Building A Stronger Recurring Cash Business

winsenlim68

Publish date: Tue, 08 Feb 2022, 10:42 AM

When it comes to investment, investors prioritise certainty. And there is nothing more certain than a long-term concession business by knowing how much a company would earn over a certain period. And I am referring to cold-hard cash and not ballooning receivables.

Prior to today’s article, I had briefly explained what Ranhill’s overall business is. Please feel free to refer to the articles over here.

But in short, the company is mainly a utility company (also an engineering services company after the acquisition of RWSB and RBSB). There are two sources of recurring income, its water supply and energy business. However, today I wish to reiterate the opportunities on the company’s energy side of the business as many may have overlooked the potential from their energy segment.

Gas Turbine

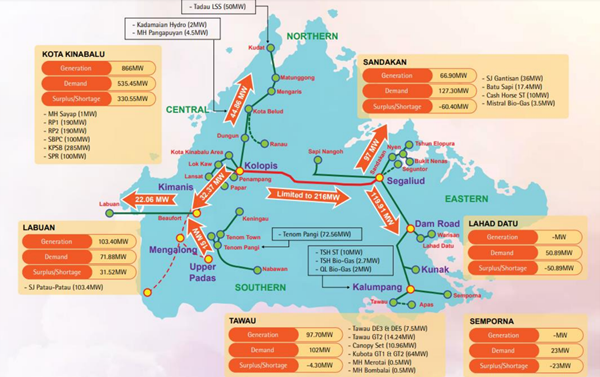

Under their energy segment, the company operates two gas turbine plants in the West-Sabah with a total of 380MW. If you have not noticed, their energy segment hasn’t been performing as of late was partly due to the capacity transmission issue. In layman’s term, this is primarily due to the current situation in Sabah facing an oversupply of power in West-Sabah while power shortage in the East-Sabah.

Thankfully, there are mitigation plans in place. Upon the completion of the Sabah East-West Transmission line in 2023, the transmission line will be able to transfer up to 400MW from the west coast to the east coast of Sabah. With greater transmission capacity to Sabah’s East Coast, this would allow Ranhill to ramp up its gas turbine plant and sell additional electricity. Hence, the oversupply situation in the west should slowly improve by itself and translate better opportunities for the company.

Solar energy

Apart from the company’s gas turbine plant, they had been awarded a LSS project of a total 50MW with a PPA signed with TNB for a period of 21 years. Upon completion of the company’s LSS, their total MW capacity would stand at 430MW. Combining their current expertise with their past experience in LSS3 & LSS4, I won’t be surprised the company continues to bid for future LSS and wins the contract. Although, I do curious about the company’s bidding tariff rate for the coming LSS5 project, but I trust the rate should be relatively higher than LSS4 as raw mats have substantially increased as compared to the previous year.

Another potential opportunity is the recently announced Electricity Supply Business Plan (RUPTL) in September 2021 by Indonesia government. The new RUPTL target is an increase of 25% from its original RUPTL in 2019, an indication of Indonesia’s determination to shift to renewable energy. As a result, the share of capacity additions from renewables in the latest plan has increased from 30% to 52% by 2030, clearly indicating the intention to gradually shift away from the reliance on fossil fuels. However, I do opine that the timeline is simply unrealistic, but I applaud the country’s direction towards RE, which potentially translate to opportunity for Ranhill in terms of asset ownership in Indonesia.

Other RE Opportunities

I believe the company’s direction moving towards expanding their renewable energy segment is a natural move given their business nature and the growing demand for clean energy.

If we look back in 2019, the company entered an MoU with an Indonesian company to explore opportunities in geothermal energy, mini hydro, and waste management. There isn’t any follow up announcement regarding this MoU (probably lapsed and void), but this indicates that the company had plans to venture into the following RE segment.

Based on the company’s latest annual report, the company mentioned its participation in Bukit Payong Waste-to-Energy project by the government. The submission was April 2021; hence I believe the result should be announced very soon.

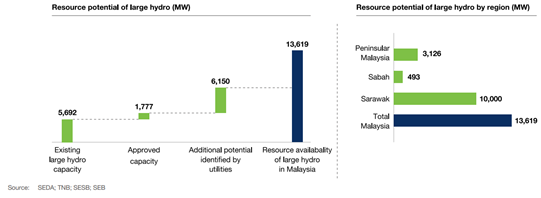

As for hydro energy, according to the Malaysia Renewable Energy Roadmap (MyRER) indicates there is a potential of 10,000MW or more to be fulfilled from both small hydro and large hydro. This represents another potential segway expansion for the company.

In the meantime, there isn’t much development for geothermal energy according to the MyRER. According to the report, feasibility studies of geothermal energy application would begin after 2025. Hence, I don’t think there will be anything exciting from this segment for a while given there are many other cheaper alternatives of RE with less complexity.

That said, Ranhill had a venture with Tawau Green Energy back in 2017 – a geothermal development project but was faced with a setback on its feed-in approval. According to their annual report, the company is exploring alternatives to revive the project. Hopefully, we may see some progression in 2022.

My closing thoughts

As most of their energy business is long term concessionaire contracts, we may see a strong growing business pillar with recurring cash flow. In the event that the company manages to achieve its target, a rerating on the company is plausible.