PCHEM - Approaching Accumulation Zone

DividendGuy67

Publish date: Fri, 16 Aug 2024, 01:08 AM

Petronas Chemical Group Berhad (PCHEM) is a cyclical stock, and since hitting the peak above RM11, price has crashed more than 50% to close 5.30 yesterday. There's definitely huge fear and you can smell the blood on the streets.

Key observations:

1. Cyclical stock.

- Cycle lows around 2011, 2015, 2020, and now 2024 - roughly every 4-5 years.

- Cycle highs/peaks are reached anywhere from 1 year to 4 years after bottom.

- Suitable for long term position traders who doesn't like to monitor markets.

2. Potential entry zones: A few technical indicators suggesting the accumulation zone is near.

- Just visually looking at the price charts show the zones mark in the green box.

- Or use some Fibonacci expansion and/or extension targets suggesting anywhere from 5.15 down to 4.72 down to 4.30.

- Or if you don't trust raw prices, use the RSI indicator on Monthly chart where when RSI < 30 and if you buy, it gave 3 signals and in all 3 signals, you will eventually win with close to 100% win rate. The indicator is now flashing a Buy.

3. Expected holding duration: 6 months to 4 years. Only for the longer term position traders who can sit on their hands.

4. Potential exit zones: There are a few variations, all are valid.

- A price chart target say RM7. I believe odds are very good, that a patient investor who can hold for 0.5-4 years should be able to target RM7 quite easily. If your entry price averages at RM5, that's 40% returns. I doubt it'll take 4 years, but in the worst case, that's 40% over 4 years or nearly 10% per annum. If it takes 2 years, that's nearly 20% per annum and if it takes 1 year that's nearly 40% per annum. Hence this trade around RM5 meets my investment objective which is to earn at least 9% per annum with very high odds of certainty.

- Multiple price targets. You don't have to sell all at RM7. You could take several bullet exit approach just like several bullets for entries.

- Monthly RSI based exits - e.g. wait till RSI gets back to 50, 60, 70 or higher.

7. Position sizing. As I own over 50 stocks, neutral is 2% capital. Perhaps +/- 1% capital. So, you can consider entries split into several bullets depending on your account size and minimum buys.

- For me, I'll split it into say 5-7 bullets between 5.2 down to 4.30, perhaps every 12-18 sen apart or so.

- The first 2 may be split into 0.5% capital so that after 2 buys, you own at least 1% capital.

- The remaining 3-5 bullets may be split into 0.4%, 0.4%, 0.4%, 0.4%, 0.4% capital so that if it's triggered, total does not exceed 3% capital.

Fundamentals

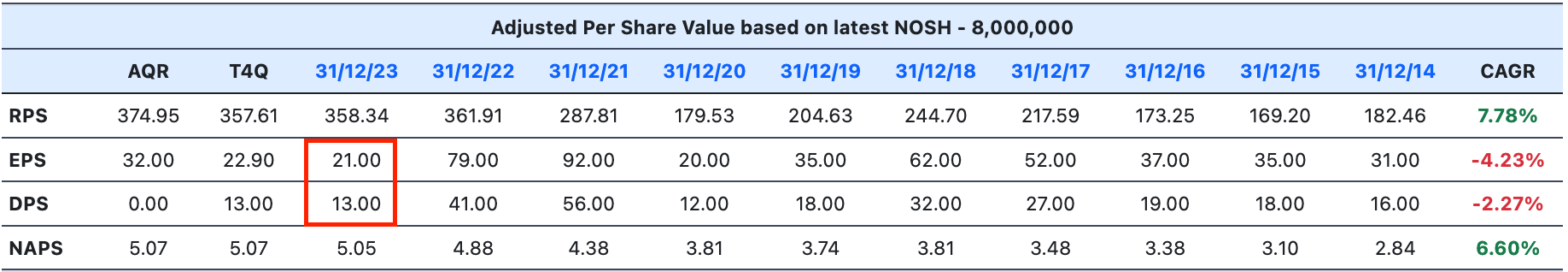

Looking at EPS, we can see that after peaking at 92 sen (FYE2021), EPS has dropped slightly to 79 sen and then crashed to 21 sen. This corresponds to the crash in prices from peak of RM11 3 years ago. It tells you 2 things. (1) Prices follows earnings and (2) Market is forward looking by at least 6-12 months.

Looking at DPS, over the same period as EPS, peaked 56 sen at FYE2021, lower (41 sen) FYE2022 and crashed FYE2023. Price action is consistent with EPS and DPS. This is notwitstanding RPS didn't drop much, nor NAPS continues to grow.

In short, the driver to this stock is more towards EPS and DPS, at least in recent years.

What is my prognosis for next 1-5 years on its EPS and DPS?

Honestly, I don't know and I don't care. All I know is that since the Chart shows every 4-5 year cycles, Price tells me everything I need to know about this stock. This is a short cut that works 99% of the time for large fundamentally sound stock, and PCHEM is a large cap stock with market capitalization of RM42 billion. This is not a speculative stock but one owned by respectable institutional investors.

Summary and Conclusion

- KISS. (Keep It Simple Simon)

- Split 3% capital into 7 bullets - first 2 is 0.5% capital, next 5 is 0.4% capital.

- Just keep buying as price goes down - let Mr Market decides for you how much you should profit.

- Stop buying after hitting 3% capital max, regardless of what happen to prices.

- Hold for 6 months to 4 years. No need to check prices every week. Perhaps once a month to update GTC sell orders at perhaps RM2 higher than your entry price, or any of the variations described above.

Yes, odds are high, you'll make at least 9% per annum, beating your investment objective.

Good luck!

Disclaimer: As usual, you are always responsible for your own trading and investing decisions.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on https://dividendguy67.blogspot.com

Discussions

Ok. Today, accumulated a small amount of PCHEM @ 5.45 for initial entry position. Queueing at lower prices and let's see if they get hit or not. Happy not to chase.

2024-08-20 20:55

DividendGuy67

Hahaha ... I shouldn't have published this article! Today, PCHEM shot up to 5.63! Even though this is big cap! Lesson learnt!

2024-08-16 23:19