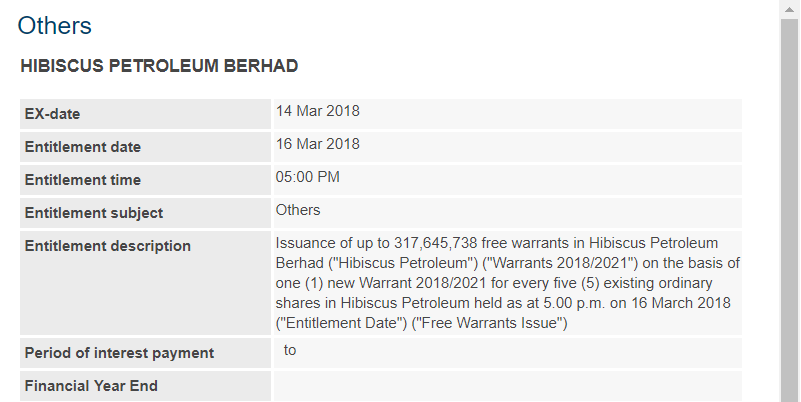

Hibiscus Prospect and warrant Ex-date

Opportunityinvesting

Publish date: Tue, 13 Mar 2018, 02:08 PM

FYI , Hibiscus warrant entitlement ex-date will be today.

For those who keen to get the free warrant do remember to purchase the share before today 5pm.

Hibiscus EGM - boss are expect to product range between 8000 - 9000 barrels per day from current anasuria 3.x k per day.

9k barrel will be combined the production for both its anasuria cluster and the new north Sabah oilfield (which is • St Joseph Producing Field • South Furious Producing Field • SF30 Producing Field • Barton Producing Field )

Opex cost per barrel for the Sabah oilfield will be RM55 - translate to around USD 15.

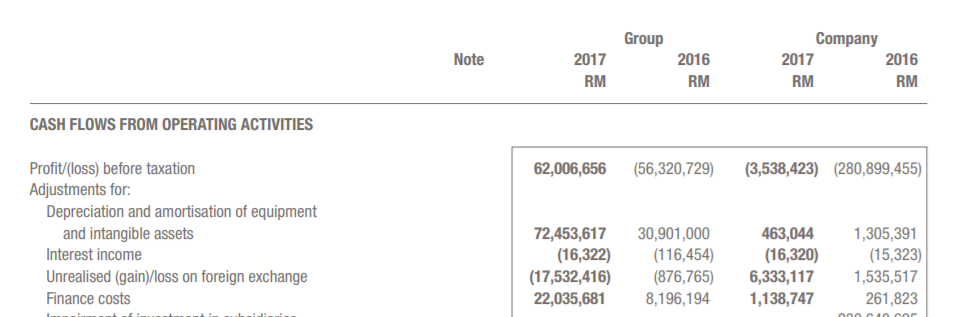

CASH FLOW from operating activities :

From the operating cash flow on hibiscus notice that the depreciation is more that the profit and this is a non-cash item.

Which hibiscus will expecting to generate a good cash flow.

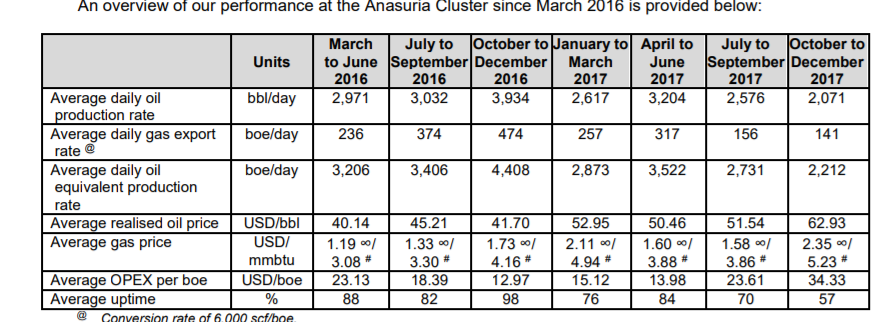

From the latest QR report , the production on Q4 had dropped to 2k barrel per day due to

The lower average uptime recorded is primarily due to the planned Offshore Turnaround project that commenced in mid-September 2017 and was completed in mid-October 2017. The impact of the Offshore Turnaround was a sixteen-day period of complete shutdown of the Anasuria FPSO in October 2017 for planned maintenance activities. In addition, we were also affected by two unplanned events that occurred during the Current Quarter:

• A temporary interruption in production of the Cook-P1 well which also affected gas lift operations on the Guillemot A field; and,

• A temporary failure of our gas compression facility on board the Anasuria FPSO which again affected gas lift operations on the Guillemot A field.

All the disturbance above is expect to normalize on 2018 and the production will go back to normal.

Advantage of hibiscus - good management

- good balance sheet ( not heavy debt )

- direct beneficial by oil price gone up

- Good prospect and growth within 3 years .

Risk - Oil price go down drastically.

by taking the current 2k - the profit 11m

if we multiple the per day barrel up to 8k at the year end - it may translate to 44m which is 2.8 sen per quarter.

this assumption also taking the average OPEX per boe are the same with the current anasuria OPEX. ( Sabah north sea have a cheaper OPEX per boe as mentioned above.)

Thus - we are optimistic on hibiscus to further go up above Rm1.

Also we expecting there will be a rally on hibiscus warrant upon listed.

Klse hub link -

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Opportunity Investing

Created by Opportunityinvesting | Feb 20, 2019

Discussions

Hi Ozzie,

is according to the announcement on Bursa.

Please enlighten us if we provide the wrong info.

Thanks

2018-03-19 17:04

Hi, you are right that one has to purchase the shares before the 14 March to be entitled to the bonus warrants. Cheers

2018-03-20 10:08

Hi Ozzie75, can follow our news on telegram.

Hibiscus prospect still looking very good. with the price now. still good .

2018-03-20 22:22

ozzie75

Are you sure your basics on ex and entitlement date is correct?

2018-03-16 15:28