over the near term with the focus turning to the upcoming reopening of travel borders and the recovery theme moving forward. Commodity prices remained elevated; the crude oil prices advanced above USD110 per barrel mark as the European Union considered on the Russian oil ban, while the CPO price hovered above RM5,800.

Sector focus:. The elevated crude oil price may continue to lift the O&G sector. Besides, the tourism sector may benefit with the border reopening in April and the easing quarantine measures in Hong Kong. Meanwhile, we expect 5G and construction related newsflow to surface in the media and may lift the sentiment on the telco and construction sectors.

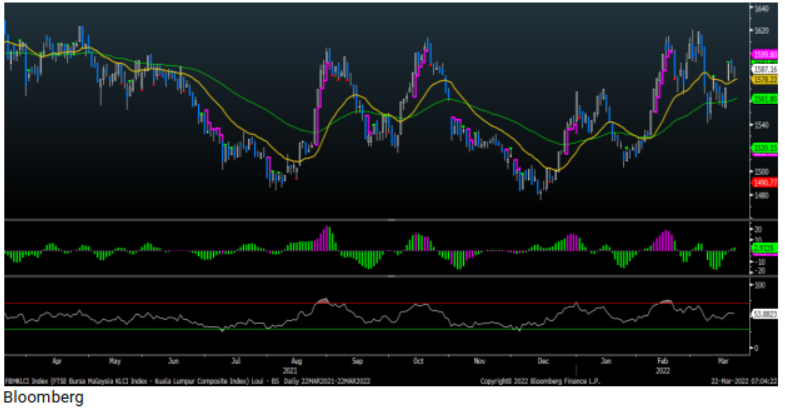

FBMKLCI Technical Outlook

The FBM KLCI booked marginal losses, snapping its three-day winning streak. Technical indicators remained positive as the MACD Histogram extended a positive bar, while the RSI hovered above 50. The next resistance is pegged around 1,600-1,620, while the support is located at 1,550.

Company Brief

Press Metal Aluminium Holdings Bhd (PMAH) aims to raise RM1.00bn via a proposed placement of up to 163.4m new shares. The proposed placement represents 2.0% of the total issued PMAH shares, and the issue price will be determined and announced later. Based on the illustrative issue price of RM6.12 per placement share, the proposed placement is expected to raise gross proceeds of approximately RM1.00bn, to be used for capital expenditure (RM210.0m), working capital (RM670.0m) and repayment of borrowings (RM120.0m). The estimated expenses related to the proposed placement of RM8.0m. (The Star)

LBS Bina Group Bhd has entered into a heads of agreement (HOA) with Ancom Bhd, Nylex (Malaysia) Bhd, Sinar Bina Infra Sdn Bhd (SBI) and BTS Group Holdings Public Company Ltd to collaborate in building and operating a light rail transport (LRT) system connected with the railway shuttle link currently being built from Singapore to Johor Bharu (RTS Link). The collaboration would include an integrated property development using the transit-oriented development (TOD) concept in Johor Bharu metropolitan region, according to a filing with Bursa Malaysia. (The Star)

Berjaya Corp Bhd (BCorp) has reported that its CEO, Abdul Jalil Abdul Rasheed, has resigned to pursue his personal interests. The resignation will take effect on 31st March 2022. BCorp has named conglomerate veterans Vivienne Cheng Chi Fan and Syed Ali Shahul Hameed as joint group CEOs, effective 1st April 2022. Syed Ali has also been made BCorp executive director.

At the same time, Berjaya Land Bhd (BLand) has announced the appointment of Datuk Abdul Rahim Mohd Zin as CEO, effective 1st April 2022. In addition, BLand also appointed Tan Tee Ming as executive director, as Nerine Tan Sheik Ping steps down. (The Edge)

TDM Bhd has accepted an offer from Ikhasas CPO Sdn Bhd to acquire two loss making Indonesian subsidiaries for RM115.0m. PT Rafi Kamajaya Abadi and PT Sawit Rezeki Abadi, have been unprofitable for the past three years (2018, 2019 and 2020), and are not expected to be profitable in the near term. The exercise provides an opportunity for the group to exit the Indonesian operations and focus its resources in its Malaysian operation. (The Edge)

Practice Note 17 (PN17) company Sumatec Resources Bhd will be delisted from Bursa Malaysia’s Main Market on 24th March 2022. The delisting is pursuant to paragraph 16.11(2)(d)(ii) of the Main Market Listing Requirements, which states that the stock market operator shall de-list a listed issuer upon the winding up of the latter. (The Edge)

Cita Realiti Sdn Bhd, a substantial shareholder of BCM Alliance Bhd, Sanichi Technology Bhd and MNC Wireless Bhd, has also emerged as the largest shareholder of Fitters Diversified Bhd. This follows its acquisition of 8.2% stake (47.0m shares) in the diversified group, bringing its total stake to 10.0% (50.0m shares). (The Edge)

Jiankun International Bhd has reported that the joint venture agreement it had inked with Menara Rezeki Sdn Bhd, related to the redevelopment of Flat PKNS Jalan Tun Razak in Kampung Baru, has been terminated. Jiankun received a notice of termination from Menara Rezeki on 21st March 2022, but did not elaborate on why the agreement was revoked. (The Edge)

Solution Group Bhd has reported that the CanSino single-dose Covid-19 vaccine; the Convidecia has been proven safe and effective for booster vaccination. The announcement came after the group, through its wholly-owned Solution Biologics Sdn Bhd has received approval from the Ministry of Health for the use of the CanSino vaccine as a heterologous booster on 21st March 2022 for adults aged 18 and above who have completed their two-dose Sinovac vaccination for at least three months. (The Edge)

The Tham family, founder and major shareholder of Greenyield Bhd, plans to inject their private plantation assets in Papua New Guinea into the agricultural and horticultural product and service provider for RM87.8m. Under a proposed plan, Greenyield will acquire a 65.0% stake in Greenyield Rubber Holdings (M) Ltd, which owns 15,313-ha of rubber and coconut plantation lands inclusive of a crumb rubber factory in Papua New Guinea. (The Edge)

NWP Holdings Bhd has announced that its managing director Datuk Seri Kee Soon Ling together with independent non-executive director Yew Onn Chong, who are being sued by the company’s management over alleged fraudulent transactions, have resigned from their post effective 21st March 2022. The company also announced the resignation of Noor Azri Noor Azerai, as its independent and non executive director. The group has appointed Datuk Tan Lik Houe as its non independent and non-executive director, and his daughter Tan Jyy Yeen as the executive director. Datuk Yeo Chai Poh was made the group’s independent and non-executive director. (The Edge)

Source: Mplus Research - 22 Mar 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-15

ANCOMNY2024-11-15

BJCORP2024-11-15

LBS2024-11-15

LBS2024-11-15

LBS2024-11-15

PMETAL2024-11-14

ANCOMNY2024-11-14

JIANKUN2024-11-14

JIANKUN2024-11-13

ANCOMNY2024-11-13

PMETAL2024-11-13

PMETAL2024-11-12

ANCOMNY2024-11-11

ANCOMNY2024-11-08

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-07

ANCOMNY2024-11-06

ANCOMNY2024-11-06

ANCOMNY2024-11-06

BJCORPMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024