M+ Online Research Articles

UOA Real Estate Investment Trust - Slow and gradual improvement in rental activities

MalaccaSecurities

Publish date: Fri, 17 Mar 2023, 08:51 AM

Summary

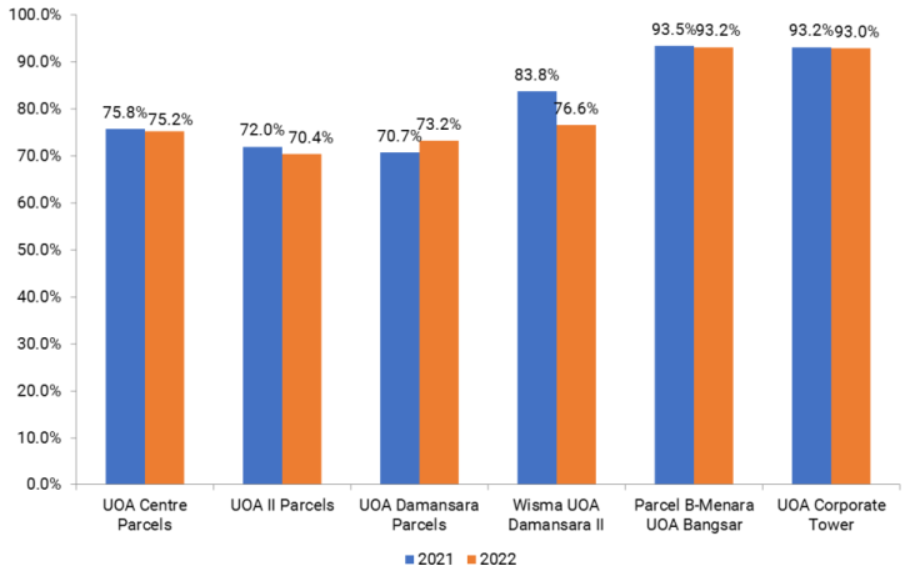

- UOA Real Estate Investment Trust (UOAR) FY22 revenue and core net profit stood at RM114.4m (-1.7% YoY) and RM61.1m (-1.2% YoY) respectively. Both top and bottom line saw mild decline, mainly due to the lower occupancy rates of properties in the portfolio with the exception of UOA Damansara Parcels, resulted from the departure of multiple tenants upon the expiry of tenancy. Average occupancy rate dropped to 80.3% from 81.5% YoY.

Occupancy rates of the portfolio properties

- Slow recovery of occupancy rate. With the overall occupancy rate of purpose-built office space in KL City improved slightly to record at 67.5% during 2H22 (1H22: 67.2%) (Knight Frank), the office rental market may begin to experience some stability moving into FY23. However, UOAR may see slow and gradual improvement in rental activities towards pre-pandemic level as market is likely to remain cautious amid challenging operating environments.

- Mild decline in office space rental rate. According to Knight Frank, the average rental rate of office space in Kuala Lumpur (KL) City experienced downward pressure to record at RM6.41 per sq ft per month in 2H22 (1H22: RM6.43 per sq ft per month). Nonetheless, we expect rental rates to remain flat upon renewal of tenancies for UOAR given the strategic location of its portfolio properties.

- Moving forward, the office market in KL may see supply outpacing demand with (i) additional 5.5m sq ft of supply pipeline scheduled for completion by end-2023, in addition to the cumulative supply of office space in Klang Valley which as of 2H22 stood at circa 113.9m sq ft, and (ii) fundamental shift in the way people work in the post-Covid-19 environment.

- Margin wise, factors such as (i) the raise in overnight policy rate by 25-basis points to 2.75% on 3rd November 2022, (ii) electricity tariff hike effective 1st January 2023 to 30th June 2023, (iii) the increase of minimum wage in 2022, as well as (iv) potential increase in property operating expenses in an inflationary environment may continue to weigh on UOAR’s margin.

- To retain existing tenants and attract new occupiers, asset enhancement initiatives (AEI) continue to play an integral part of UOAR’s operating strategies to improve the buildings’ market competitiveness. In FY22, UOAR has completed the renovation works for some of the vacant and partly fitted units within UOA Centre Parcels and UOA Damansara Parcels. The group also targets to complete the refurbishment of food court located in UOA II Parcels by FY23 which was commenced in FY22.

Valuation & Recommendation

- In view of a slower-than-expected recovery in occupancy rate amid soft market sentiment, as well as potential lower margin in an inflationary environment, we slashed our FY23f-FY25f earnings forecast by 5.5%, 7.6%, and 5.7% to RM61.5m, RM62.1m, and RM63.3m respectively. Nevertheless, we continue to like UOAR’s portfolio properties which are located in strategic locations, coupled with its Right of First Refusal over UOA Development Bhd’s investment assets.

- We retain our BUY recommendation on UOAR, with a revised target price at RM1.27 (from RM1.35). The target price is derived by ascribing a target P/E multiple of 14.0x to FY23f EPS of 9.1 sen. Meanwhile, the group remained committed to distribute 90.0% of the distributable income.

- Risks to our recommendation include the challenges in maintaining rental rates given more supply of new offices in an uncertain post-Covid-19 environment. Besides, the interest rate hikes and inflationary pressure may further dampen market confidence.

Source: Mplus Research - 17 Mar 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on M+ Online Research Articles

UOA Real Estate Investment Trust - Below Expectations: Hit by Higher Operating Expenses

Created by MalaccaSecurities | Jul 26, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments