AJIYA BERHAD - A case study for Anomaly in pricing of Private Placement

NiNa

Publish date: Wed, 06 Jan 2016, 01:00 AM

Many would be familiar with the saying -Price is what you pay, value is what you get. This article is to discuss exactly this by considering Ajiya as a case study.

The choice for Ajiiya is particularly fitting, especially after the recent Private Placement (PP) exercise. If we are to observe closer, the huge gap in the value of Ajiya stock is obvious between the following two perspective:

1. as how the ‘Big guns from behind’ sees it, and

2. as how retailers sees it

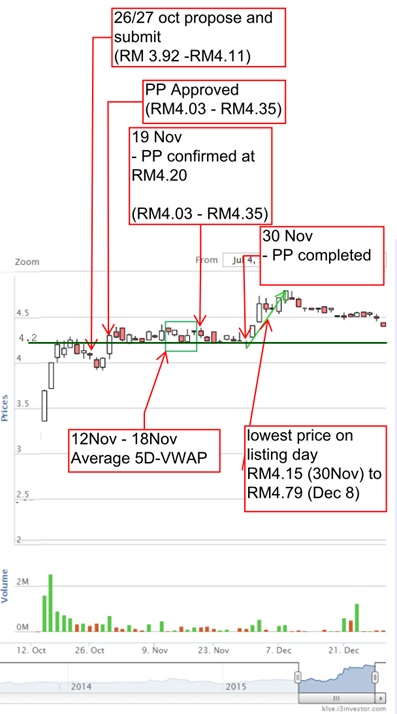

From the summary chart below, Ajiya Bhd has fixed the issue price for its PP of up to 6.92 million shares at RM4.20 per share. These 6.92mil shares were listed on 30 Nov 2015.

Interesting point to note

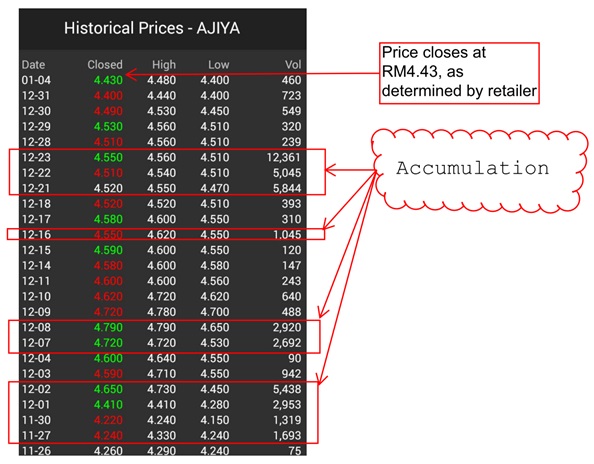

That we not only sees there is not a selldown of these 6.92mil PP shares following the listing, but there are signs of accumulation, at prices above the currently traded price. The total shares that changes hand since the listing day 22 days from the private placement listing at 30Nov to now (6 Dec 2016) is only 4.4mil, even lower than the amount of the new PP shares listed.

The price of accumulation is from RM4.5 to even RM4.79, while the current trading price is RM4.43

COMING QUARTERLY REPORT

The coming quarterly report is expected to be released in mid-January, or the next 1-2 weeks. This QR report is expected to be good as previous and outgoing construction and development projects is to be translated into revenue growth for the group.

Ajiya is a major supplier for government-driven local housing projects, in particular, the affordable housing scheme under Perumahan Rakyat 1Malaysia Bhd (PR1MA).

Ajiya’s cash position had also improved in the last one year, with cash and cash equivalents totalling RM33.64mil as at the end of August 2015, compared with RM23.89mil a year ago.

Hence, there is further potential upside movement for Ajiya’s shares. The present market price of Ajiya is clearly traded below its actual value.

Target Price: RM5.50 based on PE of 18

https://www.youtube.com/watch?v=_OPjKeT6I_A

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on NiNa

Discussions

Thanks steward. This article was inspired by your valid comment on ajiya house which says- Purchasers are PP at RM4.20 are not foolish people, they must have seen the value of the stock exceedingly above that price.

After ponder , it makes whole lot of sense.

2016-01-06 01:49

Great job.

AJIYA - A JUMPING YA!

DON‘T FORGET WHITE HORSE AND YILAI. LIKE AJIYA THEY HAVE LATENT VALUE AND POTENT POWER!

2016-01-06 07:10

Hi Calvin Tan, great to see you in this thread. Congrats on Tmakmur.

Hopefully Ajiya will be RM5, 6 soon.

2016-01-06 08:39

Good observation... Are you one of the 'accumulator'?

Just wondering how many forumers actually is keeping this counter or has a share in this counter?

2016-01-06 21:55

I bought @4.50 today after after reading the anomaly in the case study.

2016-01-06 21:58

Thanks winnerzhang, hopefully is correct. Kucimiao, I hope I am that capable to be that 'accumulator' too.. Haha, me is multimillionaire Liao if I am. But me reli ikan bilis only.

2016-01-07 11:48

thesteward

give you a 'like' Nina. Immediate TP of rm5.50 seems fair considering the major supplier under PRIMA.

2016-01-06 01:28