SERBADK - Could it be best performer of 2020?

JensenChin

Publish date: Fri, 31 Jan 2020, 10:07 AM

One of the best investments we can make is in our own knowledge and skill set. With that in mind, this article will work through how we can use Return On Equity (ROE) to better understand a business. By way of learning-by-doing, we’ll look at ROE to gain a better understanding of Serba Dinamik Holdings Berhad (KLSE:SERBADK).

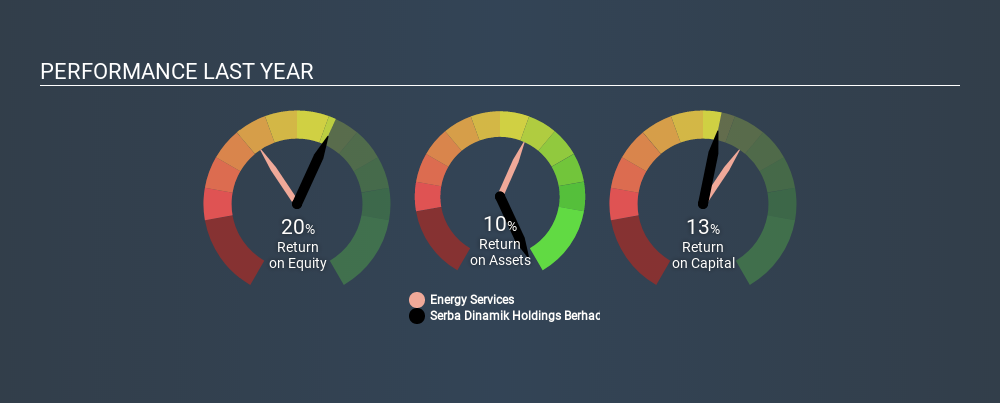

Serba Dinamik Holdings Berhad has a ROE of 20%, based on the last twelve months. One way to conceptualize this, is that for each MYR1 of shareholders’ equity it has, the company made MYR0.20 in profit.

View our latest analysis for Serba Dinamik Holdings Berhad

How Do I Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

Or for Serba Dinamik Holdings Berhad:

20% = RM472m ÷ RM2.4b (Based on the trailing twelve months to September 2019.)

It’s easy to understand the ‘net profit’ part of that equation, but ‘shareholders’ equity’ requires further explanation. It is the capital paid in by shareholders, plus any retained earnings. Shareholders’ equity can be calculated by subtracting the total liabilities of the company from the total assets of the company.

What Does ROE Signify?

Return on Equity measures a company’s profitability against the profit it has kept for the business (plus any capital injections). The ‘return’ is the amount earned after tax over the last twelve months. That means that the higher the ROE, the more profitable the company is. So, all else being equal, a high ROE is better than a low one. Clearly, then, one can use ROE to compare different companies.

Does Serba Dinamik Holdings Berhad Have A Good Return On Equity?

Arguably the easiest way to assess company’s ROE is to compare it with the average in its industry. The limitation of this approach is that some companies are quite different from others, even within the same industry classification. Pleasingly, Serba Dinamik Holdings Berhad has a superior ROE than the average (11%) company in the Energy Services industry.

That’s clearly a positive. We think a high ROE, alone, is usually enough to justify further research into a company. For example you might check if insiders are buying shares.

How Does Debt Impact ROE?

Most companies need money — from somewhere — to grow their profits. That cash can come from retained earnings, issuing new shares (equity), or debt. In the first two cases, the ROE will capture this use of capital to grow. In the latter case, the debt required for growth will boost returns, but will not impact the shareholders’ equity. In this manner the use of debt will boost ROE, even though the core economics of the business stay the same.

Serba Dinamik Holdings Berhad’s Debt And Its 20% ROE

It’s worth noting the significant use of debt by Serba Dinamik Holdings Berhad, leading to its debt to equity ratio of 1.08. while its ROE is respectable, it is worth keeping in mind that there is usually a limit to how much debt a company can use. Investors should think carefully about how a company might perform if it was unable to borrow so easily, because credit markets do change over time.

But It’s Just One Metric

Return on equity is one way we can compare the business quality of different companies. In my book the highest quality companies have high return on equity, despite low debt. All else being equal, a higher ROE is better.

But when a business is high quality, the market often bids it up to a price that reflects this. It is important to consider other factors, such as future profit growth — and how much investment is required going forward. So you might want to check this FREE visualization of analyst forecasts for the company.

If you would prefer check out another company — one with potentially superior financials — then do not miss thisfree list of interesting companies, that have HIGH return on equity and low debt.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on No nonsense

Created by JensenChin | Feb 02, 2020

Created by JensenChin | Jan 25, 2020