SYF RESOURCES BHD, the next VS Industries ??

NiNa

Publish date: Mon, 28 Dec 2015, 10:51 PM

In this first blog posting, I take the liberty to cover SYF Resources Bhd.

INTRO

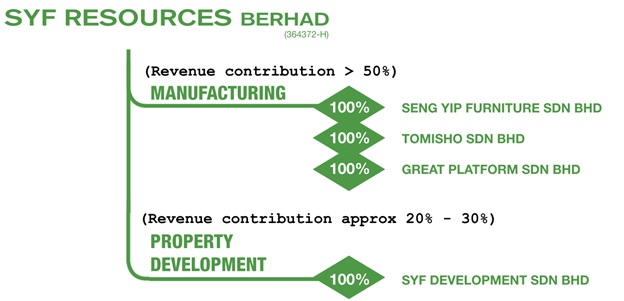

SYF is a furniture manufacturer, whose furniture products are exported to 88 countries globally, sees more than 50% of its revenue from the furniture business. SYF also has a property development unit, which it started in 2012, contributes 25% to 30% of revenue.

Rationale Behind Venturing into Property

Furniture business hasn’t been always rosy.

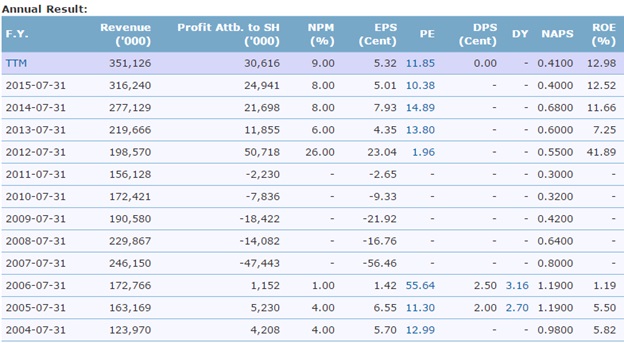

Since the liberalization of RM at 2005, the currency strengthen. Coupled with general economic slowdown of 2008/09, these have affected SYF’s core furniture business. As a result, the company suffers five consecutive loss (albeit at a reducing loss trend) from 2007 to 2011 financial year. The property boom from following years makes this venture to be only logical.

Venturing into properties at that time proofs to be a wise move. The company has made a remarkable turnaround at 2012, and things has been rosy again since. Furthermore now, even their core furniture business has turnaround and made a handsome profit.

As mentioned in their annual report on its earning:

Although the property market was weaker, there was satisfactory response to the two new projects started during the year: the mixed commercial/residential Kiara Plaza project in Semenyih and the residential semi-detached houses of Wira Heights 3 in Sungai Long. The income recognition from these new projects and the completion of the fully-sold Semenyih Hi-Tech 6 industrial project improved the division’s results and contributed to the overall increase in Group revenue.

SYF did not gamble in property venture

The way SYF approach its property business, it seems that the management is aware that they are venturing out from their forte, in contrary to the way Mah Sing has approach property as an industrialist (in plastic molding). I did not mean to belittle Mah Sing as their success are formidable, but simply to point out that SYF is more conservative and really weight in the risk at hand.

To illustrate this, SYF itself is a manufacturer that owns and operates in a factories. They are very familiar and fully understands what a factories buyer would look for and need, the way they would themselves demand (or the way their business partners, vendors or even neighbor would). They have been very successful in developing factories, not a very easy feat even big players having trouble selling this class of properties.

SYF is more cautious on the property segment, preferring to undertake a property development project on a joint venture basis. The reason for that, as explained by its management, is to avoid a huge holding cost on the land acquisition, which could burden the balance sheet.

Wise indeed. Better be safe than sorry.

SYF’s Core Business: The force Awaken

The corebusiness has turnover remarkably well from a loss making one half a decade ago, to now contribute back >50% of revenue, exporting to over 88 countries. its executive director Datuk Seri Chee Hong Leong, has estimated that the furniture industry will register double-digit growth in 2015.

SYF second manufacturing plant in Simpang Pertang is set to commence operation in January 2016. Due to this, the boards division contributed marginally to Group earnings as pre-operating expenses of the second plant in Simpang Pertang had to be absorbed whilst pending commencement of its commercial operations. Machinery installation and site works of the new plant were carried out during the year and would be completed by end of calendar year 2015. As a result, cash flow will expectedly be poor. VS Industries. Ring a bell??

So, will this still be a buy call, even when SYF at its year high ??!!

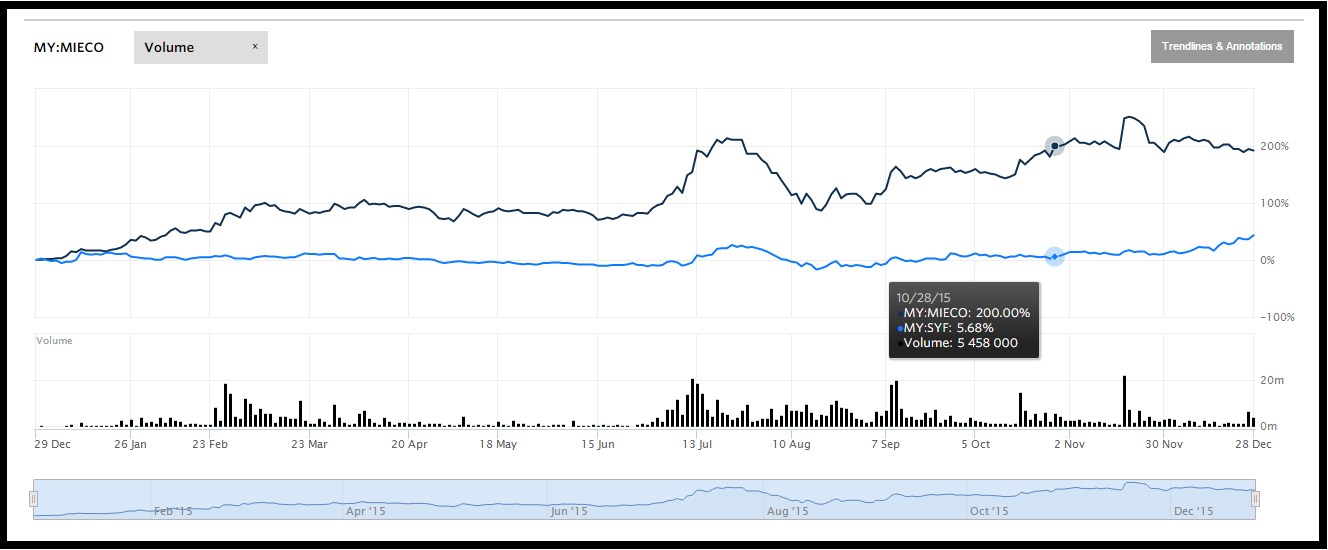

Yes indeed. Taking a one year performance comparison of both stocks, SYF and Mieco, for comparison purpose (Mieco was arbitrarily picked as being in similar industry). Mieco has increased by 200%. On the same period, SYF has only improved by 5%. An analysis of at least 20 furniture-related stocks shows that at worst an investor would be enjoying a paper gain of 19%, while at best it would be 183% (focusmalaysia.com). It should be deemed that there is still much room for upside. Investors just beginning to acknowledge SYF, hence this could be the beginning of the growth.

Disclosure: I am currently holding SYF. I do not currently hold Mieco. The above is just my opinion. All comments and discussion are welcomed.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on NiNa

Created by NiNa | Jan 06, 2016

Discussions

hi koonbee, in comparison in a way VS used to borrow money that affects their operation, but will be good in the long run. Sorry didnt make that too clear

2015-12-28 22:56

wow nowadays a lot of people blog... i3 is really flourishing... It is a good thing, abundance of trading and investing ideas !!!

2015-12-28 23:12

haha, SYF has property division la bro, how can compared to VS and MIECO! SYF goreng tetap goreng haha

2015-12-28 23:14

haha, just testing only. as i am new, can anyone advice, how to attach a label to a blog? for example this to SYF? much appreciated. thanks in advance

2015-12-28 23:14

koonbee, your mum ask you to go home, she said u spent too much time in i3, dinner also cold already...

2015-12-28 23:22

Koonbee9, don't need waste time la.

Just buy the laggards from icon blogspot.

Sure Huat one.

Then u got free time to watch YipMan3.

2015-12-28 23:28

Hi Soros228, I think cucumber is comfortable at being just a cucumber. When you eat nasi lemak, satay , or ramli burger, the taste is at least 50% different if u don't have it. value is just a perspective depends on beholder.

Hi icon8888, thanks for dropping by. Really loves reading hour sharing and posts. respect your generosity and humility. Haha, alot to learn from u, stock wise and beyond.

2015-12-28 23:30

NiNa ... wow, very comprehensive n detailed write-up on Syf. LIKE !!! Gonna jump on the bandwagon!!

2015-12-29 03:58

hi nina.. good and ho lio ,,,

Big Gun Blogger's also here..

Ikan masin and Tawkay TJ pun ada..

Good Sign...hahaha

2015-12-29 07:34

Please scrutinise the top thirty shareholders , how many on margin account and multiple account of sama person , watch out the trend otherwise might end up in traps . The shark will drag you up and down using t 3 , t4 . Enter with real bullet and keep then the big shark will get strangled ha ha

2015-12-29 21:12

syf like apek beginning to shine...hope profits bolih tahan otherwise price beh tahan...good job NiNa

2015-12-30 16:00

thanks all for posting here. appreciated your comments. congrates those who have this counter.

2016-01-06 10:55

koonbee9

I m confuse compare syf with VS?? Both company are different segmen

2015-12-28 22:52