What You Should Know Before Subscribing on AGESON Rights Issue (IMPORTANT)

stockbitsniper

Publish date: Thu, 12 May 2022, 11:03 AM

What You Should Know Before Subscribing on AGESON Rights Issue (IMPORTANT)

Upon the completion of share consolidation exercise by AGESON, we are now seeing a more stabilized share price movement for the past few trading weeks.

I figured that investors would need some clarification from the latest Abridged Prospectus for its rights issue exercise, and here are some of the common questions that could be answered.

“What is the rights issue price?”

The rights issue price is fixed at 20.0 cents, where based on the current share price of 22.0 cents, this represents a 9.09% discount at the moment.

“How can I subscribe to the rights shares?”

There are several ways where one can subscribe to rights shares, but thanks to initiative of Bursa by introducing eRights, a service which allows individual shareholders to subscribe for Rights issue via the ATM and internet banking facility of participating banks, similar to the electronic IPO applications via Electronic Share Application (ESA).

For more information, you may read the full article here (https://www.bursamalaysia.com/trade/our_products_services/central_depository_system/erights)

“What will happen to my preference shares?”

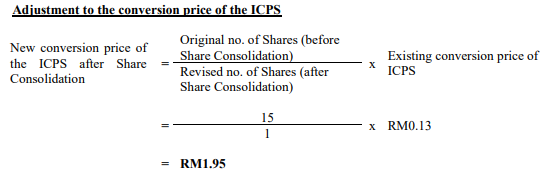

Upon the consolidation exercise, a total of 3,814,226,509 outstanding ICPS had been consolidated on a 15-to-1 basis, which equates to 254,281,767 ICPS outstanding in the market.

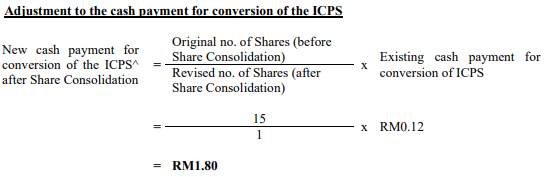

For your information, there are two common methods that are used by investors to convert their PA into common share. You may surrender 13 ICPS for 1 common share, or 1 ICPS and RM1.800 in cash for 1 common share.

Either way, the conversion price of ICPS will be RM1.950.

“What about the ICULS issuance?”

To those who followed AGESON long enough, ICPS had been a massive roadblock for the price upward movement of the company. A consolidation exercise is much needed to reduce the share circulation, and ICULS was cancelled as it will make it worse.

“Why rights issue?”

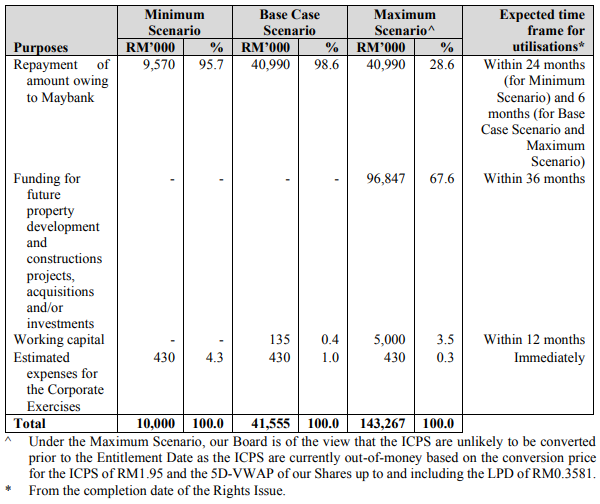

You may refer to the latest Abridged Prospectus or the snapshot included above. In short, the company will utilize the funds to reduce the loan amount with Maybank. The company had been utilising the funds raised from private placement to settle the outstanding loan with RHB bank.

Most importantly, the company is not into a loan default scenario which would potentially trigger PN17.

“Should I subscribe to the rights shares?”

That depends.

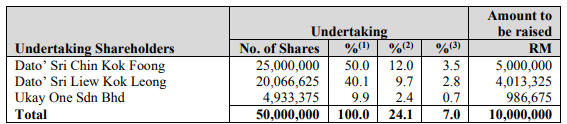

My two cents are, if you are already holding the shares, then why not. Judging by how the management is willing to pour in RM10.0 million in cash back to the company, one could tell that they are serious about turning around the company.

To those who know, there had been a legacy issue imposed by the previous subsidiary Prinsiptek, which was before the emergence of the new shareholders.

The company had once appointed Ferrier Hodgson for forensic audit against its formal director. You may read the full scale report here (https://www.thestar.com.my/business/business-news/2021/04/07/ferrier-hodgson-completes-forensic-audit-on-agesons-suit-against-its-former-managing-director)

Moving forward, it is very likely that the downside is limited for AGESON.

Hope this article helps!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

.png)

.png)